The Anchoring Bias: Avoiding Mental Lockstep in Trading

Anchoring bias trading is a pervasive cognitive phenomenon that can derail even the most experienced trader’s strategy. At its core, anchoring bias is the tendency to rely too heavily on the first piece of information encountered—often an irrelevant or outdated reference point—when making decisions. In the fast-paced world of trading, where market conditions fluctuate rapidly and data streams constantly evolve, this mental shortcut can lead to persistent errors in judgment, misinterpretation of market trends, and ultimately, financial losses. This article delves into the nature of anchoring bias, explains how it impacts trading decisions, presents real-world cases, and offers actionable strategies for mitigating its effects. By understanding the subtle ways in which anchoring can alter perceptions of risk and opportunity, traders can elevate their decision-making process, adopt more flexible strategies, and avoid falling into mental lockstep.

Understanding Anchoring Bias

Anchoring bias is not merely a quirk of human behavior; it is a well-documented psychological phenomenon with roots in cognitive heuristics. When individuals are presented with initial numbers, values, or reference points, these anchors can disproportionately influence subsequent judgments, even when new evidence contradicts the initial information. The term was first popularized by psychologists Amos Tversky and Daniel Kahneman in the early 1970s, illustrating how arbitrary starting points could bias decision-making in various fields, including negotiation, consumer behavior, and, most notably for this discussion, trading.

The Psychological Mechanisms Behind Anchoring

Anchoring works by creating a mental reference that the brain uses as a starting point for further evaluation. The cognitive process involves two main stages:

Initial Imprint: The first piece of data or information encountered acts as an anchor.

Insufficient Adjustment: Even when presented with additional information, individuals tend to make insufficient adjustments away from the anchor.

For example, if a trader initially assesses a stock price based on outdated information or an overly optimistic forecast, that initial figure may continue to influence their expectations, even when new market signals indicate that the stock is overvalued.

The human brain naturally seeks efficiency, and mental shortcuts (heuristics) offer a way to quickly evaluate decisions without processing a flood of data each time. However, this efficiency can come at the expense of critical judgment. In the realm of anchoring bias trading, a trader might fixate on a past price or a target figure derived from historical performance, neglecting the dynamic nature of the current market conditions.

Why Anchoring Bias Is Prevalent in Trading

The trading environment overwhelmingly relies on quantitative benchmarks. Daily market reports, financial metrics, and historical data all serve as potential anchors. The abundance of numbers can lead to overreliance on initial data points, causing traders to:

- Hold on to losing positions because they believe in a return to a “base price.”

- Overlook emerging trends due to an attachment to outdated price levels.

- Misinterpret new information if it doesn’t align with their anchored expectations.

Further complicating this issue is the psychological pressure that traders face. The need to conform to expected outcomes and the fear of making unilateral decisions often reinforce reliance on familiar numbers. The consequence is a sluggish response to market changes, which in a field where timing is decisive, can result in significant financial missteps.

Anchoring Bias Trading: How It Affects Decision Making

Trading is a discipline built on the careful analysis of data streams and market indicators. However, anchoring bias trading can distort interpretation and lead to systematic errors. This section explores the multifaceted ways in which anchoring interferes with objective decision-making and outlines the specific consequences for traders.

Misjudgment of Value and Risk

When traders anchor on certain price points—be it a purchase price, a historical high, or a projected target—they set a baseline expectation. This can cause:

- Overvaluation: A trader might cling to a price target from an earlier analysis, ignoring signals that suggest the stock is not achieving that level.

- Underreaction to Negative Data: Conversely, if a trader is anchored to a historical average, they might not fully react to negative market movements, assuming that the market will correct itself to the anchored level.

These misjudgments ultimately cloud risk assessment and can lead traders to maintain positions that are no longer financially viable. Overvalued positions can trigger delayed exits during market downturns, thereby amplifying losses.

Behavioral Inertia and the Reluctance to Update Beliefs

Anchoring bias creates a type of behavioral inertia among traders. Once an anchor is set, even robust evidence to the contrary may not compel a necessary change in strategy. This is exacerbated by confirmation bias—the tendency to seek out information that confirms preexisting beliefs. For traders, this means clinging to initial impressions and constantly integrating selective data that reaffirms their anchor rather than challenging it.

For instance, a trader who purchased a commodity at a particular price may continue to expect a rebound to that level despite a changing global economic climate. This reluctance to adjust beliefs can lead to significant opportunity costs, as the trader might miss alternative investment opportunities that better reflect current market realities.

Increased Volatility and Market Anomalies

The wider trading market is not immune to the collective impact of anchoring bias. When numerous market participants anchor on similar key data points—such as a set price level or future earnings projection—the market as a whole can experience self-fulfilling prophecies. Certain price levels may act as psychological barriers, where buy and sell orders cluster, resulting in increased market volatility and price gaps.

