Trading Signal Providers vs. DIY Analysis: Which Is More Reliable?

Introduction

The debate of trading signal providers vs. diy analysis has been a critical conversation among traders of all levels. Trading signal providers vs. diy analysis represents not just differing methodologies but also contrasting philosophies about the decision-making process within the markets. In this comprehensive article, we will compare these approaches by examining multiple criteria, including accuracy, timeliness, cost, flexibility, and support. We aim to provide an objective analysis to help traders decide which approach is more reliable for their specific needs.

Traders often seek efficiency and reliability whether using external signals or relying on their own technical and fundamental analyses. With the rise of automated trading systems and increased access to financial data, both methods have evolved. The underlying question remains: Can a third-party signal provider consistently outperform a well-developed DIY analysis strategy? We will explore that question by delving into detailed comparisons supported by examples, expert opinions, and recent market studies.

Our analysis will be structured to include:

- A brief overview of what trading signal providers and DIY analysis entail.

- A side-by-side comparison based on measurable criteria such as accuracy, cost effectiveness, and user control.

- A look at similarities and differences that will help traders identify potential biases and limitations inherent in each approach.

- Practical recommendations and insights into when and how each method might yield better results in different market conditions.

By the end of this article, readers will gain a comprehensive understanding of both approaches and be better equipped to choose a method that aligns with their trading goals and risk management strategies.

Overview of Subjects

Before diving into the comparison, let us briefly define and describe the two subjects:

Trading Signal Providers

Trading signal providers are third-party services that deliver buy and sell signals to traders. These services use a mix of algorithmic systems, market indicators, and often insider insights aggregated into easy-to-follow alerts. The primary advantages include saving time by not having to monitor markets constantly, and leveraging expertise that might be otherwise expensive to develop independently. However, signal providers also come with limitations such as subscription costs, potential lag in market movements, and sometimes a lack of transparency regarding their methodologies.

DIY Analysis

DIY analysis, on the other hand, encourages traders to develop and apply their own strategies based on technical and fundamental analysis. This approach empowers traders to adjust their tactics based on evolving market conditions. Key benefits include total control over the analysis process, deep learning from hands-on experience, and the potential for cost savings over time. Nevertheless, DIY analysis demands significant time investment, continual learning, and the mental discipline to filter out market noise—a challenge that can lead to human error.

Both strategies have their merits and drawbacks. While some traders rely entirely on signal providers for convenience, others prefer the autonomy and learning curve provided by DIY approaches. In the sections below, we delve into several criteria to enable a thorough and balanced comparison.

Comparison Criteria

In the upcoming sections, we will examine each method based on essential trading factors.

Criterion 1: Accuracy and Reliability

Subject A: Trading Signal Providers

Trading signal providers often claim high levels of accuracy based on backtested algorithms and historical market data. Their systems are designed to sift through large datasets in real-time to provide timely trading signals. Many providers utilize cutting-edge technology, including AI-driven models, to generate signals that adapt to sudden market changes—a factor that adds to overall reliability.

Strengths:

- Automated systems can process vast quantities of data at high speeds.

- Providers often incorporate diversified analytics, reducing the chance of oversight.

- Some attempts to measure performance with track records showcasing their historical accuracy.

Weaknesses:

- Not all signal providers are transparent about their calculation methods or success rates.

- Market conditions can change rapidly, sometimes rendering historical data less relevant.

- Overreliance on past performance may lead to complacency during volatile periods.

Examples and Data: Recent studies have shown that high-quality providers typically achieve a 55-60% success rate on signals, which is relatively competitive considering the inherent unpredictability of markets. However, individual performance may vary, and even the best systems can suffer during unexpected financial events.

Subject B: DIY Analysis

DIY analysis places the onus of accuracy entirely on the trader. Here, accuracy relies on the trader's ability to interpret data, understand market psychology, and adjust strategies dynamically. While the human cognitive element introduces potential errors, an experienced trader often benefits from a more nuanced approach that adapitates to unforeseen market movement.

Strengths:

- Direct control over analysis methods allows tailoring to personal trading style.

- Experienced traders can leverage intuition and situational awareness.

