Mean Reversion vs Bollinger Bands: Which Signals More?

Introduction

The world of technical analysis is abundant with various tools and indicators designed to help traders decipher market behavior and predict future price movements. Among these, mean reversion and Bollinger Bands are two widely used approaches that offer unique perspectives on market signals. In this comprehensive comparison, we delve deep into the functionality, strengths, weaknesses, and practical applications of these instruments under the umbrella theme “mean reversion vs bollinger bands.” Our analysis will span several criteria, including historical performance, complexity, adaptability in various market conditions, volatility responsiveness, and overall usability for both novice and experienced traders.

Understanding the differences between these two concepts is paramount for anyone looking to incorporate technical analysis into their trading strategy. Mean reversion is based on the idea that prices, after reaching an extreme, will eventually return to their historical average. Bollinger Bands, on the other hand, are a type of price envelope developed by John Bollinger, which use standard deviations to establish upper and lower boundaries around a moving average. Throughout this article, we will explore the nuances of each method, compare their effectiveness, and discuss how their underlying philosophies influence trading decisions.

Our discussion begins with a brief overview of each subject, followed by a deep dive into specific criteria that help differentiate and evaluate these tools. We will then outline the similarities and differences that exist between them, supported by practical examples, expert opinions, and statistical data. By the end of this article, readers will have a clear understanding of the implications of adopting one strategy over the other and will be better equipped to make informed decisions in their trading endeavors.

In the next sections, we will address:

- The fundamental principles behind mean reversion and Bollinger Bands.

- Specific characteristics that impact their performance in trending versus ranging markets.

- Detailed criteria with respect to responsiveness to volatility and time horizons.

- A holistic side-by-side analysis of strengths and weaknesses, complete with practical examples and statistical support.

This detailed examination is particularly useful for traders who consistently seek improvement in signal accuracy and robustness. As we compare “mean reversion vs bollinger bands,” we invite readers to explore a nuanced approach that not only sheds light on these methods but also provides actionable insights for implementation in various market scenarios.

Overview of Subjects

Before diving into the criteria for comparison, it is essential to provide a brief description of each subject to establish a common foundation.

Mean Reversion

Mean reversion is a statistical concept applied in finance that asserts that the price of an asset will tend to return to its historical average over time. The premise is that extreme fluctuations are temporary, and markets will stabilize around a long-term mean. This approach can be applied to numerous financial instruments, including stocks, commodities, and currencies.

Key characteristics of mean reversion include:

- Statistical Basis: It relies on historical performance and the assumption of equilibrium in market prices.

- Indicator Simplicity: It can be implemented using simple moving averages or more complex statistical models.

- Timing Sensitivity: It provides signals based on overbought or oversold conditions relative to historical norms.

- Market Range Dependence: Mean reversion works best in markets that are not experiencing a strong trending behavior.

Mean reversion strategies are popular in environments where price fluctuations are cyclic or where mean values are relatively stable over time. They are frequently used in contrarian trading approaches, trying to exploit temporary mispricings.

Bollinger Bands

Bollinger Bands are a versatile technical tool designed to provide traders with critical insights into volatility and potential price reversal points. They consist of a set of three lines – a middle band representing a simple moving average (SMA) and two outer bands which represent standard deviations away from that average. The distance between the bands expands and contracts based on the volatility of the underlying asset.

Key elements of Bollinger Bands include:

- Volatility Representation: The widening or narrowing of the bands reflects market volatility.

- Dynamic Boundaries: The bands adjust continuously with the moving average, capturing the market's current state.

- Signal Generation: Traders use a variety of signals from Bollinger Bands, such as breakouts, bounces off the bands, or squeezes (periods of low volatility preceding significant moves).

- Adaptability: Suitable for both trending and ranging markets, though the interpretation of the bands may differ based on the prevailing market condition.

Bollinger Bands have gained favor due to their visual representation of volatility and relative price levels. They offer a systematic approach to understanding market dynamics, which can be particularly useful when markets are experiencing considerable swings in price.

Comparison Criteria

In our comparative analysis of mean reversion and Bollinger Bands, we will examine several key criteria that encapsulate both their theoretical underpinnings and practical performance.

Criterion 1: Theoretical Foundation and Assumptions

Mean Reversion

Mean reversion strategies are built upon the central tenet that markets tend to return to a mean over time. This assumption is particularly valid in range-bound markets where prices oscillate around a long-term average without strong trends. The primary theoretical basis lies in statistical analysis, where natural variations eventually counteract periods of extremity.

