How to interpret Swiss central bank announcements for trading?

Discover how to interpret Swiss central bank announcements effectively to anticipate market moves an...

The Zero Interest Rate Policy (ZIRP) holds an important spot in the toolbox of many modern economies. Central banks often implement zirp during economic slowdowns, slashing borrowing costs down to near zero. The idea is to nudge more spending and investment along, especially when the usual monetary levers just aren’t packing much punch.

Zero Interest Rate Policy is a financial strategy where central banks set nominal interest rates at or just about zero. Normally interest rates hover between 2 and 5%. With ZIRP, the idea is to make borrowing practically free — nudging both consumers and businesses to spend more.

Think of ZIRP as a financial green light that gently pushes people to spend rather than stash cash away—kind of like pressing the gas pedal to get a car moving when it’s been idling too long.

Central banks usually tiptoe into ZIRP during rough patches like recessions or sluggish inflation or when deflation starts lurking around the corner.

"ZIRP tends to be a real go-to tool for policymakers aiming to kickstart sluggish economies by keeping borrowing costs low and widely accessible, especially when the usual tricks just don’t seem to cut it."

Central banks typically bring benchmark interest rates down close to zero and keep them there, all while keeping a keen eye on key economic signals. The idea is to make borrowing cheaper, nudging banks and businesses to ramp up economic activity

Central banks keep a close watch on economic indicators like GDP growth, unemployment levels and inflation that tell the real story.

When growth slows or inflation stays low, they often decide to nudge benchmark interest rates down toward zero to help the economy.

These lower policy rates usually ripple out and influence market interest rates on loans, mortgages and bonds, setting off a financial domino effect.

Policymakers regularly check inflation and employment data to see if their moves are working.

Based on what they find, they tweak their strategy by either sticking with the zero interest rate policy or slowly turning the dial up as the economy picks up steam.

When ZIRP is in place financial markets tend to jump into action by ramping up lending activity as cheaper credit nudges more people to borrow. Bond yields usually take a dip mirroring those low interest rates. Banks might find their profits getting a bit squeezed since the gap between lending and deposit rates narrows.

| Indicator | Before ZIRP | During ZIRP | After ZIRP |

|---|---|---|---|

| Interest Rates | Hovered between 2% and 5% | Sat comfortably around 0 to 0.25% | Typically nudges back up to 0.5 to 2% |

| Inflation Rate | Usually settled between 1.5% and 2.5% | Often slows down to a modest 0.5% to 1.5% | Generally finds its footing somewhere between 1.5% and 2% |

| GDP Growth | Ranged from a solid 2% to 3% | Usually cools off to about 0 to 1.5% | Bounces back to roughly 1.5% to 3% |

| Unemployment | Generally kept steady around 4% to 5% | Tends to creep up to 6% to 8% during this phase | Usually drops back down to about 4% to 6% |

ZIRP encourages lower borrowing costs which usually gives a leg up to both consumers and businesses by cutting down loan expenses. This often nudges asset prices upward, as investors hunt around for better returns—kind of like looking for the best slice of pie

ZIRP certainly has its perks. It can also cause unintended consequences like asset price bubbles, pinch the income of savers and throw market signals out of whack.

"When zero interest rate policies stick around for years on end, financial markets tend to get pretty cozy with those low rates. This can open the door to some vulnerabilities and make it tricky to step away from these policies without stirring up a bit of disruption."

After the 2008 financial crisis the United States Federal Reserve slashed rates down to nearly zero and held them there for quite a stretch, aiming to steady the economy through choppy waters. On the other side of the globe, Japan has been wrestling with near-zero rates since the 1990s to tackle stagnation and deflation.

| Country | Period Active | Economic Context | Observed Results |

|---|---|---|---|

| United States | 2008–2015 | In the wake of the Global Financial Crisis | Played a key role in jumpstarting the recovery, kept inflation nicely in check, and gave asset prices a decent upward nudge |

| Japan | 1999–Present | Long stretch of stagnation and stubborn deflation | Managed to eke out modest GDP growth, with inflation staying stubbornly low and an aging population continuing to loom large |

| Eurozone | 2014–2022 | Battling a debt crisis while dragging through a slow recovery | Saw steady but unspectacular growth, inflation staying on the low side, and policy measures that just seemed to go on forever |

| United Kingdom | 2009–2016 | Clawing back from recession | Spurred more lending activity, nudged asset prices higher, and carefully steered towards a slow, deliberate exit strategy |