- DIY analysis can rapidly adjust in real-time during unprecedented events.

Weaknesses:

- Higher susceptibility to emotional and cognitive biases.

- Requires significant time and continuous learning to remain accurate.

- Inconsistent performance especially among novice traders, who may misinterpret data patterns.

Examples and Data: Independent studies and trader surveys have demonstrated that DIY analysis by experienced traders can rival or even exceed the accuracy of signal providers. However, statistics reveal wide variability, with errors more common among less experienced traders who might misjudge the impact of market indicators.

Criterion 2: Timeliness and Reaction Speed

Subject A: Trading Signal Providers

Signal providers typically operate with advanced technology that captures market movements almost instantly. Their systems automatically update and broadcast signals, theoretically reducing human delay and enabling rapid responses to fast-moving trends.

Strengths:

- Automated alerts ensure minimal delay, important during volatile market fluctuations.

- Real-time data integration allows for instantaneous signal generation.

- Often available across multiple platforms including mobile apps for immediate trading action.

Weaknesses:

- Potential latency issues may arise from network or software problems.

- Some systems might be overly sensitive, generating too many signals during market noise.

- Users must be alert to verify signals before execution; automation is not infallible.

Relevant Data: Research indicates that automated signal systems can react in milliseconds to seconds, which is a significant advantage in high-frequency trading scenarios. However, delays caused by technical glitches or crowded server traffic can occasionally hinder performance.

Subject B: DIY Analysis

With DIY analysis, the timeliness of reaction depends largely on the trader's responsiveness and capability to interpret new information. Despite using modern tools and platforms, human judgment plays a substantial role, which can both enhance and depreciate reaction speed.

Strengths:

- Experienced traders can combine intuition with data-driven insights, sometimes spotting emerging trends before algorithms.

- Flexible reaction time based on discretionary decision-making.

- Allows for deliberate contemplation and strategy adjustment rather than impulsive decisions.

Weaknesses:

- Human reaction time is inherently slower compared to automated systems.

- Emotional and psychological factors can delay decision-making during critical market moments.

- Requires constant vigilance, which may lead to fatigue and slower responses over long trading sessions.

Examples and Data: Case studies reveal that while some DIY traders can act almost as quickly as automated systems, they typically lag behind in terms of pure speed. The difference can be crucial during market openings or breakouts when every second counts.

Criterion 3: Cost and Investment

Subject A: Trading Signal Providers

One of the primary considerations for many traders when choosing between these approaches is cost. Trading signal providers usually require a subscription fee, which can vary widely depending on the quality and breadth of the service.

Strengths:

- Fixed subscription costs simplify budgeting for traders.

- Many providers offer tiered pricing, allowing traders to choose services that suit their financial capacity.

- The potential cost savings from making profitable trades based on reliable signals can offset the subscription fee.

Weaknesses:

- Ongoing costs that may add up over time, especially for long-term traders.

- The subscription fee might not always correlate with the quality or success of the signals.

- There may be hidden costs if additional tools or premium services are necessary.

Examples and Data: Surveys have shown that traders who subscribe to high-quality signal providers often pay anywhere from $50 to $200 per month. While some report significant returns on investment during stable periods, during high volatility these fees may seem negligible compared to potential losses incurred from misinterpreted signals.

Subject B: DIY Analysis

DIY analysis usually requires an upfront investment in education, trading tools, and resources rather than recurring fees. Over time, this endeavor could be more cost-effective but requires considerable initial commitment.

Strengths:

- Lower recurrent costs as there are no monthly subscriptions to signal providers.

- Investment in personal development and tools can lead to long-term benefits beyond the trading context.

- Customizable setups allow traders to pay only for the tools they actually use.

Weaknesses:

- Significant initial time and monetary investment in learning and strategy development.

- Potential for higher costs due to mistakes and trial-and-error processes, particularly for beginners.

- Costs associated with premium data feeds, charting software, and research platforms can add up.

Examples and Data: Data indicates that the initial cost of a robust DIY setup, including courses, software, and market data subscriptions, might range from a few hundred to several thousand dollars. However, successful traders often see this as a long-term investment that pays dividends as their self-reliance increases.