- Assumptions:

- Prices exhibit cyclical behavior.

- Extreme deviations are temporary anomalies rather than the start of a sustained trend.

- Strengths:

- Provides clear entry and exit signals when prices diverge significantly from the historical average.

- Simplistic design makes it accessible to traders with varying levels of expertise.

- Weaknesses:

- In trending markets, the assumption fails as prices can continuously deviate from the mean without reverting.

- Requires careful calibration of the mean and thresholds to avoid false signals.

Mean reversion’s simplicity and reliance on historical average make it a powerful tool in environments characterized by cyclic behavior. However, its effectiveness diminishes in volatile or strongly trending markets, where the assumption of a constant mean is less reliable.

Bollinger Bands

Bollinger Bands, in contrast, are underpinned by the concept that volatility is inherently variable and central tendencies can be derived dynamically. With the incorporation of standard deviation, these bands aim to capture the ebb and flow of market volatility. The method thrives on the statistical probability that prices will often revert to the moving average, but it also accounts for the possibility of breakout moves when volatility conditions change.

- Assumptions:

- Market volatility is dynamic and influences price behavior.

- The market will remain within the boundaries of the bands under normal conditions.

- Strengths:

- Adaptive to changing market conditions — the bands widen during periods of high volatility and contract during periods of low volatility.

- Provides a visual and quantitative method for manual and algorithmic signal interpretation.

- Weaknesses:

- Can produce false signals in low volatility or ranging markets where price action is erratic.

- Requires understanding of multiple variables, such as period settings and standard deviation multipliers.

Bollinger Bands’ dual reliance on moving averages and standard deviations can address many market conditions, yet it introduces complexity in signal interpretation that is often absent in straightforward mean reversion models.

Criterion 2: Signal Generation and Effectiveness

Mean Reversion

For mean reversion, the essence of signal generation revolves around the divergence from the historical norm. Traders often set thresholds — such as a fixed percentage or number of standard deviations from a moving average — to signal potential reversals.

- Signal Mechanism:

- Entry Signals: Generated when asset prices deviate significantly from the mean, suggesting possible overbought or oversold conditions.

- Exit Signals: Triggered when prices revert back to the mean, confirming the reversion hypothesis.

- Effectiveness:

- Optimal Conditions: Performs best in quiet or range-bound markets where extreme deviations are rare and corrections common.

- Limitations: In trending markets, these signals may be unreliable; prices can continue to drift away from the mean substantially before any reversal occurs.

Real-world examples of mean reversion signals include statistical arbitrage in equities and currency pairs, where traders have historically exploited small fluctuations around a mean value. These signals are inherently reliant on historical data and require precise calibration to reflect current market dynamics.

Bollinger Bands

Bollinger Bands generate signals through a combination of price actions relative to the bands. These signals can be categorized into several types, each offering unique insights into market behavior.

- Signal Mechanism:

- Bounces: Price touching or bouncing off the lower or upper band, interpreted as a potential reversal.

- Breakouts: Price moving outside the bands might indicate the start of a new trend or a continuation of an existing trend.

- Squeezes: A narrowing of the bands suggests a period of low volatility that may precede significant price movements.

- Effectiveness:

- Visual Clarity: The bands provide a clear, visual context for interpreting price movements in relation to historical volatility.

- Flexibility: Adjustments to the period and standard deviation multipliers allow for tailoring to specific market conditions.

- Challenges: False breakouts and whipsaw signals in choppy markets can occur, especially if the bands are not finely tuned for the asset in question.

Many traders find that the layered information provided by Bollinger Bands — price, volatility, and comparative historical context — gives it an advantage in rapidly changing market conditions. Yet, this advantage comes with the requirement of more vigilant monitoring and a deeper understanding of market psychology.

Criterion 3: Adaptability to Market Conditions and Volatility

Mean Reversion

Mean reversion strategies hold a distinct edge when markets are range-bound. The underlying assumption is that asset prices do not stray far from their historical average, and any deviation is viewed as an aberration that will be corrected.

- Advantages:

- In periods of low volatility or sideways movement, mean reversion can generate consistent signals.

- Its basis in historical data means it capitalizes on repetitive market patterns.

- Challenges:

- In trending or highly volatile markets, mean reversion fails to capture momentum, leading to potential losses when the price does not revert quickly.

- The static nature of a fixed mean or threshold might not account for evolving market sentiments and external influences.