Moreover, the phenomenon of “clustering” around specific values may lead to irregular trading volumes and price distortions, complicating the process for algorithmic trading systems that rely on unbiased real-time data. Anchoring behavior can, therefore, produce market anomalies that are not reflective of underlying economic fundamentals but rather of a collective cognitive bias.

The Role of Anchoring in Technical Analysis

Many technical analysis techniques inherently involve reference points, such as support and resistance levels, moving averages, or Fibonacci retracement levels. While these metrics are invaluable, they can inadvertently facilitate anchoring bias. A trader focused solely on these technical signals might ignore broader macroeconomic trends or vital market sentiment indicators.

In technical trading, once a support or resistance level has been established, traders may anchor too closely to these levels. If the market reverses sharply, the anchored expectations can prevent rapid, rational decision-making. Instead of adapting to new market conditions, the trader remains locked into a view that was valid only under previous market conditions.

Real-World Case Studies: Anchoring Bias in Action

To solidify our understanding of anchoring bias trading, it is crucial to analyze real-world examples where this phenomenon had tangible impacts. In this section, we review case studies from various markets—including stocks, forex, and cryptocurrencies—and demonstrate how anchoring bias can steer traders into making detrimental decisions.

Case Study 1: The Tale of a Stagnant Stock

One well-known example comes from the stock market. A mid-cap technology company experienced rapid growth over several years, and its stock price soared past expectations. Early investors anchored their perceptions on the historical high achieved during the boom period. When market fundamentals began to shift due to increased competition and evolving technology trends, the stock price started its downward trend.

Despite clear warning signs, many traders held onto the stock, believing it would eventually return to its previously higher levels. This anchoring on past performance not only delayed necessary exit strategies but also prevented investors from reallocating their assets to more promising opportunities. The result was substantial capital erosion, compounded by the psychological commitment to the initial anchor.

Case Study 2: Forex Trading and the Anchored Exchange Rate

In the foreign exchange market, anchoring bias manifests in the form of fixed ideas about currency values. Consider a scenario where a national currency experiences a rapid inflationary spike. Traders who previously anchored their expectations on a stable exchange rate may underestimate the pace of depreciation. Believing that the currency will stabilize at its earlier value, they delay hedging or rebalancing their portfolios.

This misjudgment proved particularly costly during economic crises when countries undertook drastic measures to stabilize their currencies. The anchored expectation of stability resulted in massive losses for traders who had not adjusted their strategies in line with the emerging economic data. The forex market, known for its volatility, is especially vulnerable to such biases, with traders often caught off-guard by abrupt policy changes or economic shocks.

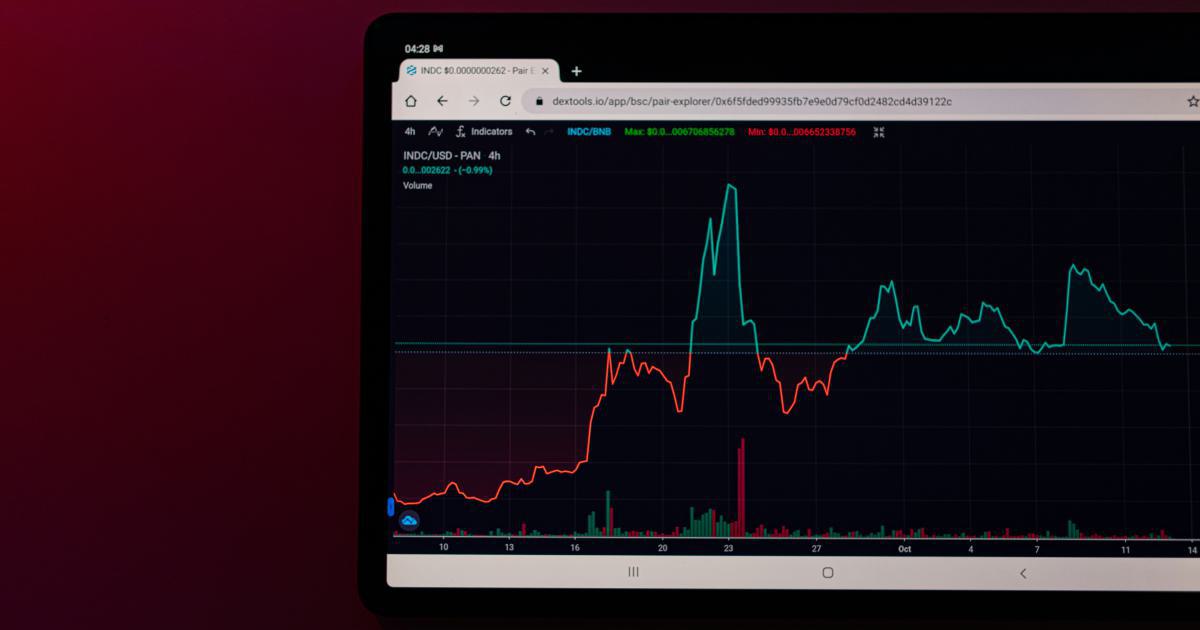

Case Study 3: Cryptocurrency and the Allure of the “High”