Criterion 4: Flexibility and Customization

Subject A: Trading Signal Providers

Flexibility in trading signal providers can be somewhat limited due to the standardized nature of automated systems. The signals are designed for a broad audience and thus often follow a "one-size-fits-all" approach.

Strengths:

- Low effort is required to implement signals, making it user-friendly.

- Signal providers typically cover a wide range of market assets and time frames.

- Standardized signals reduce the need for constant personal oversight.

Weaknesses:

- Limited customization options; signals may not take individual risk profiles or trading styles into account.

- Some providers might restrict adjustments, leaving traders dependent on predetermined algorithms.

- In rapidly changing markets, a lack of flexibility might hinder the ability to adapt quickly.

Examples and Data: Many traders report that while signal providers offer a decent level of consistency, the lack of personalized adjustments can be a drawback during extreme market conditions. Their algorithms are optimized for a generic audience and might underperform if a trader's risk tolerance significantly deviates from the norm.

Subject B: DIY Analysis

DIY analysis stands out for its inherent flexibility and ability to be tuned to individual preferences. Traders have the freedom to choose which indicators to follow, how to weigh different factors, and when to override preset signals.

Strengths:

- Full customization allows for strategies tailored to personal risk tolerance, market knowledge, and style.

- Traders can incorporate both quantitative and qualitative assessments that suit their unique perspectives.

- Ability to rapidly change strategies based on market feedback and new information.

Weaknesses:

- High flexibility requires constant monitoring and can lead to over-analysis or inconsistency.

- Less structure might overwhelm novice traders, resulting in errors or missed opportunities.

- Adapting too frequently or impulsively might detract from a long-term, disciplined trading strategy.

Examples and Data: Analyses reveal that traders employing DIY analysis can fine-tune their approach to a degree that signal providers cannot match. In particular, during erratic market conditions, the agility of DIY analysis often allows for quicker and more effective adjustments.

Criterion 5: Support and Educational Value

Subject A: Trading Signal Providers

Support and complementary educational resources are key components of many signal provider platforms. These platforms often offer customer service, tutorials, webinars, and detailed performance reports.

Strengths:

- Integrated support helps less experienced traders understand and act on received signals.

- Educational resources, such as webinars and detailed reports, empower traders to eventually learn the market dynamics.

- Community forums and expert Q&A sessions provide additional guidance and troubleshooting tips.

Weaknesses:

- The quality of support can vary significantly between providers, sometimes failing to justify the subscription fee.

- Over-reliance on external support might hinder the development of critical independent trading skills.

- Educational materials may be tailored mainly to support the signal service, rather than offering a comprehensive trading education.

Examples and Data: User reviews suggest that while many signal providers offer valuable educational resources, the quality is inconsistent. Some platforms excel with interactive modules and clear historical breakdowns, whereas others provide only generic advice.

Subject B: DIY Analysis

DIY analysis inherently involves a steep learning curve, often necessitating the pursuit of external educational opportunities, courses, and a breadth of self-study. However, this journey builds a deep and robust understanding of market dynamics.

Strengths:

- Independent research and analysis naturally foster an in-depth education in trading principles.

- Numerous online courses, community forums, and mentors can help bridge the knowledge gap.

- Encourages critical thinking and strategic planning, which can be transferred to other areas of decision-making.

Weaknesses:

- The lack of structured support can leave beginners feeling isolated and overwhelmed.

- Access to high-quality educational resources might require significant time and financial commitment.

- Without professional guidance, self-education can lead to the reinforcement of bad habits or misconceptions.

Examples and Data: Studies have shown that while DIY traders initially face a steep learning curve, those who invest in education develop a more profound and lasting trading skill set—often resulting in better long-term performance. That said, the process is time-intensive and requires a high level of self-discipline.

Similarities

Despite the inherent differences between trading signal providers and DIY analysis, there are notable similarities:

- Goal Orientation: Both methods aim to enhance trading performance and profitability. They seek to reduce the uncertainty and risk associated with the markets.

- Reliance on Data: Whether delivered through automated algorithms or self-curated indicators, both approaches use historical and real-time data as a foundation for making trading decisions.

