Is AI-Powered Charting Software the Future of Trading?

Trading is an intricate dance of data, intuition, and technology. The last few decades have seen tremendous shifts in how markets operate, with trends increasingly leaning towards the integration of Artificial Intelligence (AI) into tools that analyze and interpret market data. In this digital age, the discussion of whether AI-powered charting software trading is the next giant leap for the trading sector has become more relevant than ever. As financial markets become more volatile and bumper datasets become routine, the capacity for AI to sift through vast amounts of information in real time has the potential to redefine how traders approach decision-making.

The concept of AI-powered charting software trading refers to systems where algorithms analyze, predict, and signal market movements on interactive charts. These systems utilize machine learning models that adapt and learn from new market data, evolving their prediction methods with each tick of the market. For traders, the promise is enticing: heightened accuracy, real-time insights, and the possibility of reducing emotional biases in decision-making. But as with any technological innovation in the financial sector, this revolution comes with its own set of challenges and learning curves.

In today’s rapidly shifting trading environment, blending technological advancements with traditional methodologies is not merely an option—it is a necessity. The integration of AI into charting software represents not just a technological update but a fundamental rethinking of market analysis and strategic execution. This article explores the layers of AI integration in trading, the historical evolution of trading technologies, real-world applications, and the future implications that this dynamic new tool might have on the trading landscape.

Understanding AI-Powered Charting Software

At its core, AI-powered charting software trading combines traditional technical analysis with advanced algorithms capable of learning and making informed predictions. Unlike static charting tools of the past, modern systems harness the power of machine learning algorithms to continuously learn from historical and live data. They can detect hidden patterns and emerging trends that might otherwise be invisible to the human eye. This transformative capability has given many traders a powerful ally.

To understand how this technology works, it is useful to break it down into its main components:

Machine Learning Algorithms

Machine learning, a subset of AI, is frequently at the heart of charting software. These algorithms improve continuously by analyzing historical price data, volatility patterns, and even external variables such as geopolitical events and global economic indicators. As the software evolves, it “learns” from its predictions, refining its accuracy over time. Over the past several years, these algorithms have improved exponentially, leading to more nuanced trade signals and higher levels of market insight.

