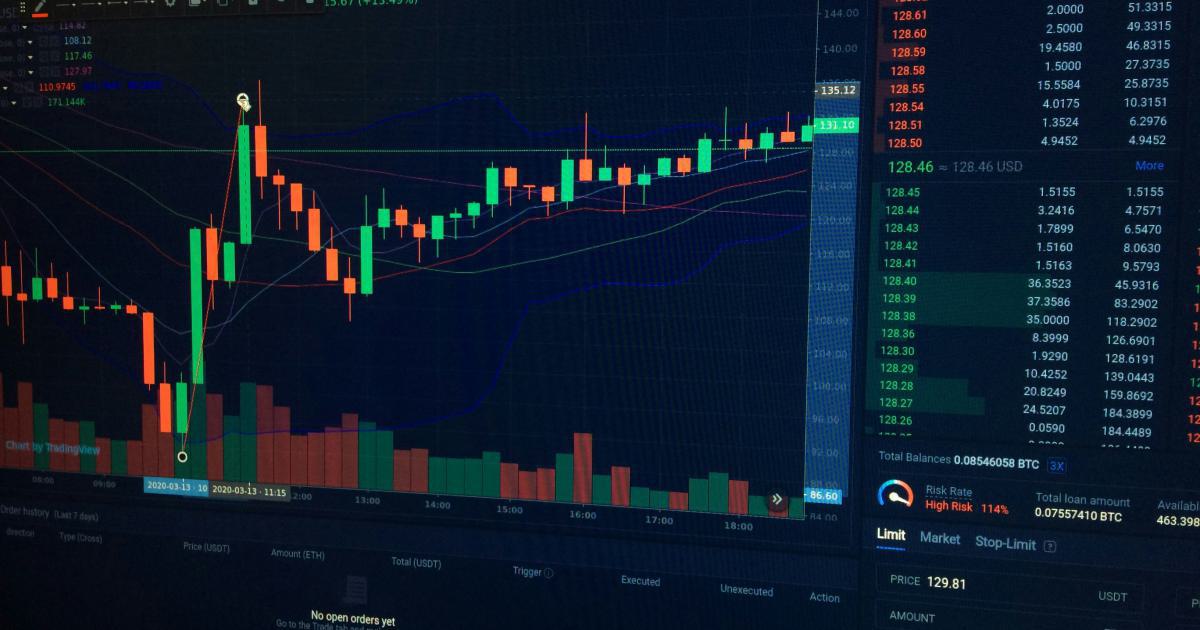

Why Position Sizing Rules Matter in Trading

Trading success hinges not only on identifying high-potential investments but also on implementing robust risk management strategies. One essential aspect that many novice and even experienced traders sometimes overlook is the concept of position sizing rules. These rules, when properly applied, allow traders to control risk exposure, manage portfolio volatility, and enhance overall performance. In this comprehensive article, we delve into why position sizing rules matter in trading and how they can be a game changer in your trading career. By understanding and applying these principles, you can improve your decision-making process, protect your capital, and increase your chances of long-term success.

Introduction to Position Sizing

Position sizing refers to the process of determining the amount of capital to allocate to a given trade. The importance of position sizing rules in trading cannot be overstated. They serve as the backbone of risk management, ensuring that losses remain within tolerable limits while allowing for maximum growth potential. When executed correctly, these rules not only safeguard your portfolio but also provide clarity and precision in your trading strategy.

The concept might seem straightforward: simply decide how much money to invest in a trade. However, the nuances become apparent when you consider factors like market volatility, trading style, and overall portfolio risk. With the unpredictable nature of the markets, even the most well-researched trade can face unexpected obstacles. Thus, position sizing rules help you determine the optimal amount of exposure to any single position to minimize risk while ensuring that you capitalize on opportunities as they arise.

What Is Position Sizing?

At its core, position sizing is a method of managing your capital in such a way that it aligns with your risk tolerance. By setting strict criteria for how much to invest in each trade, you prevent excessive losses that can derail your trading journey. Various methods of position sizing exist, and each comes with its own set of advantages and intricacies.

Some common approaches to position sizing include:

- Fixed Fractional Method: A set percentage of your total capital is risked on every trade.

- Fixed Dollar Amount: A constant dollar amount is applied regardless of the overall account size.

- Volatility-Adjusted Sizing: Position sizes are determined based on market volatility and the specific risk associated with each asset.