- Need for Adaptability: Market conditions are dynamic. Regardless of the approach, there is a continuous need for strategy revision and learning. Both trading signal providers and DIY strategies benefit from incorporating new market trends and indicators.

- Potential for Bias: Even automated systems can harbor biases based on historical data assumptions. Similarly, manual analysis is susceptible to human bias. Both require ongoing scrutiny and evaluation.

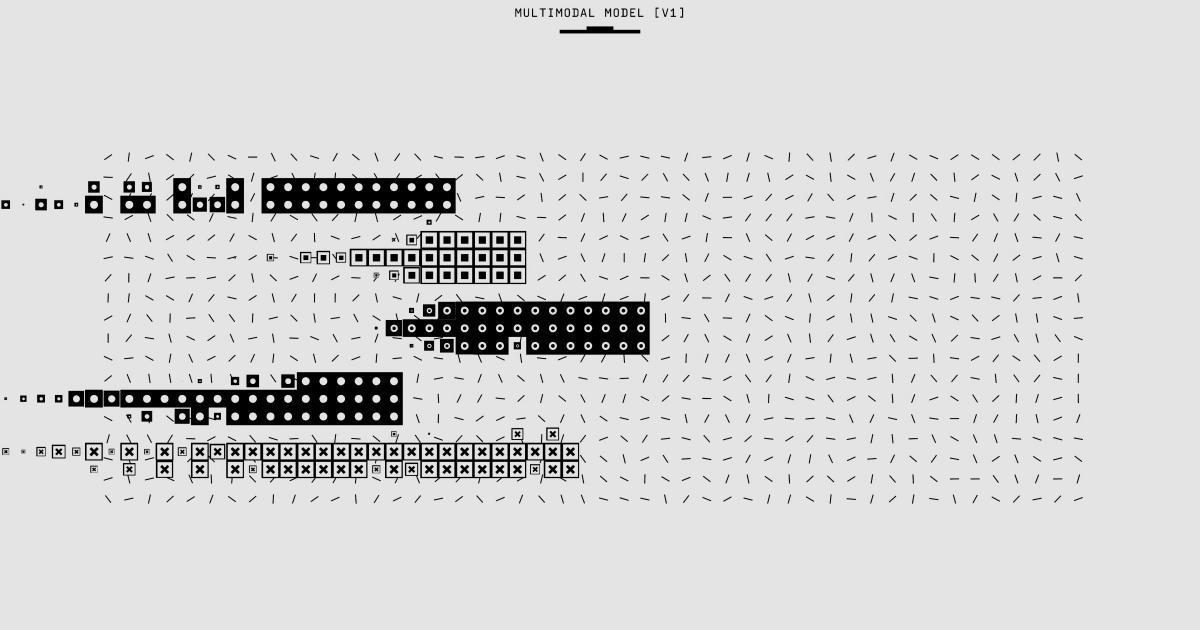

A side-by-side table highlights some of these similarities alongside differences:

| Aspect | Trading Signal Providers | DIY Analysis |

|---|---|---|

| Data Utilization | Automated, standardized data processing | Custom, individually chosen data and indicators |

| Performance Goal | Enhance decision speed and consistency | Build a personalized, evolving trading strategy |

| Adaptability | Pre-set algorithm adjustments with limited customization | High—traders adjust strategies and indicators freely |

| Learning Curve | Minimal personal learning required | Intensive self-education and continuous improvement |

Differences

The differences between these approaches are more pronounced when examining individual trade execution, strategic control, and the long-term development of trading skills.

- Control and Responsibility: Signal providers outsource the decision-making, which can be beneficial for traders seeking simplicity. DIY analysis, meanwhile, requires taking full responsibility for each decision, providing deeper control over trades but also increasing personal accountability.

- Cost Structure: Signal providers operate on subscription models, whereas DIY analysis requires investments in tools and education. The financial commitment is structured differently, influencing the long-term economic impact on the trader.

- User Experience: For newcomers, signal providers can be an accessible entry point. DIY analysis, however, is often favored by those who appreciate the discipline of developing a comprehensive understanding of market dynamics.