Data Integration and Visualization

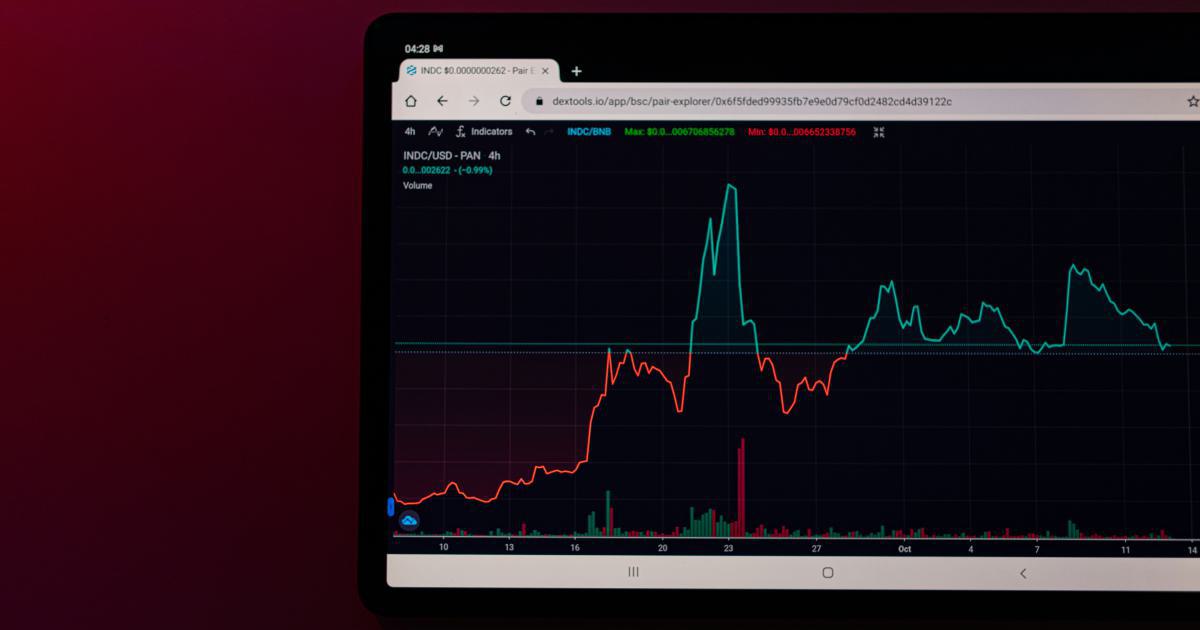

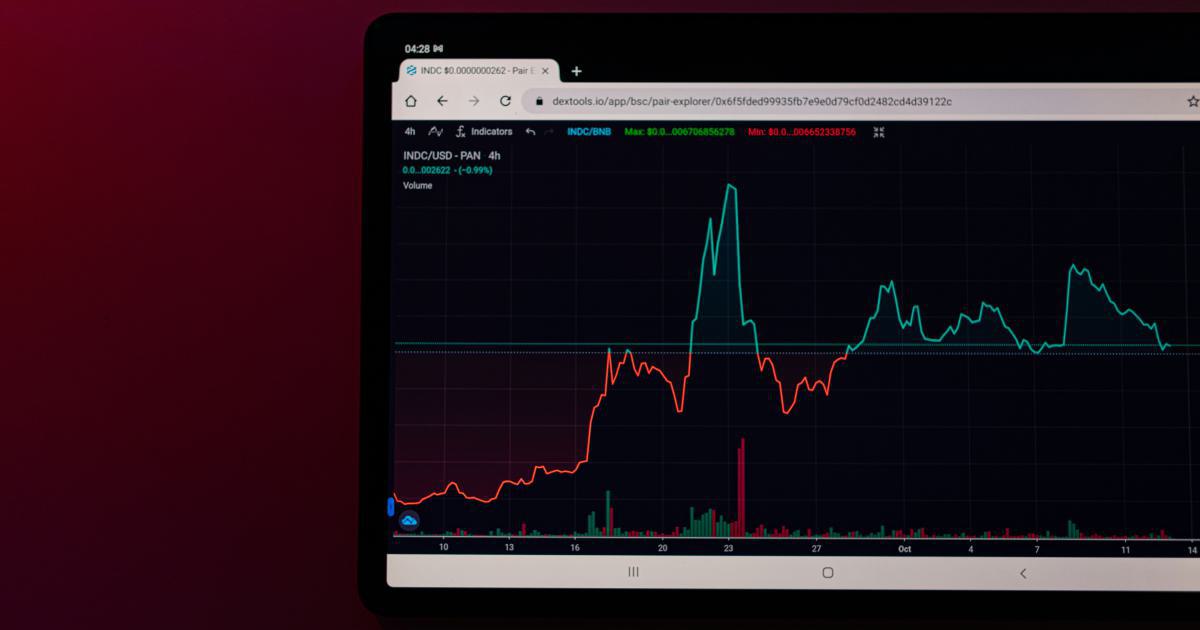

Modern charting platforms are not limited to just displaying price movements. They integrate multiple data sources such as volume metrics, sentiment analysis gathered from news feeds, and social media inputs. This multi-layered approach ensures that the charts provide comprehensive insights, making it easier for traders to see correlations between various market factors. The visualization component is equally crucial, as the ability to see data in different time frames, indicators, and formats can help traders make better comparisons and judgments swiftly.

Real-Time Analytics

One of the biggest advantages of AI in trading is the capacity for real-time analysis. Traditional charting software might require manual updates and interventions, but AI systems automate these processes and constantly update predictions. This capability allows traders to receive alerts and adjust their strategies almost instantaneously as market conditions change. Furthermore, the combination of speed and predictive analytics can lead to identifying opportunities that may last for only a few seconds—a critical advantage in high-frequency trading.

Adaptive Learning and Customization

What makes this technology particularly promising is its capacity for personalization. AI-powered systems can learn the behavior and preferences of individual traders, tailoring its analytic models to their specific trading style. For instance, a trader that relies heavily on short-term strategies might benefit from different predictive models compared to someone who prefers long-term investments. Thus, the intersection of AI and charting software is not just about raw data but about contextual intelligence that adapts to the user’s decision-making process.