- Dynamic Position Sizing: Adjustments are made according to changes in market conditions or trader performance over time.

These methods provide a structured and disciplined approach to trading. By adhering to these strategies, you limit the portfolio's exposure to adverse market moves and reinforce sound investment practices.

The Fundamentals of Risk Management in Trading

Effective trading is not merely about picking the right trades—it’s about managing the inherent risks associated with market participation. Risk management is often discussed in terms of stop losses, diversification, and portfolio rebalancing. However, position sizing rules are equally critical in ensuring that your exposure remains at a manageable level.

Managing Risk Exposure

By carefully calculating how much to invest in any given trade, you minimize the potential for devastating losses. For instance, if you decide to risk only 1-2% of your capital on a particular trade, even a series of losses will not wipe out your entire account. Position sizing ensures that your risk exposure is in line with your overall portfolio objectives.

This disciplined approach also aids in mitigating the emotional stress inherent in trading decisions. Knowing that each trade is sized appropriately helps prevent the panic and overreaction that can occur after a losing trade, thereby promoting a stable and well-planned trading strategy.

The Role of Leverage

Many experienced traders utilize leverage to amplify their returns. However, leverage also magnifies risks, making stringent position sizing rules all the more essential. Without a clear understanding of how to size your positions relative to your account size, you may inadvertently expose yourself to excessive risk—a mistake that can lead to significant financial loss.

Leverage is a double-edged sword. While it has the potential to generate higher profits, it can lead to equally substantial losses if not managed properly. Therefore, implementing proper position sizing rules becomes essential in trading environments that use leverage.

Position Sizing and Emotional Trading

Emotions play a significant role in trading outcomes. When you are confident that your trade size adheres to a pre-defined risk management strategy, you are less likely to let fear or greed dictate your decisions. This psychological edge is vital in volatile markets where emotions can run high. Maintaining a systematic approach with clear position sizing ensures that each trading decision adheres to a pre-determined risk threshold.

Position Sizing Rules and Trading Strategy

Position sizing rules must be an integral part of your overall trading strategy. Integrating them into your system not only protects your capital but also provides a framework for consistent decision-making.

Fixed Fractional Position Sizing

One of the most popular methods is the fixed fractional approach, where you risk a fixed percentage of your account on each trade. This method is lauded for its simplicity and effectiveness. For example, consider a trader with a $50,000 account who decides to risk 2% per trade, translating to $1,000 per trade. If a stop-loss order is placed such that the potential loss is within this $1,000 threshold, the method is adhered to regardless of the trade’s outcome.

The advantages include:

- Simplicity: Easy to calculate and implement.

- Flexibility: Adjusts to the natural fluctuations of your account size.

- Risk Control: Helps maintain consistency in risk exposure across different trades.

Volatility-Based Position Sizing

Another approach is volatility-based position sizing. In this method, you adjust your position size according to the asset's prevailing volatility. A volatile asset might warrant a smaller position size compared to a stable one, given the increased likelihood of large price swings. This method integrates market conditions into your risk model, ensuring that position sizes are adaptive and reflective of current market environments.

For example, if you are trading a stock that exhibits high volatility, you might restrict your investment size to mitigate the risk of sudden, adverse price movements. Conversely, for a less volatile asset, you might consider a larger position size since price movements are generally more predictable.

Risk-Reward Ratio and Position Sizing

Establishing a favorable risk-reward ratio is a core component of a successful trading strategy. By combining well-defined risk-reward metrics with disciplined position sizing, traders can ensure that, over time, their winning trades sufficiently offset their losses. The calculation is straightforward: determine the amount you’re willing to risk versus the potential reward for each trade.

For instance, if a trader commits to a risk-reward ratio of 1:3, they ensure that every dollar risked has the potential to yield three dollars upon a successful trade. Position sizing rules help enforce this ratio by adjusting the trade size so that the maximum potential loss aligns with the predetermined risk threshold.

Dynamic Position Sizing Techniques

While fixed strategies are effective, dynamic position sizing techniques take into account market trends and conditions. This method allows for adjustments based on volatility measures, trade confidence level, and even the time of day. Dynamic techniques are more sophisticated and may involve algorithm-driven systems or manual adjustments based on in-depth technical analysis.

