The Role of International Stocks in Portfolio Diversification

International stocks portfolio diversification is an essential strategy for modern investors looking to expand their horizons beyond domestic markets. In today's globalized economy, building a robust portfolio means incorporating equities from different regions, industries, and economic cycles. This comprehensive guide will explore the multifaceted role of international stocks in creating a balanced, resilient portfolio while mitigating risks and taking advantage of growth opportunities around the world.

Investing internationally is not just about chasing higher returns; it is also about spreading risk and reducing the impact of domestic market volatility. As market dynamics shift due to geopolitical events, economic downturns, or sector-specific downturns, international investments can provide a cushion. By investing across various regions, investors can benefit from disparate economic cycles and capitalize on emerging markets that may outperform mature economies in certain periods.

In this detailed analysis, we will cover everything from the fundamental differences between domestic and international stocks, the benefits of embracing global diversification, the inherent risks, and actionable recommendations for integrating international equities into your portfolio. Whether you are a seasoned investor or just beginning your financial journey, understanding the nuances of international stock portfolio diversification will empower you to create a more dynamic and resilient investment strategy.

Understanding International Stocks

Investing in international stocks means buying shares of companies that are based outside your home country. These companies can be listed on foreign stock exchanges or even on international sections of domestic exchanges. With the progressive globalization of financial markets, investors now have easy access to stocks from Europe, Asia, Africa, and Latin America.

Definition and Types

International stocks can be broadly classified into two categories:

- Developed Market Stocks: These are shares of companies operating in established economies such as the United States, Canada, Western Europe, Japan, and Australia. They tend to be more stable with mature industries, offering steady dividends and slow but consistent growth.

- Emerging Market Stocks: This group includes stocks from rapidly developing economies like China, India, Brazil, and Russia. These markets are characterized by high growth potential but come with considerable volatility and risk. The political, economic, and regulatory environment in these countries is often less predictable, creating both opportunities and pitfalls.

Investors can also differentiate between these two by considering market liquidity, transparency, and regulatory frameworks. Often, diversification across both developed and emerging markets is recommended to harness the growth potential of emerging economies while maintaining the stability provided by developed markets.

