What Are The Best Indicators For Trading Volume?

In the world of trading, few factors are as critical yet overlooked as trading volume. The best indicators for trading volume not only provide insights into market sentiment but also help traders determine the strength of price movements, manage risk, and optimize entry and exit points. This comprehensive guide explores a wide array of volume indicators, explaining their relevance and applications in both manual and algorithmic trading setups. Whether you are an experienced trader or a beginner, understanding these indicators can transform your approach to market analysis and trading decisions.

Introduction

Trading volume represents the number of shares, contracts, or units that change hands during a given period. It acts as a proxy for trader interest, liquidity, and overall market participation. High volumes often accompany significant price moves, while low volumes may indicate market indecision. Consequently, integrating volume analysis with price movements provides deeper insight into market dynamics.

In this article, we delve into various volume indicators, discuss their nuances, and illustrate how they can be effectively leveraged. We examine the best indicators for trading volume, including On-Balance Volume (OBV), Money Flow Index (MFI), Accumulation/Distribution Line (A/D Line), and several others. Each section is designed to provide detailed explanations, real-world examples, actionable strategies, and expert tips that can elevate your trading performance.

Trading today is not solely about the direction of price but also about understanding the underlying force (volume) driving that movement. By examining the breadth and depth of volume changes, traders can identify potential reversals, confirm trends, and even anticipate breakouts. This rich narrative walks you through the theoretical background, practical applications, and inherent limitations of these indicators.

Understanding Trading Volume

What is Trading Volume?

Trading volume is an essential metric that quantifies the number of transactions occurring over a specific time frame. It is a mirror reflecting the market's collective action and sentiment. While price charts show the “what” of market movements, volume charts offer insights into the “why” behind these moves.

Fundamentally, high volume during a price increase suggests strong buying power, confirming an uptrend. Conversely, increased volume during a downturn might signal strong selling pressure. Analyzing both aspects together allows traders to validate trends or question weak moves that occur on low volume.

The Role of Volume in Technical Analysis

Volume is a pivotal element in technical analysis because it illustrates the conviction behind price moves. Indicators based on volume help in:

- Confirming the validity of trends,

- Detecting divergences between price movements and volume, and

- Providing clues to potential reversals or continuations.

For instance, if a market’s price is rising, but volume is dwindling, it might indicate that the current trend is losing momentum. Alternatively, sudden spikes in volume can act as precursors to major trend changes or breakouts, alerting traders to pay closer attention.

How Volume Enhances Trade Decisions

Volume analysis can influence several aspects of trade management:

Entry and Exit Strategies: By confirming the strength of a trend, volume indicators can help refine entry points and advise when to exit a trade.

Risk Management: Integrating volume data into risk assessments can reveal if profits are sustainable or if changes in volume suggest an impending reversal.

Detecting Market Manipulation: In markets prone to manipulation, unusual volume changes might serve as early warnings against traps set by large institutional players.

Even automated trading systems use volume data to improve signal accuracy. As a result, a deep knowledge of volume indicators is indispensable for developing robust trading systems.

Detailed Analysis of Volume Indicators

When it comes to identifying the best indicators for trading volume, each tool has its own methodology and intended purpose. In this section, we will scrutinize several popular volume indicators, analyzing their construction, application, and the nuances that make them vital for traders.

On-Balance Volume (OBV)

One of the earliest and most popular volume indicators is the On-Balance Volume (OBV). OBV aggregates volume to predict price trends by adding volume on up days and subtracting it on down days.

How OBV is Calculated

OBV is calculated with the following simple rules:

- If today's closing price is higher than yesterday's, add today's volume.

- If today’s closing price is lower than yesterday’s, subtract today’s volume.

- If the closing prices are equal, OBV remains unchanged.

By cumulating these volumes over time, OBV creates a running total that can signal whether the market is being accumulated or distributed. A rising OBV, paired with rising prices, indicates that buyers are in control. Conversely, if prices are rising but OBV is declining, it might hint that selling pressure is creeping in, potentially signaling a reversal.

