Step-by-Step Guide to Optuma Backtesting

Backtesting is an essential technique for evaluating trading strategies using historical market data, and in this guide, we delve into the comprehensive process of optuma backtesting. Whether you are a novice trader or an experienced market analyst, understanding how to properly backtest your strategy using Optuma software can dramatically enhance your trading performance. This step-by-step guide walks you through the detailed methodology, common pitfalls, practical tips, and advanced strategies to ensure you can confidently implement and analyze your trading ideas.

Introduction to Backtesting and Optuma

Backtesting is the process of applying a trading strategy to historical data to determine its viability. In the world of trading, the ability to refine strategies based on past performance is invaluable. By leveraging the power of Optuma’s analytical tools, traders can simulate various market conditions and performance metrics, allowing for a realistic preview of potential future outcomes. This article explains how to set up Optuma backtesting environments, build effective strategies, and interpret results correctly.

Historically, backtesting has been used to simulate market operations by quantifying the performance of trading strategies against real-world data. In an ever-changing market environment, the importance of a reliable backtesting framework is paramount. Optuma, with its robust set of tools and user-friendly interface, has become a go-to platform for traders looking to enhance their analysis through detailed backtesting.

In the sections that follow, we dive into the nitty-gritty of the process:

- Understanding the fundamentals of backtesting.

- Setting up the Optuma environment for optimal performance.

- Gathering and cleaning data for realistic simulations.

- Developing a sound trading strategy.

- Analyzing results and interpreting various performance metrics.

- Advanced techniques and troubleshooting.

- Real-world case studies and expert tips.

By the end of this guide, you will have a detailed understanding of how optuma backtesting works and be equipped with actionable insights to improve your trading strategies.

Understanding the Concept of Backtesting

Backtesting involves simulating trades based on historical market data to determine how a strategy would have performed. This method allows traders to see the reliability and profitability of their trading approaches without risking actual capital. It translates the theoretical into the practical by providing a performance snapshot, highlighting which aspects of the strategy are robust and which may require adjustments.

Why Backtesting is Crucial for Traders

There are several key reasons why backtesting is indispensable:

- Objective Analysis: Backtesting removes emotional biases from trading, ensuring that strategies are evaluated on empirical data rather than gut feelings.

- Risk Assessment: By simulating past market conditions, traders can gauge potential drawdowns and assess the strategy's risk-adjusted returns.

- Performance Optimization: Historical tests facilitate the fine-tuning of parameters in a strategy, leading to improved efficiency and higher profitability.

- Confidence Building: Validated strategies provide a psychological edge, as traders are more likely to trust and adhere to systems that have proven statistically viable.

Key Elements of a Successful Backtesting Process

To ensure that backtesting yields reliable insights, several critical components must be considered:

High-Quality Data: Ensure that the data used is accurate, comprehensive, and free from errors.

Realistic Simulation: The backtesting environment should mimic live-trading conditions as closely as possible, including factors such as slippage and transaction costs.

Robust Strategy Framework: A well-defined strategy with clear entry and exit points, risk management rules, and adaptive mechanisms helps in building a credible test.

Iterative Refinement: Continuous testing and re-optimization help in adjusting the strategy to new market trends over time.

The Role of Optuma in Backtesting

Optuma stands out as a sophisticated tool for backtesting due to its extensive library of indicators, charting capabilities, and user-friendly interface. Its modular design allows traders to incorporate custom-coded strategies and seamlessly execute complex backtests. Furthermore, Optuma’s integrated scripting language offers infinite flexibility, enabling the creation of bespoke indicators and alerts tailored to your trading system.

By integrating technical analysis and fundamental indicators, Optuma provides a holistic view of the market dynamics, making it an ideal choice for traders who demand precision, flexibility, and accuracy in their simulations.

Setting Up Your Optuma Environment for Backtesting

Before diving into a backtest, it's crucial to set up your Optuma environment correctly. This section guides you through the essential setup steps, ensuring that you can maximize the efficiency and accuracy of your simulations.