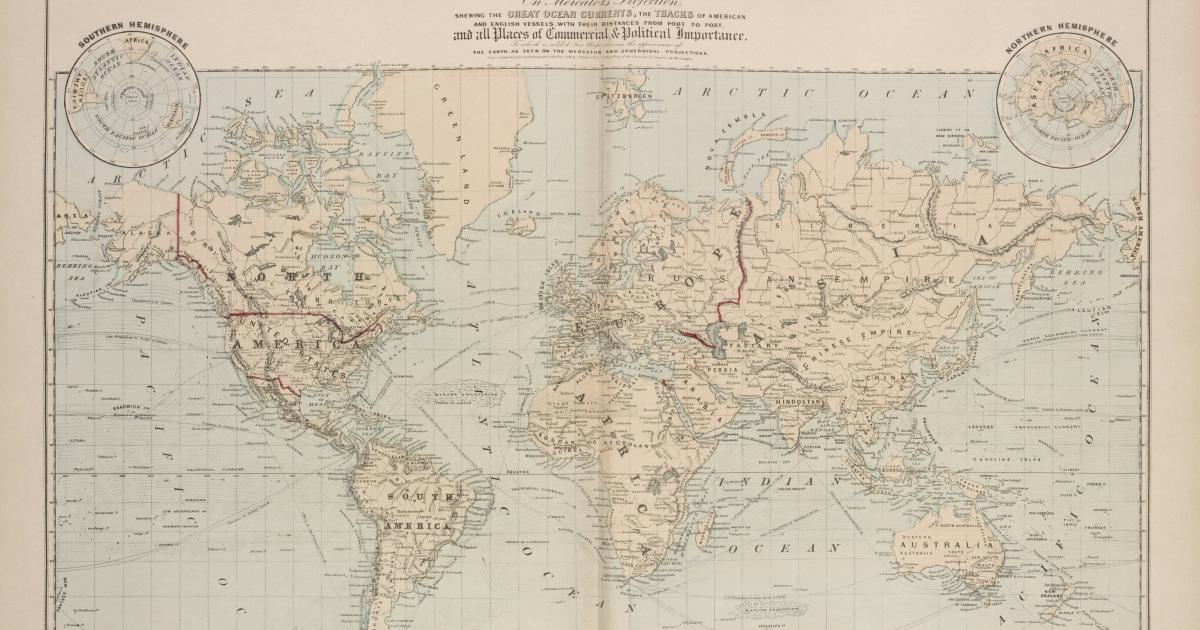

The Historical Evolution of International Markets

Historically, the globalization of stock markets has evolved alongside advancements in communication technology, trade liberalization, and political reforms. The deregulation of many financial markets since the 1980s, along with technological breakthroughs, has paved the way for investor access to international equities. The phenomenon known as "global convergence" has seen once-isolated stock markets become integrated parts of the international financial system, reinforcing the importance of diversifying beyond local markets.

This integration has made it easier for investors to navigate currency fluctuations, regulatory differences, and logistical challenges. Moreover, international indices, such as the MSCI World Index or the FTSE Global All Cap Index, provide benchmarks that help investors track performance trends across multiple regions simultaneously.

Benefits of Investing in International Stocks

The allure of international stocks lies in their potential to offer:

- Higher growth prospects in emerging economies.

- Diversification benefits which can stabilize portfolio returns.

- Opportunities to invest in innovative sectors that might not be well represented in domestic markets.

- Access to global industry leaders that dominate their markets on a worldwide scale.

By understanding these categories, investors are better equipped to allocate their resources effectively, considering their own risk tolerance and long-term investment goals.

Why Diversify with International Stocks?

Diversification is a critical element of portfolio construction that can help reduce overall volatility and exposure to risk. The concept of international stocks portfolio diversification offers a way to spread investments across different geographical regions and sectors. The guiding philosophy is simple: do not put all your eggs in one basket. By tilting your allocation towards multiple markets, you benefit from the fact that economic cycles in different regions rarely coincide perfectly.

Economic Cycles and Market Behavior

Each country or region has its own economic cycle that is influenced by unique factors such as monetary policies, political stability, cultural nuances, and consumer behavior:

- Developed Markets: These markets tend to have steady growth, but they can be affected by interest rate changes, political decisions, or market saturation. In times of economic downturn, developed markets may still benefit from stability and long-term growth trends.

- Emerging Markets: These are typically characterized by faster expansion due to industrialization, urbanization, and increasing consumer demand. However, they can quickly become volatile due to inflation risks, changing commodity prices, and political instability.

When international equities are added to a portfolio, one market's downturn may be offset by stability or growth in another. This interplay of asynchronous cycles reduces the impact of localized economic downturns on the overall portfolio.

Impact of Currency Fluctuations

Investing in international stocks introduces the element of currency risk. Currency fluctuations can either increase or decrease the value of the investment, independent of the stock performance itself. For example, if the currency of the market in which you invest depreciates relative to your home currency, even a well-performing stock might yield lower returns when converted back.

To manage this risk:

- Investors can opt for currency-hedged funds.

- Diversification across various currencies may also help.

- Staying abreast of global economic indicators and forex trends is advisable to time exposure wisely.

International Stocks Portfolio Diversification: Balancing Risk and Reward

Including international stocks involves understanding both the potential for enhanced growth and the exposure to risk factors such as currency fluctuations and regulatory differences. However, when managed properly, the advantages often outweigh the risks:

- Portfolio Noise Reduction: Since international markets do not always move in tandem with domestic markets, they offer a natural hedge against localized economic shocks.

- Enhanced Returns: Some global sectors or companies may outperform local counterparts due to more favorable economic conditions or access to exclusive technologies and innovations.

- Access to Unique Sectors: Investors can tap into sectors like renewable energy in Europe, technology in Asia, or commodities in South America, ensuring that the portfolio is not limited by the trends predominant in just one region.

In practice, a diversified portfolio that includes international stocks often exhibits lower volatility than a portfolio concentrated solely on domestic equities. This balance between risk and reward is vital for long-term wealth accumulation.

Benefits of International Stocks Portfolio Diversification

This section delves deeper into the specific benefits derived from including international stocks in portfolio diversification. The global landscape is uniquely advantageous when it comes to reducing risk and seizing opportunities.