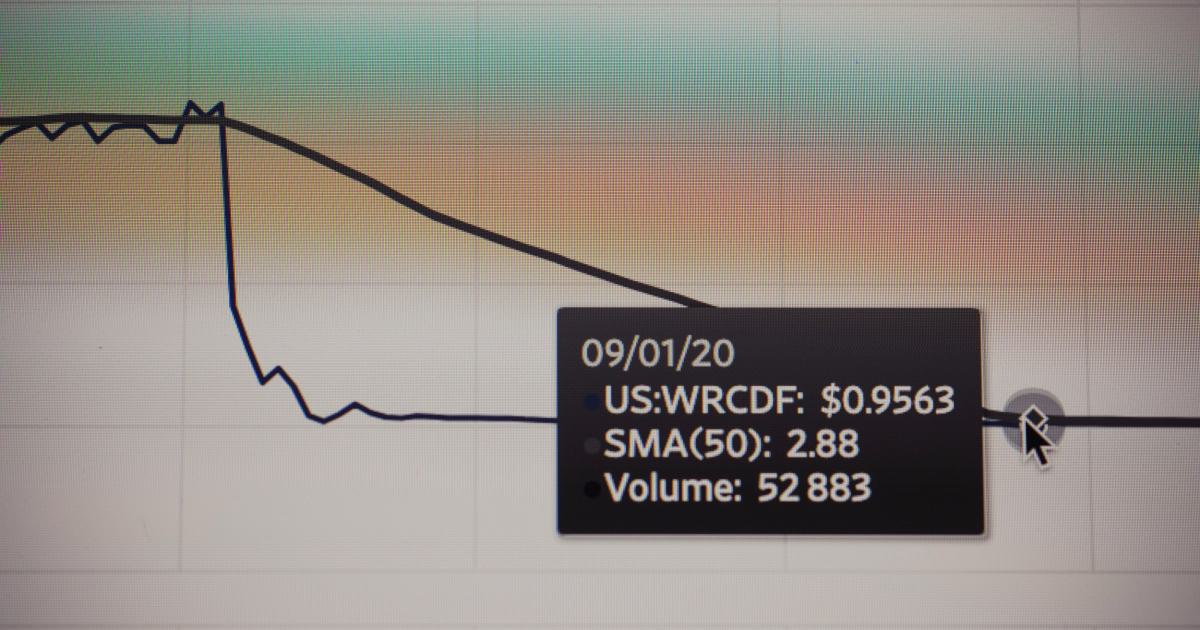

Real-World Example of OBV

Consider a scenario where a stock has experienced a steady price increase over several weeks but its OBV line has fallen. This divergence might indicate that the climbing prices are not backed by strong volume, suggesting that the trend might lack sustainability. In practice, traders monitor such divergences closely to preempt a possible market correction.

Best Practices When Using OBV

- Always use OBV in conjunction with price charts.

- Look for divergences between OBV and price movements.

- Combine OBV with other indicators, such as moving averages, to filter out false signals.

Accumulation/Distribution Line (A/D Line)

The Accumulation/Distribution Line is similar in purpose to OBV but incorporates more facets of price action into its calculation. It factors in the relationship between the closing price and the range of the period to better reflect buying and selling pressure.

Calculation Method

The A/D Line computes a multiplier representing where the close lies within the high-low range, which is then applied to the period’s volume. The result is added to a cumulative total. This method gives more weight to trading days where the close is nearer the high or low of the day.

Interpretations and Signals

- A rising A/D Line indicates that the market is accumulating, suggesting further upward movement.

- A falling A/D Line implies distribution, which is often a precursor to a decline.

- Divergences between price and the A/D Line can serve as warning signs of impending reversals.

Volume Price Trend (VPT)

The Volume Price Trend indicator builds on the logic of OBV but adjusts the impact of volume based on the percentage change in price. It gives a more sensitive measure by weighing volume by the degree of price movement.