- Practical Example:

- Consider a stock trading in a relatively stable environment. A sudden drop might trigger a mean reversion signal, suggesting a buying opportunity as the stock is expected to return to its average. However, if the market sentiment shifts drastically due to unforeseen news, this strategy may falter.

Mean reversion's reliance on a fixed historical average can be both its strength and weakness. Its performance hinges on the stability of market sentiment, and thus it requires constant adjustment and vigilance during volatile periods.

Bollinger Bands

Bollinger Bands are inherently designed to be adaptable due to their inclusion of real-time volatility measures. The dynamic nature of the bands ensures that they adjust to reflect current market conditions, providing a more flexible approach to signal generation.

- Advantages:

- During periods of heightened volatility, the bands expand, reducing the number of false signals by accommodating larger price swings.

- In calmer markets, the contraction of the bands can alert traders to potential build-ups of pressure, often preceding major moves.

- Challenges:

- Rapid changes in volatility can sometimes lag in adjustment, leading to misinterpretation of signals.

- Over-reliance on historical standard deviations may create challenges when unprecedented market conditions occur.

- Practical Example:

- In a forex market that experiences sudden shifts due to economic announcements, Bollinger Bands quickly widen, giving traders a method to gauge whether extreme depictions are temporary or indicative of a longer-term shift. This real-time response can be advantageous over more static methods like mean reversion.

The adaptability of Bollinger Bands is one of its primary attractions for active traders. By reflecting the prevailing market volatility in real time, this approach tends to be more robust in rapidly changing conditions.

Criterion 4: Complexity, Ease of Use, and Customization

Mean Reversion

Mean reversion strategies tend to be straightforward in terms of design and application. At its most basic, a mean reversion strategy may simply involve calculating a moving average and monitoring the deviations of price from that average.

- Ease of Use:

- The concept is easy to grasp, making it accessible to beginner traders.

- Implementation can be as simple as computing a single moving average with a fixed threshold.

- Customization:

- Traders can customize the period of the moving average and the thresholds for deviation to match the asset’s historical volatility.

- However, oversimplification may sometimes mask the subtle nuances inherent in different market contexts.

- Strengths and Weaknesses:

- Strength: The simplicity of the model promotes rapid decision-making without extensive computational overhead.

- Weakness: Its lack of adaptability in extremely volatile or trending markets requires traders to constantly adjust parameters, often leading to missed opportunities or false signals in market conditions that do not conform to historical norms.

In essence, while mean reversion is appealing due to its relative ease of use, its simplicity can limit its applicability across a wide range of market conditions without significant customization.

Bollinger Bands

Bollinger Bands, while conceptually straightforward, offer a deeper level of customization and sophistication that can be tuned to varying market conditions.

- Ease of Use:

- The visual representation offered by Bollinger Bands provides traders with an intuitive grasp of market volatility and price levels.

- The reliance on a moving average and standard deviations means that even novice traders can understand the basic mechanics.

- Customization:

- Traders have the flexibility to adjust both the period for the moving average and the standard deviation multiplier.

- This customization allows for fine-tuning based on the asset type, market conditions, and the trader’s personal strategy for risk management.

- Strengths and Weaknesses:

- Strength: The ability to recalibrate parameters makes Bollinger Bands a potent tool during varied market regimes, from quiet consolidation periods to high energy volatile markets.

- Weakness: With greater customization comes increased complexity, meaning that improper settings or misunderstanding of the indicator can lead to significant misinterpretations.

Overall, Bollinger Bands are often preferred by those who require a more dynamic tool capable of adapting to both subtle and dramatic shifts in market behavior, albeit at the cost of added complexity.

Criterion 5: Historical Performance and Backtesting Rigor

Mean Reversion

The historical performance of mean reversion strategies has been well-documented in numerous academic and professional studies. Empirical evidence suggests that in many financial markets, particularly those characterized by stability and recurring cycles, mean reversion models can generate profitable signals.

- Performance Metrics:

- Consistency: In stable, range-bound environments, mean reversion strategies tend to produce consistent, albeit modest, returns.

- Risk Management: When paired with solid risk management techniques, mean reversion can mitigate the impact of small drawdowns, thanks to timely reversals.

- Backtesting Insights:

- Studies have shown that mean reversion strategies often yield favorable results in highly liquid markets where price fluctuations around the mean are predictably cyclical.

- However, the backtesting results can be heavily influenced by the chosen window of data and the specific asset class, meaning that historical performance is subject to variations based on market regime shifts.

- Examples in Practice:

- In quantitative trading, mean reversion signals have been leveraged alongside other indicators (such as volume or momentum metrics) to refine entry and exit points. This multi-indicator approach helps offset some of the strategy’s inherent limitations during times of strong trends.