Installation and Licensing

To begin with, ensure that you have a legitimate copy of Optuma installed on your computer. Follow the vendor's guidelines for downloading and installing the software, and be sure to activate your license. A properly licensed copy not only validates your access to all features but also ensures you receive timely updates and technical support.

Download the Installer: Visit the Optuma website and download the latest installer version.

Run the Installer: Follow on-screen instructions to install the software. Ensure that you install any prerequisite packages.

Activate Your License: Upon launching Optuma, enter your license details. This step is crucial to unlock the full suite of features offered by the platform.

Data Acquisition and Management

The quality of your backtesting results relies heavily on the quality of your data. Optuma supports multiple data formats and providers, allowing you to import historical market data seamlessly.

Source Reliable Data: Use reputable data providers to ensure that you have complete and accurate datasets. Many platforms provide free datasets, but premium data often offers higher resolution and better accuracy.

Clean the Data: Check for missing values, outliers, or inaccurate entries. Use built-in data cleaning tools or export the data to a spreadsheet for manual cleaning.

Import Data into Optuma: Use the data import wizard in Optuma to load your cleaned data. Select the appropriate data file format (CSV, Excel, etc.) and confirm the mapping of data fields.

Configuring the Backtesting Engine

Once your data is in place, configure the backtesting settings. This includes setting the test period, initial capital allocation, and specific strategy parameters. The configuration interface in Optuma allows for detailed adjustments to simulate real-world trading conditions.

- Define the Test Period: Select a historical period that is representative of the market conditions under which your strategy should perform. This period should be long enough to include different market cycles.

- Set Financial Parameters: Specify starting capital, leverage ratios, and any transactional charges.

- Input Strategy Criteria: Clearly define the technical indicators, entry/exit rules, and risk management criteria that will guide your backtest.

Integrating Custom Strategies

Optuma’s flexibility allows you to integrate custom strategies using its proprietary scripting language. If you have developed a unique algorithm or set of rules, you can code it directly into the platform.

- Scripting Basics: Familiarize yourself with the Optuma scripting language. Reference the online documentation, which includes examples and tutorials.

- Code Your Strategy: Write your code following best practices in modular programming. Test your code snippets individually before running a full backtest.

- Validate and Debug: Use the simulation tools available in Optuma to debug and verify that your code is executing as expected.

With your environment configured, you’re ready to embark on the process of backtesting your strategy. The next sections will break down the backtesting process into manageable steps and highlight common challenges along with their solutions.

Step-by-Step Process for Optuma Backtesting

This section gives a detailed, step-by-step walkthrough of how to perform optuma backtesting, ensuring you stay on track from the initial idea stage to a full simulation analysis.

Step 1: Defining Your Trading Strategy

Before launching any backtest, a clear and concise trading strategy must be established. This process involves identifying market conditions, specifying entry and exit signals, and determining risk management thresholds.

Market Analysis: Determine the asset class, market segment, and time frame you intend to test. Consider factors such as volatility, liquidity, and market trends.

Entry Signals: Define the trigger points for initiating a trade. This may include moving average crossovers, momentum indicators, or price breakout levels.

Exit Signals: Just as important as the entry is setting exit conditions to secure profits or mitigate losses. Use stop-loss orders, profit targets, or trailing stops.

Risk Parameters: Calculate parameters such as position sizing, maximum drawdown, and stop-loss limits. These will determine the overall risk profile of your strategy.

The objective is to develop a strategy that is rigorous yet adaptable to variations in market behavior. Document every element clearly so that the criteria can be easily modified if the backtesting results suggest improvements.

Step 2: Setting Up the Test in Optuma

After defining the strategy, set up your test parameters in Optuma. This involves configuring the chart, selecting the appropriate indicators, and inputting the custom scripts if applicable.

Open a Chart Window: Launch a new chart in Optuma and load the historical data for the specified asset.

Add Technical Indicators: Place your chosen indicators on the chart. Make sure to align the indicator settings with your strategy's specifications.

Input Trading Rules: Use the scripting interface to code your trading rules. This can be done by either writing new scripts or importing pre-built strategies.