Calculation and Utility

VPT is calculated by adding a fraction of the day’s volume proportional to the percentage price change to the previous VPT value. This weighting makes VPT more responsive to significant price changes. For example, a small volume on a day with a large price change can impact the VPT more considerably than a similar volume on a day with minimal price change.

Practical Applications

- VPT is useful for confirming trends and signaling the momentum behind price moves.

- Like OBV, divergences from price can indicate potential trend shifts.

- Its responsiveness to price changes makes it suitable for detecting early signals in highly volatile markets.

Money Flow Index (MFI)

The Money Flow Index (MFI) is often considered a volume-weighted version of the Relative Strength Index (RSI). It incorporates both price and volume to determine the buying and selling pressure.

Understanding MFI Calculation

MFI calculates the typical price (average of high, low, and close) and then multiplies it by volume, which produces the raw money flow. This raw value is then separated into positive and negative flows and smoothed over a chosen period. The result is a measure that oscillates between 0 and 100, much like RSI.

Interpretation of MFI

- An MFI reading above 80 is considered overbought, while a reading below 20 signals oversold conditions.

- Divergence between the MFI and price may signal potential reversals.

- MFI can also complement other momentum indicators to provide confluence in decision-making.

Chaikin Money Flow (CMF)

Developed by Marc Chaikin, the Chaikin Money Flow indicator is another volume-weighted oscillator that focuses on the accumulation and distribution over a specified period.

Key Features of CMF

- CMF evaluates the weighted average of accumulation and distribution.

- It fluctuates around the zero line, where readings above zero suggest buying pressure and below zero indicate selling pressure.

- CMF is particularly adept at identifying shifts in market sentiment before significant price movements occur.

Using CMF in Trading

By watching for instances where CMF crosses above or below critical threshold levels, traders can infer potential changes in market behavior. For example, a CMF crossing above zero after a prolonged negative reading might mark the beginning of an accumulation phase.

Volume Weighted Average Price (VWAP)

Unlike the previously discussed indicators, the Volume Weighted Average Price (VWAP) focuses on providing an average price that takes volume into account over a particular period—usually a single trading day.

Components of VWAP

VWAP divides the total dollar value traded (price multiplied by volume for every transaction) by the total volume for that day. The resulting average is a tool for:

- Benchmarking trade execution,

- Determining fairness of prices, and

- Enhancing timing for intraday trading decisions.

VWAP in Practice

Institutional traders use VWAP to ensure that they do not disrupt the market and to gauge whether their trades have been executed at favorable prices. By comparing the current price to VWAP, traders can decide whether to exercise or hold their position.

Integrating Volume Indicators into Trading Strategies

Combining Multiple Indicators

Although each volume indicator provides unique insights, traders often enhance their analysis by combining several indicators. Doing so can reduce the incidence of false signals and deliver a more robust confirmation of market trends. For instance, using OBV in conjunction with the A/D Line can:

- Confirm the sustainability of a trend,

- Validate suspected divergences with greater confidence,

- Provide a cross-check against temporary market noise.

Algorithmic Trading and Volume Data

Modern trading platforms increasingly utilize algorithmic strategies that incorporate trading volume using sophisticated statistical models. Many algorithms rely on a combination of the best indicators for trading volume to generate entry and exit signals in real time. By processing huge amounts of tick data, these automated systems can identify subtle divergences or confirm trends quickly.

For example, a high-frequency trading system might detect micro-fluctuations in OBV and MFI readings, triggering buy or sell orders within milliseconds of a shift. Such systems benefit greatly from the depth provided by multiple volume indicators, enhancing predictive accuracy.

Actionable Steps for Manual Traders

Begin with a comprehensive review of daily or intraday volume patterns.

Select volume indicators that align with your trading style—long-term investors may prefer the Accumulation/Distribution Line, while day traders might lean towards VWAP or MFI.

Backtest these indicators using historical price and volume data to understand their performance in various market conditions.