Risk Mitigation Through Geographical Spread

One of the primary benefits of an international approach is the reduction of systemic risk. Systemic risk, or market risk, is inherently linked to the economic and political health of a single country. By investing in companies located in multiple countries, investors can dilute the impact of adverse events localized to one region. For instance, while a domestic market might be experiencing a recession, an international market could be on an upswing due to favorable policies or emerging trends in technology.

Enhanced Return Opportunities

Investment returns can be significantly boosted by exposure to global growth trends. Many emerging markets offer rapid industrialization, a burgeoning middle class, and a relatively untapped consumer base compared to developed economies. For example, sectors like technology, healthcare, and infrastructure in countries such as India and China have shown robust growth in recent years. Investors who captured these opportunities at the right time have enjoyed outsized returns.

Portfolio Volatility Reduction

Diversification across multiple asset classes and geographies is a well-known risk management tactic. When mainstream indices may be influenced by local factors, international equities can provide a counterbalance. The diversification benefit arises when asset returns are not perfectly correlated; that is, when one area's downturn does not necessarily imply a downturn in another. This naturally leads to smoother ride for the overall portfolio performance.

Access to Diverse Economic Sectors

Domestic markets may limit exposure to certain industries that are thriving in other parts of the world. By investing internationally, one gains access to:

- Innovative Sectors: Industries like biotechnology and renewable energy might be more developed in certain foreign markets.

- Specialized Markets: Some countries excel in sectors such as luxury goods, automobile manufacturing, or precision engineering.

- Cultural Consumer Behaviour: Consumer trends vary widely by region. International exposure helps capture niche markets where innovation and demand are on the rise.

Expanding into international stocks not only diversifies risk but also taps into growth engines that may outperform traditional domestic sectors over time.

Tax and Regulatory Considerations

Another less discussed but important benefit of this strategy is the potential for tax diversification. In certain cases, investing in foreign markets might allow investors to benefit from favorable tax treaties or lower tax regimes. However, these benefits come with their own set of complexities, such as understanding varying regulatory environments, which should be approached with careful professional advice.

Real-World Case Study: The Global Automotive Industry

Let’s consider the global automotive industry as an example of the advantages of international diversification. When economic conditions in one country decline, global giants not only rely on domestic sales but also on international markets to maintain their revenue. For instance, during an economic downturn in the United States, a major automotive company might see increased sales in Europe or Asia. This international revenue stream stabilizes the overall performance, demonstrating how international stocks portfolio diversification can buffer against regional economic slumps.

The case of Toyota is particularly illustrative. As a company that has operations and sales across multiple continents, Toyota benefits from diverse risk exposures. While fluctuations in one region might dampen sales, strong performance elsewhere can compensate—an equilibrium that many domestically focused companies struggle to achieve.

Risks and Considerations for Global Investors

While the benefits of international investments are significant, there are unique risks associated with buying international stocks. Investors must be cautious, conducting thorough due diligence to identify and mitigate these risks.

Political and Regulatory Risks

Political instability or abrupt regulatory changes in any given country can have severe impacts. For instance:

- Sudden changes in trade policies, tariffs, or sanctions can imperil earnings.

- Regulatory differences, such as less stringent corporate governance standards, can increase risk.

- Geopolitical tensions can create uncertainties that are not typically present in more stable, domestically focused portfolios.

These factors can affect market liquidity, corporate valuations, and, ultimately, returns on investment. Investors should always research the political climate and regulatory environment of the country where the company operates.

Currency Volatility

As discussed, currency risk is a critical factor. Even if an investment shows nominal growth in local currency, adverse currency movements can erode returns when converted back to the investor’s home currency. Employing strategies like currency hedging or simply diversifying investments across countries with stable currencies can mitigate this risk.

Market Access and Liquidity Concerns

Some international markets, particularly in emerging economies, can have less liquidity compared to developed markets. Thinly traded stocks may experience large price swings and higher transaction costs. Additionally, there can be differences in reporting standards and financial transparency, complicating investment decisions for those used to stringent domestic requirements.

Information and Data Accessibility

Investors may face challenges gathering reliable information about foreign companies. Differences in accounting standards, language barriers, and limited analyst coverage can all contribute to higher information asymmetry. This makes thorough research and sometimes consulting local expertise indispensable when considering international investments.

Managing Investment Costs

Costs related to international investment can include higher brokerage fees, currency conversion costs, and taxes on foreign dividends. These additional expenses can eat into the overall investment return if not managed properly. Investors should weigh these costs against the potential benefits and seek cost-effective ways to access international markets, such as using international index funds or ETFs.