Cryptocurrency markets offer fertile ground for anchoring bias trading. In a notable instance, a widely followed cryptocurrency reached an all-time high that was rapidly circulated across social media, financial news outlets, and trading forums. Retail traders anchored their expectations on this peak, projecting it as the norm rather than an exceptional event.

Subsequently, when the cryptocurrency's value fluctuated due to regulatory uncertainties and market saturation, many investors were reluctant to accept the new lower price levels. Anchoring on the previous high, they delayed selling, hoping for a rebound that never materialized as market conditions shifted permanently. This situation underscores the profound impact of anchoring bias, particularly in markets driven by sentiment and speculation.

Insights from the Case Studies

These case studies highlight key insights into the detrimental effects of anchoring bias trading:

- A strong focus on historical data or arbitrary price levels can obscure current market realities.

- Anchoring delay crucial decision-making, especially during volatile market conditions.

- Collective anchoring across traders can lead to market inefficiencies and distortions.

- The persistence of anchoring bias, even in the face of contradictory evidence, often results from psychological comfort and the fear of admitting a mistaken judgement.

Traders who recognize these pitfalls can begin to implement strategies to counteract the influence of anchoring bias, improving decision-making accuracy in their trading practices.

Mitigating the Effects of Anchoring Bias in Trading

Awareness of one’s susceptibility to cognitive biases is the first step towards effective mitigation. In the realm of anchoring bias trading, several techniques have proven effective in minimizing its negative impact. This section explores actionable strategies, ranging from self-reflection and adjustment techniques to advanced tools that leverage technology and data analytics.

Diversification of Data Sources

One of the primary ways to combat anchoring bias is to avoid relying on a single data source. Traders should:

- Utilize a diverse array of market data.

- Seek real-time information.

- Integrate both technical and fundamental analysis to form a holistic view of market trends.

By accessing varied sources of insight, traders can counterbalance the influence of any single anchor. This approach encourages a more dynamic re-evaluation of market conditions and reduces the likelihood of falling into a mental trap anchored on outdated data points. Moreover, the diversity of information promotes continuous learning and adaptability, enabling traders to swiftly pivot their strategies when necessary.

Establishing Clear, Data-Driven Frameworks

Another effective strategy is to develop systematic, data-driven frameworks for trading decisions. Trading plans that rely on predetermined metrics, such as moving averages, stop-loss levels, and risk-reward ratios, can help insulate traders from emotionally driven decisions anchored in past performance. Some recommended practices include:

- Periodically revisiting and updating trading models.

- Incorporating stress-testing scenarios to evaluate the robustness of a trading strategy under different market conditions.

- Using historical backtesting to objectively assess the validity of the anchor and determine if it remains relevant.

Implementing these frameworks ensures that traders make decisions based on current, quantitative data rather than solely on memory or historical precedent. This methodical approach not only reduces reliance on mental shortcuts but also fosters more disciplined trading behavior.

Regular Self-Audit and Reflection

Self-audit routines are critical in identifying and addressing personal biases. Traders can benefit from:

- Keeping detailed trading journals.

- Documenting the rationale behind each major decision.

- Reflecting on outcomes to identify recurring patterns tied to anchoring bias.

Over time, reviewing these records can reveal consistent patterns where anchoring influenced trading outcomes, providing an opportunity for conscious correction. Regular self-reflection, combined with objective feedback from mentors or trading groups, can help traders recognize the moment when they are becoming overly attached to an initial number or opinion.

Incorporating Technological Tools

Modern trading platforms offer a suite of analytical tools designed to help offset human biases. Algorithmic trading systems and decision support tools can:

- Analyze large datasets without the influence of cognitive biases.

- Provide real-time alerts when market conditions diverge from established parameters.

- Offer scenario analysis to test various hypothetical market developments.

By integrating these tools, traders can create a more objective trading environment where decisions are based on systematic analysis rather than subjective impressions anchored in past data. Such integration not only complements human judgment but also helps streamline the process of updating trading strategies based on the most current market information.