Set the Backtest Parameters: Within the Optuma backtesting module, enter your test period, initial capital, and any market-specific arrangements like transaction costs or slippage.

The interface design of Optuma allows traders to interact dynamically with the test parameters. Adjusting these settings in real-time and observing preliminary results can provide immediate feedback on how the strategy might perform under various market conditions.

Step 3: Running the Backtest

Once all settings are correctly applied, initiate the backtest. During this phase, Optuma will simulate trades by sequentially processing the historical data.

Execute the Backtest: Click on the “Run” button or equivalent command to begin the simulation.

Monitor Live Simulation: Watch as the software processes each trade. The simulation will display real-time updates on positions, profit/loss, and drawdown levels.

Data Logging: Optuma logs detailed trade data, including entry/exit times, executed prices, and cumulative returns. Save this log for further analysis.

Iterate as Needed: If preliminary results deviate significantly from expectations, pause and adjust your parameters. Testing different configurations can often reveal optimization opportunities.

The backtest phase is where theory meets practice. The detailed logs generated by Optuma become invaluable for understanding the nuances of your strategy’s performance.

Step 4: Analyzing Backtesting Results

After running the simulation, you need to analyze the results meticulously. Optuma backtesting provides a comprehensive report, but you need to interpret the data to discern strengths and weaknesses.

Review Performance Metrics: Focus on metrics such as net profit, win rate, maximum drawdown, Sharpe ratio, and profit factor. Compare these values against your strategy’s initial objectives.

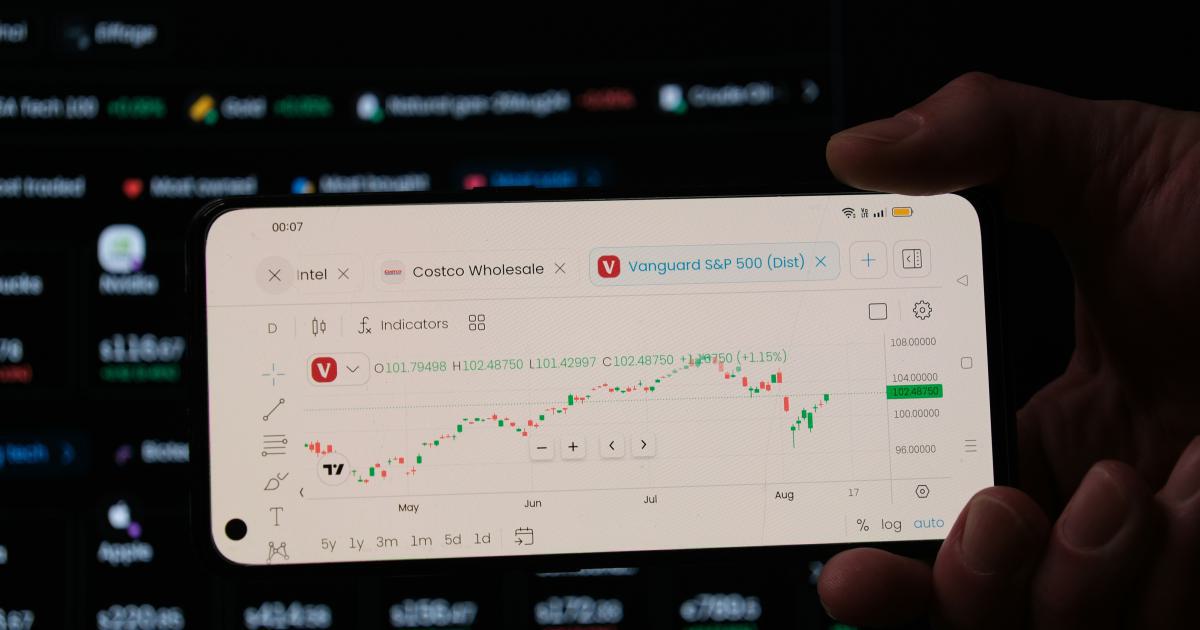

Visual Analysis: Utilize charts and graphs generated by Optuma to visualize the progression of the strategy over time. Look for patterns in performance during different market phases.