Strategies and Best Practices for International Portfolio Diversification

Building a successful portfolio that includes international stocks requires a well-thought-out strategy. Below, we outline some actionable steps and expert tips for investors seeking global diversification.

Step-by-Step Investment Strategy

Perform Global Research:

- Start with a detailed analysis of global economic trends and identify regions with strong growth potential.

- Evaluate the political and regulatory environments of target countries.

- Use globally recognized indices for benchmarking potential investments.

Determine Your Allocation:

- Assess your risk tolerance and decide what percentage of your portfolio should be allocated to international stocks.

- Balance between developed and emerging markets based on your investment horizon.

- Consider using a core-satellite approach where a core portion of the portfolio is stable domestic stocks, complemented by a satellite allocation for higher-risk international stocks.

Evaluate and Select Investments:

- For direct equity investments, look for companies with robust financial health, strong corporate governance, and a track record of performance.

- Consider mutual funds or exchange-traded funds (ETFs) that focus on international or global markets, offering instant diversification across multiple countries.

Currency and Hedging Strategies:

- If concerned about currency risk, explore hedged ETFs or incorporate currency diversification into your strategy.

- Regularly review macroeconomic indicators that could impact currency values.

Monitor and Rebalance:

- Once you have invested, review the portfolio periodically to adjust the exposure as global economic conditions change.

- Rebalancing ensures that the portfolio remains aligned with your investment goals and risk tolerance.

Practical Tips for Managing International Investments

- Stay Informed: Global markets move rapidly, and staying updated through international news and data services is crucial.

- Leverage Technology: Use investment platforms that offer detailed insights, analytics, and risk management tools specifically designed for global markets.

- Manage Costs Effectively: Evaluate all fees including management fees, transaction costs, and foreign exchange fees. Often, low-cost ETFs can provide the required exposure with minimal overhead.

- Seek Professional Advice: Especially if you are new to international investing, consider consulting financial advisors with expertise in global markets.

- Diversify Within Diversification: Even within international equities, diversify among different sectors and regions. For example, invest simultaneously in European tech stocks, Asian consumer goods, and Latin American natural resources.

Tools and Resources

Modern investors have access to numerous online tools and platforms:

- Global Index Trackers: MSCI, FTSE, and S&P international indices provide a solid framework for benchmarking.

- Market Data Providers: Bloomberg, Reuters, and other financial news portals are invaluable resources for global economic and market data.

- Investment Communities: Online forums and communities can offer insights, peer experiences, and updated strategies from global investors.

By following these actionable steps and leveraging modern resources, investors can significantly reduce the complexities associated with international investments. The key is to manage the inherent risks while reaping the benefits associated with a well-diversified global portfolio.

Real-World Case Studies and Success Stories

Examining real-world examples can provide clarity on how international stocks portfolio diversification works in practice. Here are two case studies that highlight the benefits and challenges of investing across borders.

Case Study 1: The Multinational Technology Giant

Consider a multinational technology company that has established a strong presence across North America, Europe, and Asia. This company’s diversified revenue streams shielded it from regional economic slowdowns. During the early 2000s, a downturn in the domestic market was offset by rapid growth in emerging markets, particularly in Asia, where consumer demand for technology products surged. The company’s well-structured global strategy not only stabilized its performance but also propelled sustained long-term growth, confirming the merits of international diversification.

The multinational’s story underscores the advantage of having a geographically diversified revenue base. Investors who recognized the company’s global approach often enjoyed relatively lower volatility in returns, even during episodic downturns in certain regions.

Case Study 2: Emerging Market ETF Success

Another compelling example is the performance of an emerging market ETF. Over the past decade, this ETF provided exposure to high-growth regions in Latin America and Asia. Despite occasional market turbulence, the ETF’s diversified investments across several countries allowed it to consistently outperform domestic benchmark indices. The portfolio benefited from averaging out extreme volatility in any single market while capturing the robust growth trends of emerging economies.

This case demonstrates how a focused yet diversified vehicle, like an ETF, can simplify exposure to international equities while offering risk management benefits through broad diversification. It also serves to illustrate that successful execution relies on the continuous monitoring of regional dynamics and appropriate rebalancing.