- Flexibility: Trading signal providers offer set methodologies prepared for the masses, whereas DIY analysis provides complete freedom to adapt, modify, and pivot strategies as one learns and grows. This difference can be pivotal depending on market conditions and individual personality.

Analysis

Interpreting the comparisons above yields several key insights:

Balanced Decision-Making:

Risk Versus Reward:

Cost-Benefit Considerations:

Technological Integration:

Market Adaptability:

Building a Trading Identity:

Each method comes with trade-offs, and the "reliability" of an approach ultimately depends on the trader's goals, discipline, and willingness to adapt. A hybrid model that integrates the strengths of both might be the optimal strategy for many—a model where signal providers are used as supplementary inputs to a broader, self-constructed analytical framework.

Conclusion

In summary, the comparative analysis between trading signal providers and DIY analysis has revealed that there is no one-size-fits-all answer to reliability. Both methods have distinct advantages: automated systems provide speed and ease-of-use, while DIY analysis offers customization, deeper learning, and long-term strategic flexibility.

For traders who seek immediate, actionable insights with minimal personal input, signal providers represent a compelling choice, particularly when supported by robust education and an understanding of market nuances. On the other hand, for those who wish to develop a sustainable and personally tuned trading strategy, embracing DIY analysis—even with its steep learning curve—can lead to a rewarding mastery of market dynamics.

Ultimately, the decision may come down to personal preference, as well as a clear evaluation of one’s risk tolerance, time investment capacity, and financial resources. A blended approach, which leverages automated signals as one component of a broader analytical framework, might well be the ideal path forward for many traders. Regardless of which method is selected, ongoing education and adaptive strategy development remain key pillars for long-term trading success.

By carefully assessing the strengths and weaknesses detailed throughout this article, traders are now better equipped to align their strategies with their individual trading styles and market conditions. As technology and markets evolve, so too must the approaches that traders utilize. Whether you lean towards trading signal providers or embrace the challenge of DIY analysis, informed decision-making and continuous learning will serve as your greatest assets.

Final Thoughts

The journey towards reliable trading success is fraught with challenges and constant evaluation. Understanding the nuanced differences between external trading signal providers and hard-earned DIY analysis is a crucial step in this journey. As you refine your trading strategy, remember that a method’s reliability isn’t solely a function of its immediate effectiveness, but also its capacity to evolve with shifting market landscapes.

The diverse perspectives and empirical data presented here can serve as a guidepost in your trading career. Both avenues offer unique benefits, and by integrating them judiciously, you may find that leveraging multiple strategies enriches your overall trading performance. In a world where market volatility is the norm, being versatile and well-informed can be the definitive edge that sets you apart from the rest.

The ongoing dialogue between technology-driven automation and traditional analysis continues to inspire innovation. Traders who adapt and learn from both the successes and failures inherent in these methods will not only survive but thrive in the ever-changing financial landscape.

Taking the time to master both external advice and independent analysis could, in the final analysis, be the key to unlocking sustained profitability. As markets become more complex, the best traders will be those who constantly blend the strengths of modern technology with the art of strategic insight.

In conclusion, the reliability of trading signal providers vs. DIY analysis cannot be measured in isolation. Rather, it is the interplay between sound strategy, continuous learning, and the willingness to adapt that ultimately determines success in the unpredictable world of trading.

Unlock Trading Potential with Automated Analysis

Tired of missing opportunities and making suboptimal trading decisions? TrendSpider's cutting-edge platform automates complex technical analysis, saving you time and reducing human error.

With multi-timeframe analysis, dynamic alerts, backtesting, and customizable charting, you'll gain a competitive edge in identifying trends and making informed trades across global markets.

Unleash the Power of Automated Trading Analysis

Are you struggling to keep up with the fast-paced trading world? TrendSpider empowers you with cutting-edge tools for optimal strategy execution.

Our automated technical analysis suite eliminates guesswork, backtests strategies, and delivers real-time alerts, saving you valuable time and effort.

Ludovik Beauchamp

18 posts written

With over two decades of experience navigating volatile markets, Ludovik Beauchamp provides invaluable guidance on risk management, portfolio optimization, and adaptability in the face of uncertainty.

Read Articles