Consider a scenario where a trader is participating in a highly volatile market. Dynamic sizing may involve a smaller-than-usual position until market conditions stabilize, even if the fixed-fractional system would suggest a larger position. This flexibility is often the result of real-world experience, where adjustments are necessary to align with current market behavior.

Common Pitfalls in Position Sizing

Even the most robust trading strategies can fall apart without sound position sizing rules. Many traders make mistakes that compromise their risk management, eventually leading to significant losses or, worse, complete account depletion. Understanding these pitfalls can help you steer clear of potential disasters.

Overexposure

A common mistake is overexposure, where traders allocate too much capital to one trade. This not only increases the risk of substantial losses but also disrupts the overall balance of your portfolio. It is imperative to calculate position sizes based on a percentage of your total capital rather than on the allure of potential rewards.

Miscalculating Stop-Loss Levels

The stop-loss order is an integral part of managing risk in trading. However, misplacing stop-loss levels can negate the benefits of careful position sizing. If your stop-loss is too close, you may inadvertently get stopped out by normal market fluctuations. Conversely, if it is too loose, you risk taking on more loss than initially intended. Combining a well-determined stop-loss strategy with accurate position sizing rules is important for effective risk management.

Ignoring Transaction Costs

Another oversight is neglecting transaction costs such as commissions, slippage, and other fees. These factors can significantly impact your net returns, especially when using a fixed fractional position sizing method. Always include these costs in your calculations to ensure that the position size is truly reflective of your potential risk.

Overcomplicating the System

While advanced models like volatility-based or dynamic position sizing can provide a competitive edge, overcomplicating the process may lead to analysis paralysis. It is important to strike a balance between precision and simplicity. For most traders, a well-thought-out fixed fractional approach may be sufficient, with adjustments made only when necessary.

Real-World Case Studies

To illustrate the concepts discussed, let’s examine a few real-world case studies that highlight the successful application of position sizing rules in trading.

Case Study 1: The Consistent Growth Trader

John, a seasoned trader, managed a $100,000 portfolio. He adopted a fixed fractional position sizing method, risking only 1% of his account per trade ($1,000 per trade). Despite experiencing occasional losses, John's strict adherence to his position sizing rules ensured that no loss overextended his portfolio’s potential. Over time, consistent small gains compounded dramatically, allowing him to grow his account steadily. His strategy proved effective even during volatile periods and market downturns.

Case Study 2: Volatility-Adjusted Success

Maria, another experienced trader, specialized in volatile mid-cap stocks. Recognizing that these stocks often experienced rapid and unpredictable price swings, Maria chose a volatility-based position sizing approach. For highly volatile stocks, she reduced her position size to safeguard her portfolio. Conversely, she increased her exposure when trading stable stocks. This adaptive strategy allowed Maria to navigate volatile markets successfully and ultimately achieve a robust performance record with limited drawdowns.

Case Study 3: The Dynamic Adjuster

Alex, who combined both technical analysis and a dynamic position sizing strategy, used algorithm-based signals to adjust his trading size. In calmer market conditions, his system increased position sizes to capitalize on favorable trends, while in turbulent times, the size was automatically reduced. This flexible approach enabled him to balance risk more accurately, ensuring that his trades were sized appropriately for prevailing market conditions, and shielding him from large, unexpected losses.

Implementing Position Sizing Rules in Your Trading Plan

Integrating position sizing into your trading strategy requires a systematic approach and a thorough understanding of your own risk tolerance and market behavior. Here are actionable steps you can take to implement position sizing rules effectively:

Step 1: Assess Your Risk Tolerance

Before diving into any calculations, assess your financial situation and risk tolerance. Ask yourself:

- What is the maximum percentage of my total capital I can afford to lose on a single trade without jeopardizing my financial security?

- How does my emotional tolerance for loss impact my trading decisions?

Answering these questions provides a solid foundation for determining a position sizing strategy that aligns with your personal circumstances.

Step 2: Choose a Position Sizing Method

Based on your risk tolerance and trading style, select the appropriate position sizing method. A beginner might start with a fixed fractional approach, while experienced traders can explore volatility-based or dynamic techniques. It is crucial to select a method that you can stick with and adjust as your trading experience grows.

Step 3: Develop a Trading Journal

Document every trade, including the position size, entry and exit points, stop-loss levels, and the rationale behind each decision. Over time, this trading journal will not only serve as a record of your performance but also help you refine and adjust your strategy. Regular review of your journal can highlight patterns and reveal areas for improvement.