Statistical Validation: Conduct statistical tests to validate whether the observed performance is statistically significant or merely a result of random chance.

Documentation: Record all findings, noting where the strategy performed well and where it faltered. Use these insights to refine and iterate upon your approach.

This analytical process not only confirms the strategy’s potential but also identifies key areas for improvement. By systematically reviewing the data, traders can prevent costly mistakes in live trading conditions.

Step 5: Fine-Tuning and Optimizing Your Strategy

Successful backtesting is an iterative process. After analyzing the initial results, adjustments to the strategy may be necessary. This step involves recalibrating the parameters, improving indicator sensitivity, or changing risk management thresholds.

Identify Weak Points: Use the detailed reports to pinpoint phases where the strategy underperformed.

Parameter Optimization: Adjust key parameters, such as indicator windows or stop-loss distances, to see if performance metrics improve.

Regime Analysis: Consider segmenting your analysis by market regimes (bullish, bearish, sideways) to understand how the strategy behaves under different conditions.

Run Multiple Simulations: Vary one parameter at a time while keeping others constant to understand its impact. This systematic process helps unveil the most effective configuration.

Implement Robustness Testing: Utilize walk-forward analysis and Monte Carlo simulations within Optuma to gauge strategy resiliency against random market fluctuations.

A well-optimized strategy is one that isn’t overfitted to historical data – it adapts to a range of market scenarios with consistent performance. Continuous refinement, backed by data, builds confidence and minimizes risk in live trading.

Step 6: Real-World Examples and Case Studies

To fully grasp the power of optuma backtesting, consider these real-world examples which illustrate practical applications:

Case Study 1: Trend-Following Strategy in a Volatile Market

A trader developed a trend-following strategy using a combination of moving averages and momentum indicators. By simulating trades over a decade that included multiple market crashes and recoveries, the trader could test the resilience of the strategy. Although the initial results featured significant drawdowns during severe market downturns, subsequent refinement of the stop-loss mechanism reduced the maximum drawdown by 25% without sacrificing profitability.

Case Study 2: Mean Reversion in Low Volatility Markets

Another example highlighted a mean reversion strategy applied to a relatively stable asset class. The trader capitalized on small price oscillations around a mean value, employing tight profit-taking targets. Backtesting revealed consistent performance improvements after incorporating a dynamic risk adjustment that scaled position sizes according to market volatility. The study underscored how optuma backtesting not only validates a concept but also pinpoints when and where minute adjustments can yield significant performance gains.

Lessons Learned and Actionable Solutions

- Always test over a variety of market conditions. Avoid relying solely on bull market data.

- Use a combination of technical indicators rather than a single indicator to confirm trade signals.

- Document every change and its impact. This historical record can become your personal trading manual.

Each case study reinforces the importance of a systematic, data-driven approach to refining your trading strategy.

Advanced Techniques and Expert Tips

For traders who wish to push the boundaries of backtesting further, a few advanced techniques can provide an additional edge:

Incorporating Machine Learning

The integration of machine learning models in the backtesting process can uncover hidden patterns and enhance strategy predictions. Techniques such as regression analysis, decision trees, and neural networks can be adapted to forecast market trends based on historical data.

- Data Preprocessing: Begin with feature extraction and normalization. Ensure that the dataset is refined for machine learning consumption.

- Model Training: Split the data into training and testing sets. Use the training set to teach the model about historical trends and then validate using the testing set.

- Integration: Once the machine learning model is sufficiently accurate, integrate its predictions into your Optuma backtest to refine entry and exit signals.

Walk-Forward Optimization

Walk-forward optimization offers a robust way to ensure that your strategy is not just a product of overfitting to a specific dataset. Instead, it continuously re-optimizes as new data is introduced, simulating a real-world trading environment.

- Segment Your Data: Divide your dataset into distinct training and testing periods.

- Reoptimization: After each period, adjust the strategy parameters to reflect recent market conditions and then test in the subsequent period.

- Continuous Improvement: This process mirrors live market adaptations, helping you build a strategy that evolves with the market.