Incorporate these insights into your trading plan and adjust stop loss and take profit levels based on volume-driven market dynamics.

Constantly monitor and recalibrate your chosen indicators as market conditions evolve.

Case Study: Trend Reversal in a Volatile Stock

Imagine a volatile stock showing a gradual uptick in price. However, as the price reaches a new high, the OBV begins to decline, while the Money Flow Index shows an approaching oversold condition. By cross-verifying with the Accumulation/Distribution Line, a diligent trader observes a clear divergence—price rises are not matched by an increase in buying volume. As a result, the trader prepares for a possible trend reversal by tightening stop-loss levels and eventually taking profits ahead of the downturn, thereby protecting their capital and maximizing gains.

Expert Tips for Volume-Based Strategy Optimization

- Always consider context: Volume indicators can sometimes generate false signals in illiquid markets or during periods of market manipulation.

- Use longer-term moving averages in conjunction with volume indicators to smooth out short-term noise.

- Pay attention to market-specific idiosyncrasies. For example, indicators might behave differently in tech stocks compared to commodities.

- Monitor external factors such as economic data releases or geopolitical events that may lead to volume surges not directly related to technical setups.

- Combine technical analysis with fundamental insights to refine your overall market perspective.

Limitations and Challenges of Volume Analysis

Data Quality and Market Conditions

While volume indicators offer valuable insights, they are not without limitations. Data quality, particularly in less regulated markets, can be problematic. Inconsistent reporting or artificially inflated volumes can lead to misleading signals. Traders should verify the reliability of their data sources and, when possible, cross-reference with alternative data streams to ensure accuracy.

Interpretation Variability

Indicators based on volume often require contextual understanding. A sudden spike in volume might indicate strong market interest, but it can also signal panic selling. The interpretation of volume data can vary across different asset classes, time frames, and market conditions, requiring traders to adopt flexible analytical frameworks.

Technical Constraints

- Certain indicators, such as VWAP, are inherently tied to specific trading sessions, making them less applicable for swing traders.

- Conflicts between signals from different indicators necessitate careful evaluation—a divergence in one indicator may conflict with confirmation from another.

- Overreliance on a single indicator without considering broader market sentiment can result in suboptimal decisions.

Mitigating Limitations

Traders can mitigate these challenges by using a multi-indicator approach, calibrating indicators to suit their trading timeframe, and incorporating robust risk management strategies. Continuously reviewing performance and adjusting indicator settings according to prevailing market conditions is also essential.

Advanced Considerations: Hybrid Models and Algorithmic Applications

Developing Hybrid Indicator Models

Advanced traders often develop hybrid models that combine volume-based indicators with other technical factors such as volatility, momentum, and trend analysis. A hybrid model might blend OBV, money flow metrics, and RSI to produce a composite signal with greater reliability.

Steps to Build a Hybrid Model

Identify key indicators that complement each other.

Develop a weighted formula that merges signals from each indicator.

Backtest the model extensively across different market regimes.

Refine the parameters based on observed performance and market feedback.

Integrate risk management protocols to handle anomalies or model breakdowns.

The goal of these hybrid models is to overcome the limitations inherent in individual indicators while capitalizing on their strengths. For instance, incorporating volatility measures with volume data can help clarify whether a sudden surge in volume is driven by genuine market interest or is merely short-lived noise.

Implementation in Algorithmic Trading Strategies

Algorithmic trading platforms excel in processing and combining multiple indicators simultaneously. By leveraging machine learning techniques, traders can develop adaptive systems that consider historical correlations and current market sentiment to forecast future volume patterns. These systems adjust their parameters in real time, accounting for shifts in market behavior.

Real-World Algorithm Application

Imagine an algorithm that monitors OBV, MFI, and VWAP concurrently. The system might detect that the OBV is trending down despite rising prices, the MFI is approaching oversold levels, and the current price is below the VWAP. This confluence of signals might trigger an automated exit from a long position or a well-timed short entry, thus maximizing profitability and minimizing risk.