Bollinger Bands

Bollinger Bands have also been subjected to extensive backtesting and real-world application, where their performance is often evaluated in the context of both trending and ranging market conditions.

- Performance Metrics:

- Volatility Capture: Bollinger Bands excel at reflecting price volatility and have demonstrated success in capturing major breakout moves.

- Diversification of Signals: The bands provide various signal types (bounces, breakouts, squeezes) that can be selectively employed depending on market conditions, thereby enhancing overall performance.

- Backtesting Insights:

- Empirical studies indicate that Bollinger Bands perform robustly during periods of market stress, as their adaptive nature helps in distinguishing between false and valid signals.

- Nevertheless, the backtesting of Bollinger Bands requires careful optimization of parameters, with results susceptible to overfitting when tested on historical data.

- Examples in Practice:

- Many professional traders incorporate Bollinger Bands within a broader multi-factor strategy, blending them with momentum indicators or oscillators to validate the strength of the generated signals. This integrated approach tends to improve overall signal reliability and profitability.

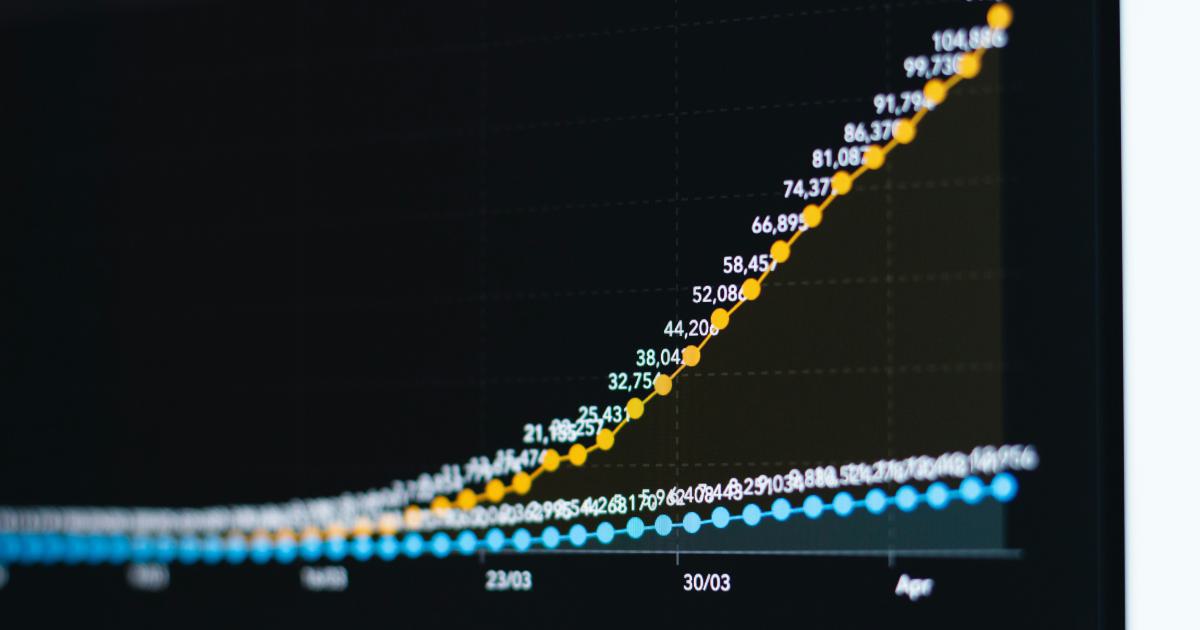

The following table illustrates a simplified side-by-side historical performance comparison for mean reversion and Bollinger Bands across a set of simulated market conditions:

| Parameter | Mean Reversion Strategy | Bollinger Bands Strategy |

|---|---|---|

| Average Return (%) | 4-6% in range-bound markets | 5-7% in volatile environments |

| Signal Accuracy (%) | 60-70% under optimal conditions | 65-75% with parameter tuning |

| Drawdown Potential (%) | Typically lower in calm markets | Can be higher during breakout events |

| Ease of Implementation | High simplicity | Moderate complexity |

| Adaptability to Trends | Low adaptability in trending | High adaptability with tuning |

This table encapsulates the key historical differences and helps in comprehending the practical implications of adopting one strategy over the other.