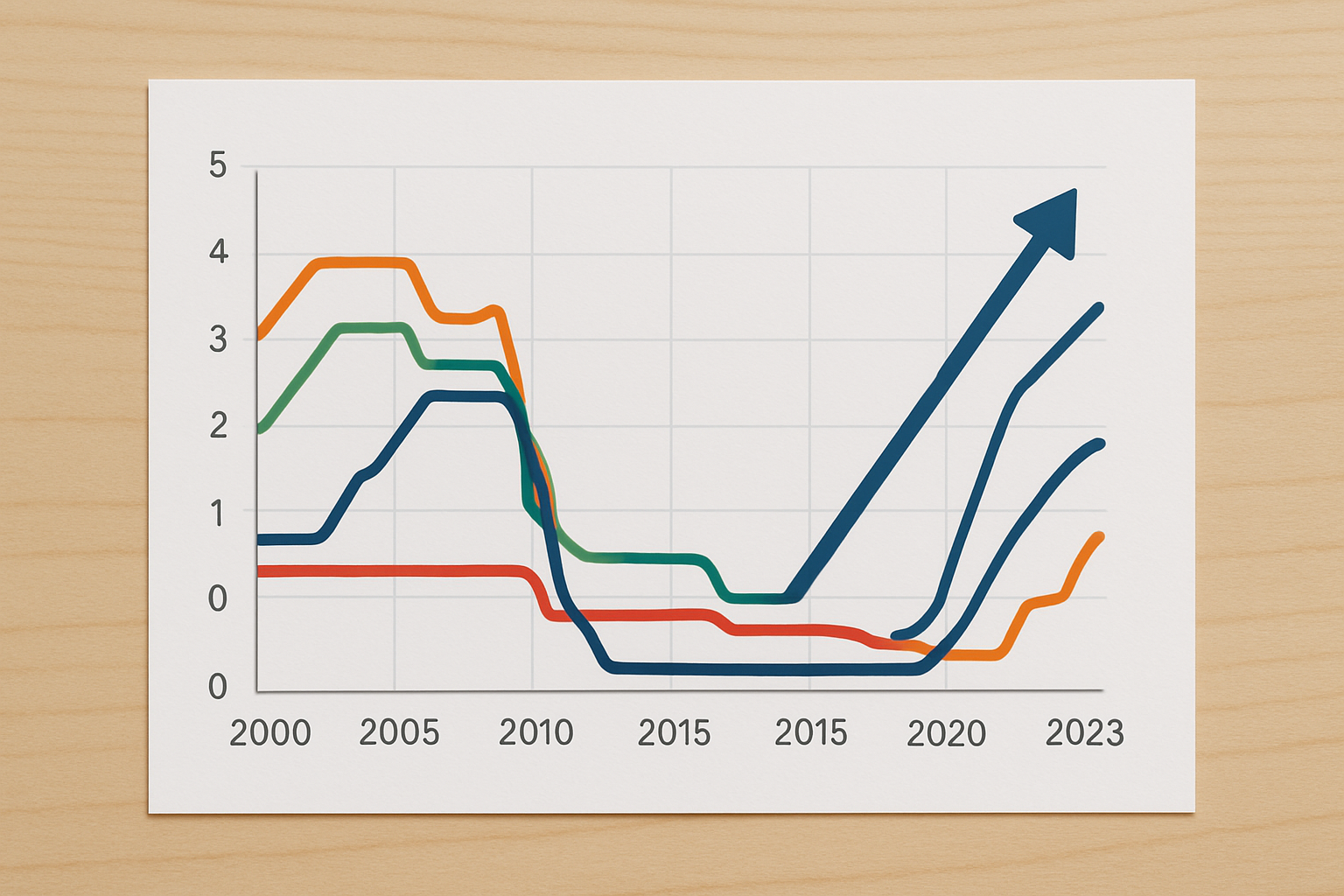

Chart depicting zero interest rate periods across different countries over the past two decades

ZIRP still holds a important spot as many countries wrestle with the economic fallout from the COVID-19 pandemic. Central banks have kept rates near zero or sometimes below as if walking a tightrope trying to maintain liquidity and encourage lending. They aim to keep credit markets afloat amid stubborn inflation and slow growth.

Policymakers today are walking a tightrope, trying to spur growth with ZIRP while keeping inflation from running wild and ensuring the financial system doesn’t wobble.

As economies slowly bounce back and wrestle with inflation, the future of ZIRP appears to be edging toward a slow and steady phase-out or a selective stay depending on local quirks and the shifting goals of monetary policy.

Alternatives to ZIRP (zero interest rate policy) include targeted fiscal stimulus and forward guidance plus unconventional tricks like quantitative easing.

Tired of missing opportunities and making suboptimal trading decisions? TrendSpider's cutting-edge platform automates complex technical analysis, saving you time and reducing human error.

With multi-timeframe analysis, dynamic alerts, backtesting, and customizable charting, you'll gain a competitive edge in identifying trends and making informed trades across global markets.

As a dedicated trader, you know the power of technical analysis in navigating the financial markets. TrendSpider is the cutting-edge tool you need to take your trading strategies to new heights. With its advanced charting capabilities and automated pattern recognition, TrendSpider empowers you to make informed decisions faster.

19 posts written

Combining his expertise in finance and blockchain technology, Keval Desai is known for his groundbreaking work on decentralized trading platforms and digital asset markets.

Read Articles

Discover how to interpret Swiss central bank announcements effectively to anticipate market moves an...

Discover what protectionism means in global trade, why countries use it, and its effects on economie...

Understanding dovish vs hawkish policy shifts is essential for market participants as these changes...

Learn how hawkish and dovish Federal Reserve communications impact forex markets. This guide breaks...