Future Trends in Volume-Based Analysis

As trading technology advances, the integration of alternative data sources—such as order book dynamics, social media sentiment, and even weather data—into volume analysis will likely gain prominence. These additional data points can provide a fuller picture of market conditions, enabling more nuanced predictive models. Moreover, the ongoing evolution of AI and big data analytics promises to refine and enhance the precision of volume indicators further.

Practical Guidelines for Implementation

Step-by-Step Guide for Beginners

Start by familiarizing yourself with basic volume indicators like OBV and VWAP.

Choose a demo trading account to backtest these indicators in real time.

Gradually incorporate additional indicators such as MFI and CMF, and observe their behavior during different market trends.

Document your observations and adjust your trading strategy based on recurring patterns or signal divergences.

Scale your strategies once consistent patterns emerge, always ensuring robust risk management practices are in place.

Recommendations for Experienced Traders

- Revisit historical charts and examine how volume indicators behaved during major market events.

- Consider creating custom indicator combinations that align with your market perspective and trading style.

- Continuously update your knowledge base by reviewing recent academic studies and market reports related to trading volume analysis.

- Engage with online trading communities to share insights and learn from industry veterans. Peer reviews and discussions can often yield ideas that simple model testing might miss.

Continuous Learning and Adaptation

Markets change, and indicators that worked in one regime may behave differently in another. Maintain a mindset of continuous improvement and routinely review both successes and failures. As algorithmic trading continues to evolve, staying abreast of technological advancements and data analytics will be key to leveraging volume indicators effectively.

Conclusion

Volume remains a foundational pillar in the realm of technical analysis. The best indicators for trading volume, such as OBV, MFI, A/D Line, VPT, CMF, and VWAP, offer traders the ability to gauge market strength and predict price moves with greater accuracy. While each indicator comes with its own limitations, a combined approach, supported by solid backtesting and continual learning, can substantially improve trade management strategies.

Integrating volume indicators with broader strategic frameworks is essential for capturing market shifts. Whether used in manual trading or embedded in complex algorithmic systems, these tools empower traders to make informed decisions, manage risk adeptly, and ultimately, gain a competitive edge in the dynamic trading arena.

This article has provided an in-depth exploration of volume indicators, delving into theoretical concepts, practical applications, and the intricacies of each tool. Armed with these insights, traders can now approach the market with enhanced confidence, fully equipped to interpret volume dynamics and integrate them into comprehensive trading plans. As market conditions evolve and new technologies emerge, the fusion of volume data with advanced analytics will remain a critical domain for those aiming to maintain a competitive advantage.

By continuously refining your understanding and application of these volume indicators, you are better positioned to capitalize on market opportunities and safeguard your trading capital against unforeseen downturns. Ultimately, mastering trading volume analysis is a journey that combines technical expertise, strategic insight, and a deep understanding of market psychology—a journey that pays dividends in effective decision-making and sustained trading success.

Whether you are setting up your first demo account or refining an advanced algorithmic strategy, volume indicators will continue to serve as a vital component of your technical analysis toolkit, guiding you through the complex interplay of market forces and enabling you to harness the true power of trading volume.

Happy trading, and may your analyses be as robust as the volumes that drive the market!

Unlock Trading Potential with Automated Analysis

Tired of missing opportunities and making suboptimal trading decisions? TrendSpider's cutting-edge platform automates complex technical analysis, saving you time and reducing human error.

With multi-timeframe analysis, dynamic alerts, backtesting, and customizable charting, you'll gain a competitive edge in identifying trends and making informed trades across global markets.

Unleash the Power of Automated Trading Analysis

Are you struggling to keep up with the fast-paced trading world? TrendSpider empowers you with cutting-edge tools for optimal strategy execution.

Our automated technical analysis suite eliminates guesswork, backtests strategies, and delivers real-time alerts, saving you valuable time and effort.