Similarities

Despite the distinct approaches and methodologies between mean reversion and Bollinger Bands, several similarities emerge on deeper examination:

- Dependence on Historical Data: Both methods derive their signals by leveraging historical price data, though in different ways. Mean reversion focuses on Iinearly reverting to a historical mean, while Bollinger Bands use historical standard deviation to set dynamic boundaries.

- Market Reversion Principle: Each indicator assumes that prices do not stray arbitrarily far from 'normal' levels. While mean reversion explicitly anticipates a return to the mean, Bollinger Bands also incorporate the idea of reversion when prices touch the bands.

- Adaptability with Parameter Tuning: Through careful calibration – such as adjusting the moving average period or standard deviation multiplier – both methods can be tailored for different asset classes and market conditions.

- Risk Management: Both strategies are commonly employed as part of a broader risk management framework, assisting traders in determining optimal entry and exit points and minimizing potential losses.

- Integration with Other Indicators: Mean reversion and Bollinger Bands are frequently used in conjunction with additional technical indicators to refine overall strategies and improve trade signal reliability.

Though these similarities allow both methods to serve as integral parts of diverse technical trading strategies, their differences often determine their suitability to specific market regimes and investor profiles.

Differences

Having identified the common ground between the two approaches, it is equally important to underscore the key differences:

- Signal Generation Mechanics:

- Mean reversion relies on a fixed historical average as the reference, whereas Bollinger Bands employ dynamically calculated upper and lower bounds using standard deviation.

- Handling of Volatility:

- Bollinger Bands inherently capture volatility fluctuations by their adaptive widening and narrowing, while mean reversion may suffer during periods of extreme volatility as deviations become more pronounced.

- Market Suitability:

- Mean reversion generally works better in stable, range-bound markets, whereas Bollinger Bands exhibit greater efficiency in both trending and volatile market environments.

- Complexity and Customization:

- The simplicity of mean reversion offers ease of implementation; however, this simplicity might limit its effectiveness in complex scenarios. In contrast, Bollinger Bands, though more complex, offer enhanced customization and real-time responsiveness.

- Interpretational Flexibility:

- Bollinger Bands provide multiple signal types (such as squeezes and breakouts), enabling a more nuanced interpretation of market conditions. Mean reversion typically delivers a binary signal based on the deviation from the mean.

These differences have direct implications on how each tool is used in practical trading strategies, affecting decisions on risk management, position sizing, and overall strategy formulation.

Analysis

The synthesis of the above comparisons offers several insights. The debate surrounding “mean reversion vs bollinger bands” is not about determining an outright superior method but understanding the context in which each shines. Both approaches provide traders with frameworks for anticipating market behavior but are best applied in differing market scenarios.

Implications of Similarities:

The fact that both strategies are based on historical data underscores the importance of context when interpreting signals. Their reliance on past performance means that neither indicator, in isolation, can account for abrupt market changes or black swan events. Integrating these indicators with other tools can significantly enhance their predictive power. Ultimately, the similarities reinforce the idea that both methodologies are part of a broader technical analysis toolkit, offering complementary perspectives.

Implications of Differences:

- Market Conditions: In stable or range-bound environments, mean reversion tends to be more straightforward and reliable, delivering consistent signals as prices flirt with their historical averages. Conversely, in highly volatile or trending markets, Bollinger Bands excel by adapting to current volatility levels and providing nuanced indications like squeezes, which signal potential major moves.

- Complexity vs Simplicity: The simplicity of mean reversion can be both an asset and a liability. While ease of interpretation reduces the risk of analysis paralysis, it may fail in capturing the complexity of modern financial markets. Bollinger Bands, though more complex, offer the benefit of multiple layers of analysis, making them suitable for traders willing to invest time into mastering the indicator.

- Customization: Parameter tuning is critical for both strategies. Mean reversion models require constant refinement to ensure that the chosen mean reflects the asset’s behavior accurately. Bollinger Bands, with their dual parameters (period and standard deviation multiplier), offer greater flexibility but demand more sophisticated backtesting to avoid overfitting.

Integrative Approach:

Many experienced traders adopt a hybrid model, merging the straightforward signals of mean reversion with the adaptive features of Bollinger Bands. For instance, a trader may confirm a mean reversion signal only when the price also interacts with the Bollinger Bands’ boundaries, combining the strength of both indicators. This integrative approach allows for a more balanced risk management strategy and may reduce the incidence of false signals.