Training and Continuous Education

In the fast-evolving landscape of trading, continuous education remains paramount. Engaging in workshops, webinars, and courses related to behavioral finance and decision-making can:

- Enhance awareness of cognitive biases.

- Equip traders with practical strategies to recognize and combat anchoring.

- Foster an environment of ongoing professional development.

Mentors and peer groups can serve as invaluable resources, offering feedback that challenges anchored thinking and promoting adaptive strategies that align with real-time market conditions. Continuous learning not only refines technical skills but also builds the mental resilience necessary to navigate trading challenges without falling prey to anchoring bias.

Integrating Behavioral Strategies into Trading Routines

Finally, an integration of behavioral strategies into daily trading routines can significantly moderate the influence of anchoring bias. Techniques such as mindfulness training, stress management, and cognitive behavioral exercises can enhance self-awareness, enabling traders to step back and critically assess whether their decisions are being unduly swayed by initial data points. Over time, incorporating these practices into a regular routine can gradually diminish the reliance on mental anchors, empowering traders to make more informed, adaptive decisions.

Advanced Techniques: Combining Analytical and Behavioral Approaches

In an industry where milliseconds can dictate the difference between profit and loss, merging analytical tools with awareness of cognitive biases creates a robust trading strategy. Advanced traders have increasingly recognized that the mitigation of anchoring bias trading is not solely a matter of gathering more data or refining models, but also of understanding the mental and emotional processes that underpin decision-making.

Dual-Track Decision Making

The dual-track approach involves maintaining two concurrent frameworks:

Objective, data-driven signals derived from quantitative analysis.

Subjective, perceptual checks that examine personal biases and psychological triggers.

By continually cross-referencing these frameworks, traders develop the discipline needed to question initial anchors and adjust in real time. For instance, if a technical indicator suggests one direction but personal anchoring to a previous price level suggests another, a well-rounded strategy would prompt a reassessment of the weight given to each signal.

Feedback Loops with Real-Time Analytics

Incorporating real-time analytics not only enhances market responsiveness but also establishes feedback loops that continuously refine prediction models. Automated trading systems, when paired with human oversight, can detect patterns that hint at the onset of anchoring bias. Such systems can prompt traders with alerts—suggesting that a particular anchored reference point may no longer be valid—thereby encouraging timely strategy adjustments.

Collaborative Trading as a Check Against Bias

Collaboration among trading teams can serve as an effective countermeasure to anchoring bias. When multiple perspectives converge on a single decision, the tendency to rely on a single anchor is less likely to go unchecked. Regular team reviews and discussion forums that focus on decision rationale promote external accountability. In such a collaborative environment, individual biases are more readily identified and mitigated, fostering a culture of continuous improvement and objective decision-making.

Conclusion and Future Outlook

Anchoring bias is a formidable mental trap in the trading domain, capable of undermining sound decision-making and distorting risk assessment. As explored in this article, the effects of anchoring bias trading are multifaceted, ranging from persistent overvaluation of assets to market-wide distortions that exacerbate volatility. By understanding its psychological roots and recognizing its practical manifestations through case studies, traders are better equipped to implement strategies that counteract its influence.

The future of trading will likely witness an even greater integration of behavioral finance and advanced analytical tools. Continuous education, coupled with evolving technological aids, promises to further expose and neutralize cognitive biases. As traders increasingly harness these tools and adopt disciplined strategies, the detrimental impacts of anchoring bias can be curtailed, paving the way for more adaptive, resilient approaches to navigating complex market conditions.

In summary, while the gravitational pull of past performance and arbitrary reference points will always lurk in the background, a proactive, well-informed trading strategy stands as the strongest defense. Embracing both the analytical rigor of data-driven models and the reflective power of self-auditing ensures that traders can avoid mental lockstep and remain agile in the face of an ever-changing market landscape.

The journey to overcome anchoring bias is ongoing. With deliberate practice, continuous refinement of decision-making frameworks, and the courageous willingness to challenge one’s internal narratives, traders can transform this cognitive vulnerability into an opportunity for growth. The time to recalibrate, reassess, and realign one’s strategies is now—ensuring that every trade is informed not by the ghosts of past data but by the clear, objective signals of the present.

By addressing the pitfalls of anchoring and embracing innovative, reflective techniques, traders have the potential to enhance not only their financial performance but also their overall confidence and agility in an unpredictable market. The path is challenging, yet with persistence and perseverance, the rewards of improved decision-making and sustained market success await.

Unmatched Trading Power with Binance

Are you ready to take your trading game to new heights? Binance offers a cutting-edge platform for seamless cryptocurrency transactions.

With lightning-fast execution, top-tier security, and a vast selection of coins, you'll have all the tools you need to maximize your profits. Join now and experience the future of trading.

Emily Leroux

53 posts written