Understanding these aspects of AI-powered charting platforms is essential for grasping how they can re-define trading strategies. The ability to process vast datasets, update analytics in real time, and learn from market trends positions these systems as potential game-changers in the trading world.

The Evolution of Trading Technology

Historically, the trading industry has continuously embraced innovations to streamline decision-making and anticipate market trends. From the days of telephone-based orders and ticker tapes to the modern era of algorithmic trading, technology has always been a core component in enhancing trading efficiency. Today, we stand on the cusp of another transformative era with the advent of AI-powered charting software trading.

Early Technological Advancements in Trading

Trading as an industry has long relied on speed and information dissemination. In the mid-20th century, ticker tape machines were the revolutionary communication tools that provided real-time price information. They marked the beginning of a journey towards systems that could keep pace with rapid market movements. As technology advanced, electronic trading systems emerged that automated the order placement process, reducing human error and increasing execution speed.

With the advent of computerized trading systems in the 1980s and 1990s, the market witnessed a profound change. Traders now had access to advanced charting tools and real-time data feeds, which enabled a more detailed analysis of market trends. This era also saw the rise of technical indicators, such as moving averages and Bollinger Bands, tools that remain popular today. However, these tools were largely based on fixed formulas and lacked the adaptability provided by AI.

The Role of Algorithmic Trading

Algorithmic trading, which involves executing trades based on pre-programmed instructions, took the market by storm in the early 2000s. These algorithms could quickly scan market data and execute trades faster than any human trader. Initially, algorithms were simple and based on historical data, but they have since grown increasingly complex. Today, many trading firms deploy high-frequency trading systems that execute thousands of trades in fractions of a second.

Algorithmic trading laid the groundwork for more sophisticated systems by proving that automated processes could outperform human intuition when it came to speed and reliability. However, one major limitation was that these algorithms were typically rigid, following set rules without adapting to changes in market conditions unless manually reprogrammed.

Integration of AI into Trading Systems

The advent of machine learning has pushed the boundaries far beyond what traditional algorithms could achieve. AI-powered charting software trading leverages deep learning models which continuously adjust based on new data. Unlike traditional algorithms that require explicit instructions, AI systems identify patterns and trends autonomously. For example, deep learning neural networks, which mimic the human brain’s approach to learning, have been used to process immense datasets, drawing inferences that can lead to better-informed trades.

This integration has not only enhanced the speed of trade execution but also improved the predictive power of trading systems. Traders now can anticipate market movements more effectively, mitigating risks while capitalizing on short-term opportunities. With improved data analytics, these systems help traders make informed decisions by providing clearer insights into the underlying market dynamics.

The Pursuit of Accuracy and Speed

In the modern competitive landscape, the accuracy and speed of trading decisions often make the difference between profit and loss. AI-driven models have pushed the boundaries by introducing concepts such as algorithmic self-correction and dynamic adjustment in trade strategies. They can analyze historic market volatility alongside current transactions to forecast short-term price swings with an impressive degree of accuracy, underscoring the importance of swift decision-making in today’s high-speed markets.

Furthermore, the benefits extend into risk management. Advanced AI models not only predict favorable trades but also signal potential downturns and market corrections. This dual role of prediction and prevention allows traders to implement stop-loss measures more effectively and adjust their portfolios in anticipation of market reversals.

The evolution of trading technology from rudimentary systems to modern AI-driven platforms marks a significant milestone in financial history. The capabilities of AI-powered charting software trading continue to push the frontiers of what is possible, setting the stage for a future where real-time analytics, adaptive learning, and precise forecasting converge to create smarter, more responsive trading environments.

How AI is Transforming Charting and Trading

As we delve deeper into the subject, it becomes clear that the integration of AI into charting software is more than just a technological upgrade—it signifies a paradigm shift in market analysis and trade execution. The keyword ai-powered charting software trading encapsulates this evolution where traditional charting is being reimagined with elements of intelligence and adaptability.