Step 4: Test Your Strategy

Before committing significant capital, test your chosen position sizing rules under different market scenarios. Consider utilizing simulated trading environments or backtesting your approach using historical data. This testing phase is vital such that any flaws or oversights can be addressed without jeopardizing your actual capital.

Step 5: Adjust and Evolve

Markets evolve, and so should your position sizing strategy. It is important to revisit your trading plan periodically to ensure that your rules remain effective. As you gain experience and market conditions change, you may find it necessary to fine-tune your approach. Flexibility is key—position sizing rules should not be rigid; instead, they should adapt to both your growth as a trader and fluctuations in the market.

Tools and Techniques to Enhance Position Sizing

Modern trading platforms offer a range of tools to assist in effective position sizing. From risk management calculators to algorithmic trading systems, traders have access to sophisticated means of implementing these rules.

Risk Management Calculators

Risk management calculators can help streamline the process of determining the optimal trade size. By inputting your capital, risk percentage, and stop-loss level, these tools instantly generate the ideal position size. Many online platforms or dedicated trading software come with built-in calculators that can save time and reduce human error in your calculations.

Trading Software and Algorithms

For those who prefer a more automated approach, trading software and algorithms can dynamically adjust your position sizes based on real-time data. By integrating technical indicators, volatility metrics, and historical performance data, these systems provide a customized position sizing solution that adapts quickly to market changes.

Educational Resources and Communities

Participating in trading communities and leveraging educational resources can also enhance your understanding of position sizing. Many experienced traders share their insights, strategies, and experiences online through forums, webinars, and courses. Engaging with these resources can provide invaluable perspectives and help you implement best practices in your trading routine.

Software Integration with Broker Platforms

Many brokerage platforms now integrate sophisticated risk management tools directly into their trading interfaces. These systems allow you to predefine risk parameters for each trade, such as maximum drawdown limits. By aligning the trading software with your personal position sizing rules, you automate a portion of your risk management process, ensuring consistency even when market conditions are rapidly evolving.

Psychological Considerations in Position Sizing

Trading is as much a psychological endeavor as it is a mathematical one. The discipline required to stick to predetermined position sizing rules can be challenging, especially during periods of market turbulence. Understanding the psychological aspects of trading can further enhance your ability to adhere to your risk management strategy.

Overcoming Cognitive Biases

Cognitive biases such as overconfidence, recency bias, and loss aversion can lead to deviations from your planned position sizing strategy. Recognizing these biases is the first step in mitigating their impact. For instance, after a series of wins, the temptation to increase your position size can be strong. However, maintaining strict position sizing discipline ensures that you do not overexpose yourself based on emotions rather than sound analysis.

The Role of Discipline in Trading Success

Discipline is the cornerstone of successful trading. When armed with a clear set of position sizing rules, traders are less likely to succumb to impulsive decisions. Developing and adhering to this discipline requires continuous learning, self-reflection, and sometimes even a mentor to provide an objective perspective on your trading habits.

Building Confidence Through Consistency

A well-defined position sizing strategy not only protects your capital but also builds confidence. Knowing that each trade is executed with a calculated risk means you are less likely to second-guess your decisions. This consistency helps in managing stress and fosters a resilient mindset that is crucial for long-term success in the financial markets.

Integrating Position Sizing with Other Trading Strategies

Position sizing rules work best when integrated with other proven trading strategies. Whether you are employing technical analysis, fundamental analysis, or a blend of both, a robust position sizing strategy can amplify your overall trading performance.

Technical Analysis and Position Sizing

Technical indicators can provide clear signals for market entry and exit. When combined with disciplined position sizing, these signals ensure that even if a trade does not move as anticipated, the risk remains contained. For example, if technical indicators suggest a favorable entry point based on chart patterns or momentum indicators, applying proper position sizing can mitigate the risk associated with potential false signals. This dual approach of technical analysis supplemented by meticulous risk management can lead to more consistent trading outcomes.

Fundamental Analysis Integration

While technical analysis focuses on price action, fundamental analysis examines the underlying factors influencing an asset’s value. Position sizing rules complement fundamental strategies by offering a framework for managing the uncertainty inherent in evaluating a company’s long-term prospects. For instance, even if a stock appears undervalued based on its fundamentals, unforeseen market events may lead to losses. By controlling the trade size, you ensure that such losses remain manageable and do not jeopardize your entire portfolio.