Risk Management Best Practices

Risk management is an integral part of any trading strategy. For successful optuma backtesting, consider implementing these advanced risk management techniques:

- Dynamic Position Sizing: Adjust the number of shares/contracts based on the volatility or risk profile of the current market.

- Stop-Loss and Take-Profit Tiers: Instead of a single threshold, utilize multiple triggers to exit trades gradually.

- Diversification Across Strategies: Run simultaneous backtests on multiple strategies to prevent over-reliance on a single approach.

- Stress Testing: Simulate extreme market scenarios to ensure the strategy can withstand adverse conditions.

Expert Tips for Effective Backtesting

- Maintain a trading journal to document each strategy adjustment. This can provide invaluable insights into what works and what doesn’t.

- Regularly update your data source to ensure that your backtests incorporate the latest information.

- Look for correlations between different market indicators and use them to synergize entry and exit points.

- Don’t shy away from manual adjustments. Sometimes, a human perspective uncovers anomalies that automated systems might overlook.

By incorporating these advanced techniques and expert tips, you can refine your approach, emerging with a robust, adaptive trading strategy that performs well in diverse market situations.

Common Challenges in Backtesting and How to Overcome Them

While optuma backtesting is a powerful tool, traders often encounter several challenges. Here are the key issues along with actionable solutions:

Data Quality and Integrity

Issue: Inconsistent or inaccurate data can lead to misleading results. Solution: Always source data from reputable providers and employ rigorous cleaning techniques. Cross-verify the imported data with known benchmarks to ensure its accuracy.

Overfitting

Issue: A strategy that performs perfectly on historical data may fail in live trading due to over-optimization. Solution: Use techniques like walk-forward optimization and Monte Carlo simulations to test your strategy's robustness. Ensure that parameter adjustments are based on statistical evidence rather than anecdotal observations.

Ignoring Transaction Costs

Issue: Neglecting the costs of trading, such as commissions, slippage, and bid-ask spreads, results in inflated performance metrics. Solution: Integrate realistic transaction costs into your backtesting simulation. Most platforms, including Optuma, provide features to simulate these conditions accurately.

Software and Scripting Limitations

Issue: Bugs or limitations in the platform’s scripting language can create unexpected performance discrepancies. Solution: Regularly update your software, and make use of community forums and support channels. Test individual components of your strategy to isolate problems.

Psychological Biases

Issue: Confirmation bias may lead traders to ignore negative backtesting results. Solution: Approach your testing with a critical mindset. Let statistical evidence guide your decisions, and be prepared to adjust or abandon strategies that do not hold up under scrutiny.

By proactively addressing these challenges, you ensure that your optuma backtesting not only provides reliable insights but also paves the way for a more disciplined, effective trading approach.

Conclusion: Embracing the Art and Science of Backtesting

Backtesting using Optuma is both an art and a science. It requires a meticulous approach to data, a clear understanding of market mechanics, and the courage to adjust and refine strategies iteratively. Through thorough preparation, realistic simulation, and continuous analysis, traders can transform historical data into actionable insights, thereby increasing confidence and performance in live trading.

In summary, the journey of optuma backtesting—when taken step-by-step—equips traders with essential tools to navigate volatile markets. From setting up your environment to executing detailed simulations and finally analyzing performance, each stage of the process contributes to a deeper understanding and a more resilient trading strategy.

As you refine your strategy and incorporate advanced techniques such as machine learning and walk-forward optimization, remember that the ultimate goal is not simply to generate profits but to cultivate a robust system that thrives in real-world conditions. Embrace continuous learning, remain adaptable, and utilize backtesting as a means to master your trading techniques for long-term success.

Remember, the best strategies are not those that are perfect in theory but those that are tested, tweaked, and proven under pressure. Happy backtesting and may your trading journey be as profitable as it is insightful!

Unleash the Power of Automated Trading Analysis

Are you struggling to keep up with the fast-paced trading world? TrendSpider empowers you with cutting-edge tools for optimal strategy execution.

Our automated technical analysis suite eliminates guesswork, backtests strategies, and delivers real-time alerts, saving you valuable time and effort.

Sophia Dekkers

52 posts written