Future Outlook and Conclusion

The global economy continues to evolve, driven by technological innovations, shifting trade policies, and emerging market dynamics. Looking ahead, international stocks will likely remain a cornerstone of a well-diversified portfolio. As domestic markets become increasingly saturated, the pursuit of alternative growth avenues will drive investors to explore international equities further.

Emerging Trends Influencing Global Investments

Technological Advancements: Continuous innovation in technology, particularly in artificial intelligence, biotechnology, and green technologies, is reshaping industries worldwide. Companies leading these transformations may offer robust growth prospects, regardless of their home country.

Shifting Global Trade Dynamics: Trade agreements, tariffs, and geopolitical tensions are altering where and how companies operate. Investors are increasingly factoring in global supply chain resilience and diversification.

Sustainability and ESG Investing: Environmental, Social, and Governance (ESG) criteria are becoming pivotal in investment decisions. Many international companies are at the forefront of sustainability initiatives, thereby attracting investors who prioritize ethical and responsible investing.

Digital Transformation: The rise of digital platforms has not only transformed industries but also the way investors access and manage investments. The increasing availability of international market data has made it easier for investors to make informed decisions.

Concluding Thoughts

International stocks portfolio diversification is more than just a buzzword—it is a robust strategy that can enhance returns, reduce portfolio volatility, and provide exposure to growth engines beyond domestic boundaries. By carefully analyzing global economic trends, managing currency and political risks, and employing strategic allocation methods, investors can construct portfolios that are both resilient and adaptive to the challenges of the modern financial landscape.

The key takeaways for investors are:

- Embrace global diversification as a means to reduce overall risk and improve returns.

- Stay informed about geopolitical shifts, currency dynamics, and regulatory landscapes.

- Use structured investment strategies and modern tools to efficiently manage international exposure.

- Regularly review, rebalance, and adapt your portfolio to align with global market trends.

In today’s interconnected world, the opportunities provided by international stocks are vast. Whether you are seeking to hedge against domestic volatility or aiming to capture high-growth opportunities abroad, incorporating international equities into your investment strategy can provide the diversification needed for long-term financial success.

Investment is inherently about balancing risks and rewards. While the journey may involve navigating occasional uncertainties, the benefits of a well-crafted global portfolio—enhanced by the diverse economic climates and growth patterns of international markets—are undeniable. As markets continue to integrate, the role of international stocks in portfolio diversification will only become more pronounced, making it an indispensable strategy for investors who aspire to not only preserve but also grow their wealth in an ever-changing global market.

By understanding the dynamics of international markets, comprehending the trade-offs involved, and applying actionable diversification strategies, investors can weather economic storms and capitalize on the growth opportunities that lie beyond domestic borders. Ultimately, a well-diversified portfolio that spans continents stands as a testament to the power of broad-based risk management and strategic allocation in achieving sustained financial success.

In conclusion, the pursuit of international stocks portfolio diversification is a journey toward balancing risk with opportunity on a global scale. It invites investors to think beyond conventional boundaries, embrace the myriad challenges of a rapidly evolving market landscape, and position themselves to reap the rewards of a genuinely diversified portfolio. As the world becomes more interconnected, adopting an international perspective in investment strategy becomes not only advisable but necessary for those who want to secure their financial future in an unpredictable global environment.

Investors who commit to understanding global economic trends, leverage advanced tools for market analysis, and remain agile in their strategy are best prepared to take full advantage of the vast opportunities presented by international markets. The path to a diversified investment portfolio is rife with both challenges and immense potential. Ultimately, the active pursuit of international stocks portfolio diversification can pave the way for sustained growth, stability, and financial success in an interconnected world.

Unlock Your Trading Potential with Edgewonk

Struggling to improve your trading performance? Edgewonk's advanced analytics tools are designed to give you the edge you need.

With detailed trade journaling, robust strategy analysis, and psychological insights, you'll gain a comprehensive understanding of your strengths and weaknesses. Don't miss out on this game-changing opportunity.

Unlock Your Trading Potential with Edgewonk

Struggling to consistently achieve profitable trades? Edgewonk's cutting-edge analytics empower you to analyze your performance and refine your strategies.

Our advanced trading journal software provides detailed insights, psychological analysis, and personalized recommendations tailored to your unique trading style.