Enhanced Data Analysis and Pattern Recognition

One of the most significant advantages of integrating AI in trading lies in its ability to process and analyze vast datasets swiftly. Where human analysis might falter under the weight of millions of data points, AI systems can discern subtle patterns that hint at underlying market trends. These algorithms can spot correlations between seemingly unrelated data sets—correlations that might indicate upcoming market shifts. The software can, for instance, analyze fluctuations in European stock visions alongside movements in Asian markets, ultimately deducing implications for the US markets.

Moreover, AI-powered charting tools are not limited to textbook patterns. They can recognize unconventional formations that deviate from traditional chart patterns but still hold predictive value. This capability is particularly crucial during times of market stress or volatility when historical norms no longer apply. It provides traders with a nuanced, multi-dimensional view of market dynamics.

Real-Time Response and Automation

In high-stakes trading, time is money. Traditional systems that require manual monitoring and updating simply cannot compare to AI systems in terms of speed and accuracy. Real-time analysis allows traders to respond almost instantaneously to emerging market trends. For instance, during flash crashes or rapid market rebounds, AI systems can trigger buy or sell orders faster than human reflexes.

Automation is another critical improvement. AI-powered charting software trading reduces the need for manual intervention by automating routine tasks such as data collection, analysis, and even the execution of trades. This allows traders to focus on strategic decision-making rather than the minutiae of data processing. Over time, continual feedback between executed trades and the AI’s learning algorithm refines the decision-making process, reducing errors and improving profitability.

Customization and Adaptability

The dynamic nature of markets necessitates systems that can adapt quickly. Unlike static models, AI-powered systems are built to learn and evolve. They adjust strategies in response to sudden changes in market behavior, regulatory adjustments, and shifting economic conditions. Many platforms now offer customizable algorithms that traders can fine-tune based on their risk tolerance, investment horizon, and preferred trading instruments. Such adaptability ensures that the tool remains relevant even as market conditions shift unpredictably.

Additionally, these systems are beginning to integrate sentiment analysis from news articles, social media, and other public data sources. By marrying traditional technical analysis with sentiment insights, traders are equipped with a broader perspective on market conditions. This happens through sophisticated natural language processing models that can quantify the impact of public sentiment and news on market sentiment. Essentially, what once required a human analyst poring over reports is now automated, offering near-instant insights that can be acted upon rapidly.

Increasing Accessibility for Retail Traders

Historically, many of these advanced trading technologies were confined to major financial institutions and hedge funds. However, the democratization of AI and the advent of user-friendly platforms have made these tools progressively more accessible to retail traders. Today, sophisticated charting software powered by AI is available via cloud platforms, subscription services, and even open-source projects, empowering individual traders with resources previously reserved for professionals. This has contributed to a more level playing field in the trading community, encouraging a broader participation rate in the markets and thereby introducing more liquidity and competition.

Integration with Trading Platforms

The integration of AI-powered charting technology directly into popular trading platforms has further accelerated its adoption. Major financial software providers are now offering package solutions that combine real-time trading, risk management, and AI-driven analytics under a single interface. This integration not only simplifies the user experience but also enhances the overall efficiency of trading operations. In many cases, the workflow becomes seamless—from generating insights, to setting up alerts, to executing trades—thanks to the direct connectivity between the analysis module and trading execution systems.

Real World Examples and Case Studies

The practical applications of ai-powered charting software trading extend beyond theoretical models. In today’s trading ecosystems, several pioneering firms and individual traders have already begun to reap the benefits of AI integration. These real-world examples not only validate the technology’s potential but also highlight the diversity of use cases and benefits.

Hedge Funds and Institutional Adoption

Major hedge funds have long been at the forefront of technological innovation in trading. Many of these sophisticated financial institutions are now employing AI-powered charting systems to gain a competitive edge. For example, some funds use these advanced tools to predict market corrections or to synergize trading strategies across different asset classes. These systems can process a multitude of signals—from technical indicators to global news—ensuring that the fund's trading strategies are constantly optimized. The ability to adapt to sudden market changes has allowed many institutional traders to avoid significant losses that might have otherwise resulted from slower, manual decision-making processes.