Combining Strategies: A Holistic Approach

In modern trading, success often arises from combining multiple strategies. A holistic approach that integrates position sizing rules, technical analysis, and fundamental insights provides a comprehensive system to navigate the complexities of the market. Traders who adopt this multifaceted strategy can better balance risk and reward, ensuring that no single factor disrupts their overall trading performance.

Expert Tips for Successful Position Sizing

Over time, many professional traders have refined their approach to position sizing. Here are some expert tips that can further optimize your strategy:

Start Small and Scale Up: Especially if you’re new to trading, begin with lower position sizes. As your confidence and account balance grow, gradually increase your investment in trades.

Consistently Evaluate Your Performance: Use your trading journal to analyze performance over time. Adjust your position sizing rules based on both successes and failures.

Stay Updated with Market Conditions: Regularly review current volatility, economic indicators, and market trends to ensure your position sizing remains relevant.

Leverage Technology: Use risk management calculators and automated tools to complement your manual analysis.

Learn from Peers and Mentors: Engage with trading communities to exchange strategies and ideas about effective position sizing for different asset classes.

Remain Emotionally Detached: Always follow your pre-determined strategy. Avoid increasing position sizes impulsively based on recent wins or market hype.

Implementing these tips in your trading plan can help you avoid common pitfalls and enhance the robustness of your risk management strategy.

The Future of Position Sizing in an Evolving Trading Landscape

As markets evolve, so too do the tools and strategies that traders use to manage risk and optimize returns. The future holds significant promise for more advanced methods of position sizing, driven by innovations in artificial intelligence, machine learning, and big data analytics. These technologies are enabling traders to analyze vast amounts of market data and implement dynamic position sizing strategies that adjust in real time.

Advancements in Algorithmic Trading

Algorithmic trading platforms are increasingly sophisticated. They can calculate the optimal position size for a trade almost instantaneously, incorporating a multitude of market indicators and historical trends. As algorithms become more refined, the precision of position sizing is expected to improve, thereby enhancing the overall risk management process.

Integration with Robo-Advisors

Robo-advisors and automated trading bots are becoming more common in retail trading. These systems incorporate risk management rules, including advanced position sizing algorithms, to create balanced portfolios that adapt to market changes. As these tools continue to gain popularity, they may further democratize professional-level risk management practices for everyday traders.

Customized Trading Solutions

With advancements in technology, traders might soon access highly customized position sizing solutions that align with their personal risk tolerance, trading style, and even psychological profile. This personalization could lead to strategies that are far more effective in managing risk while maximizing returns, ushering in a new era of tailored trading solutions.

Conclusion

In the realm of trading, rules and discipline are paramount. The principles behind position sizing rules provide traders with a framework to manage risk, mitigate losses, and capitalize on market opportunities. By adhering to robust position sizing strategies, you not only protect your portfolio but also enhance your decision-making process. From fixed fractional and volatility-based approaches to dynamic and algorithm-driven techniques, the options are diverse and can be adapted to suit any trading style.

Position sizing rules matter in trading because they are the bridge between effective strategy and risk management. They empower traders to weather the market's inevitable ups and downs without succumbing to emotional decision-making. Whether you are a market veteran or just starting out, integrating solid position sizing practices into your trading plan will provide you with a competitive edge, foster a disciplined mindset, and ultimately lead to sustained trading success.

As the trading landscape continues to evolve, so too will the importance of these rules. Embracing technological advancements and integrating new insights can further refine your strategy. Now is the time to re-examine your current trading plan, evaluate your risk management protocols, and ensure that position sizing is given the prominence it deserves.

By continuously learning, adapting, and applying best practices in position sizing, you lay the foundation for long-term success. The financial markets will always present challenges, but with disciplined position sizing rules, you are better equipped to handle volatility, minimize losses, and maximize growth potential. Embrace the power of position sizing as a central pillar in your trading strategy, and watch as your discipline translates into consistent and sustainable performance.

Happy Trading!

Unleash the Power of Automated Trading Analysis

Are you struggling to keep up with the fast-paced trading world? TrendSpider empowers you with cutting-edge tools for optimal strategy execution.

Our automated technical analysis suite eliminates guesswork, backtests strategies, and delivers real-time alerts, saving you valuable time and effort.

Leila Amiri

36 posts written