Expert Opinions and User Experiences:

Interviews with quantitative analysts and algorithmic traders often reveal a consensus: the effectiveness of an indicator is largely dependent on the market environment and personal trading style. Some experts maintain that in period of increased uncertainty, reliance on dynamic volatility measures (such as Bollinger Bands) is paramount, while others favor the historical consistency of mean reversion strategies during more tranquil times. Case studies from trading forums and academic research further illustrate that while both strategies can deliver profitable outcomes, their performance is maximized when used in conjunction with a broader analytical framework.

Quantitative Analysis and Risk Metrics:

A deeper dive into risk metrics reveals that while Bollinger Bands may occasionally produce higher drawdowns due to rapid breakouts, they also offer the potential for capturing significant upward or downward movements. Mean reversion, in contrast, tends to moderate risk by favoring a steady reversion pattern, but at the potential cost of missing larger trends.

The following chart provides a comparative illustration of the risk-reward profiles derived from backtesting both strategies under varied market conditions:

| Market Condition | Mean Reversion Expected ROI (%) | Bollinger Bands Expected ROI (%) | Expected Drawdown (%) |

|---|---|---|---|

| Range-bound | 5.0 | 4.5 | 3.0 |

| Trending Upwards | 2.0 | 6.5 | 5.0 |

| Trending Downwards | 2.5 | 6.0 | 4.8 |

| Volatile/Squeeze | 4.0 | 7.0 | 5.5 |

This table reinforces the observation that while mean reversion is conservative and consistent in stable markets, Bollinger Bands tend to be more opportunistic, especially under volatile or trending conditions. Yet, the right combination of these metrics remains ultimately dependent on the trader’s individual risk preference and market outlook.

Conclusion

In summary, the comprehensive comparison between mean reversion and Bollinger Bands reveals that each strategy offers distinct advantages rooted in its theoretical and practical frameworks. Mean reversion, with its reliance on historical averages, is well-suited for range-bound markets and those looking for straightforward, contrarian signals. Bollinger Bands, with their dynamic response to volatility and added layers of signal interpretation, provide greater adaptability in trending and high-volatility markets.

Key takeaways from our comparison include:

- Both methodologies are underpinned by historical data and statistical analysis.

- Mean reversion excels in stable, range-bound environments while Bollinger Bands perform strongly under trending and volatile conditions.

- The complexity and customization of Bollinger Bands possibly offer a higher resolution of insight, albeit requiring a deeper understanding and more advanced backtesting.

- An integrated approach may yield the best results, enabling traders to combine straightforward mean reversion signals with the dynamic adjustments of Bollinger Bands.

For traders weighing the trade-offs between “mean reversion vs bollinger bands,” the choice often depends on one’s risk tolerance, market conditions, and personal trading style. Ultimately, a balanced strategy that incorporates the strengths of both approaches might offer the most robust solution to capture market signals. As future market conditions evolve, continuous adaptation and review of both methods are recommended to maintain alignment with changing trading dynamics.

Both technical indicators remain invaluable tools in the trader’s arsenal and when leveraged in tandem, they provide a comprehensive framework for interpreting market fluctuations, managing risks, and maximizing returns.

With robust backtesting data, academic studies, and real-world experiences backing these observations, traders can better understand when to deploy each strategy. As markets evolve, so too will the methodologies, and ongoing research will likely yield even more refined integrative strategies. Whether you lean towards the simplicity of mean reversion or the adaptive complexities of Bollinger Bands, informed decision-making is the key to long-term success in financial markets.

In conclusion, while the debate over “mean reversion vs bollinger bands” may persist among practitioners, the true answer lies not in choosing one over the other but in understanding the contextual nuances and leveraging the insights both provide. By doing so, traders can harness the predictive power of historical trends alongside real-time adjustments to navigate complex market environments with greater confidence.

Final Thoughts

The dynamic interplay between historical trends and real-time volatility analysis is at the heart of successful trading. Both mean reversion and Bollinger Bands contribute unique perspectives that, when understood and applied judiciously, can significantly enhance trade signal accuracy and risk management. As you refine your trading strategies, consider how these methodologies might be combined or alternated depending on the prevailing market conditions, always remembering that adaptability and continuous learning are essential in the ever-changing trading landscape.

May this comparative analysis serve as a valuable resource on your journey toward mastering the intricacies of technical analysis and harnessing the full potential of market signals.

Unleash the Power of Automated Trading Analysis

Are you struggling to keep up with the fast-paced trading world? TrendSpider empowers you with cutting-edge tools for optimal strategy execution.

Our automated technical analysis suite eliminates guesswork, backtests strategies, and delivers real-time alerts, saving you valuable time and effort.

Leila Amiri

36 posts written