One case study involved a leading hedge fund that integrated an AI-driven charting platform into its trading operations. By leveraging the system's ability to analyze not only historical price patterns but also transient market sentiments, the fund reported a significant improvement in trade accuracy over a six-month period. The ultimate result was an enhanced return on investment relative to previous quarters when using traditional systems. This example underscores the transformative potential of combining machine learning with conventional trading analytics.

Retail Traders and Market Democratisation

The democratization of AI-powered trading technology is one of its most remarkable achievements. Numerous fintech startups are now offering subscription-based trading platforms embedded with AI capabilities, allowing retail traders to benefit from advanced analytics without the need for extensive technical knowledge. One noteworthy example is a mobile trading app that provides personalized insights drawn from AI-driven predictions. Users have reported that the app helped them make more informed trading decisions by alerting them to market trends that they might have otherwise missed.

Case studies from the retail sector often highlight how the fusion of AI and charting software has empowered individual traders to achieve more consistent results. These platforms typically feature intuitive interfaces where traders can adjust parameters according to their risk appetite. The result is a higher level of self-confidence and more strategic planning in executing trades, fostering an environment where advanced technology and individual creativity come together.

Institutional Versus Retail: A Comparative Analysis

While both institutional and retail users benefit from ai-powered charting software trading, the approaches differ significantly. Institutions typically leverage the technology on a large scale, feeding multifaceted datasets into their AI models to process macroeconomic indicators along with micro-level market data. In contrast, retail traders might use more streamlined versions of the software focused on a specific set of indices or commodities. Despite these differences, the underlying technology remains the same—a testament to the versatility and broad applicability of AI in trading.

The case studies reveal that no matter the scale, the continuous learning models ensure that every trade is backed by data-driven precision, reducing emotional biases and human errors. As both market segments continue to adopt these solutions, the line between retail and institutional trading strategies is likely to blur further, ushering in an era of universally smarter trading systems.

Challenges and Considerations

As promising as ai-powered charting software trading is, its adoption is not without challenges. Successful implementation and effective utilization require addressing several core issues that encompass technical, regulatory, and market-related aspects.

Data Quality and Integrity

One of the primary challenges is ensuring the quality and integrity of the data fed into these systems. AI models are only as good as the data they are trained on. Inaccurate or outdated data can lead the AI to make erroneous predictions, potentially causing significant financial loss. Regular data audits, validation processes, and incorporating multiple data sources are critical to maintaining the integrity of the analytics. Moreover, as trading systems become increasingly interconnected, the risk of data breaches and manipulation also rises, emphasizing the need for robust cybersecurity measures.

Regulatory and Ethical Implications

The financial industry is heavily regulated. The integration of AI into trading systems raises new regulatory and ethical questions. For instance, if an AI system makes a mistake that leads to a significant market disruption, determining accountability can be exceedingly complex. Regulators worldwide are only beginning to grasp the implications of AI in financial systems, and there is an ongoing debate about appropriate oversight measures. Furthermore, the ethical considerations around algorithmic trading, such as market manipulation and fairness, add another layer of complexity to AI’s widespread adoption.

Overreliance on Automation

While automation brings speed and precision, it also carries the risk of overreliance. In scenarios where AI-driven models fail due to unexpected market conditions or black swan events, traders who have become too dependent on automated decisions may find themselves at a disadvantage. It remains crucial for traders to maintain a balanced approach—leveraging AI for routine analysis while retaining the ability to intervene manually when market conditions deviate from the norm. This balance is particularly important during periods of excessive volatility or market anomalies.

Integration and Adaptability Challenges

Implementing AI-powered systems within existing trading infrastructures can be challenging. Financial institutions typically have legacy systems that might not interface easily with modern AI algorithms. The transition requires not only technological adjustments but also comprehensive training for personnel to effectively harness the capabilities of these new tools. Bridging the gap between traditional trading practices and modern AI methodologies necessitates significant investment in both technology and human capital.

Market Perception and Trust

An equally important aspect is trust. For many traders, especially those with years of experience using traditional methods, it can be challenging to place confidence in a machine’s ability to navigate volatile markets. Building trust in AI-powered charting software trading involves demonstrating consistent performance, transparency in how decisions are made, and clear communication between the developers and the end users. The more demonstrable the results, the quicker the market will acclimate to new norms and embrace these innovative tools.

Future Trends and Predictions

The rise of AI in trading is still in its early stages, and its potential is vast. In the coming years, the integration of AI into charting software is expected to deepen, creating a host of opportunities and innovations that could reshape the entire trading ecosystem.

Advancements in Machine Learning

The progression of machine learning models shows no sign of slowing down. Researchers are constantly refining algorithms to make them more accurate and better at processing unstructured data. Future iterations of ai-powered charting software trading will likely incorporate more advanced neural network architectures and enhanced data fusion techniques, enabling a more holistic view of market conditions. The models will improve not only in speed but also in their ability to learn from less structured sources such as global news and even real-time economic reports.

Expansion of Data Sources

As markets evolve, so too will the data that influences them. The future may see a broader integration of alternative data sources—from satellite imagery of retail parking lots to real-time logistical updates. Incorporating these diverse data points into AI models promises to provide even deeper insights. This expansion will allow charting software to anticipate market movements that are influenced by factors previously beyond the scope of traditional financial models.

Increasing Collaboration Between Human and Machine

Another significant trend is likely to be the increased collaboration between human traders and machine learning systems. Instead of replacing the human element entirely, AI will serve as an augmentation tool—providing analysis, suggestions, and insights that traders can then leverage with a human touch. This hybrid model allows for the strengths of both human intuition and machine precision to be combined, potentially leading to more robust and adaptive trading strategies.

Global Regulatory Developments

As the technology evolves, regulators around the world will continue to assess the implications of AI in financial systems. It is anticipated that clearer guidelines and frameworks will be developed, enabling a more secure and transparent implementation of ai-powered charting software trading. These regulatory developments will not only provide a legal framework but will also boost market confidence in AI-driven trading decisions.

Investment in Education and Training

To bridge the gap between traditional methodologies and futuristic AI tools, there will be a growing emphasis on education and professional training. Universities, fintech platforms, and trading firms will increasingly offer courses and certifications focusing on the integration of AI in trading. This surge in educational resources will equip a new generation of traders who are adept at using these tools, further accelerating the adoption of AI in financial markets.

Conclusion

The journey of trading technology—from ticker tapes to automated algorithms and now to AI-powered charting software trading—marks one of the most exciting evolutions in financial history. This transformation offers numerous benefits, from enhanced data analysis and real-time decision-making to personalized strategies and increased accessibility for a broader range of market participants. Yet, as with every technological revolution, the integration of AI into trading must be approached cautiously, with attention to data integrity, regulatory oversight, and the need for maintaining human judgment.

For traders, institutional investors, and developers alike, the ongoing advancements in AI present incredible opportunities for innovation and improved market performance. The challenges, while significant, are not insurmountable and serve as catalysts for deeper research, better integration, and enhanced collaboration between man and machine.

The future will likely see a trading landscape where humans and AI work side-by-side, each complementing the other. As these technologies continue to evolve, the potential for smarter, more efficient, and even more democratized trading becomes increasingly real. The evolution of ai-powered charting software trading signals not just a technical upgrade, but a paradigm shift in how market dynamics are analyzed and capitalized upon—paving the way for a new era in financial strategy.

In conclusion, while challenges remain and the journey is far from complete, AI-powered charting software trading has already demonstrated its capability to enrich the trading process thoughtfully and intelligently. The melding of advanced analytics, machine learning, and human insight heralds a future where trading strategies are not only data-driven but also dynamically responsive to an ever-changing market environment. Embracing this future may well be the key for traders and institutions alike to secure a competitive edge in tomorrow's financial landscape.

Unlock Your Trading Potential with Edgewonk

Struggling to consistently achieve profitable trades? Edgewonk's cutting-edge analytics empower you to analyze your performance and refine your strategies.

Our advanced trading journal software provides detailed insights, psychological analysis, and personalized recommendations tailored to your unique trading style.

Quentin Merriweather

52 posts written