Best Cryptocurrency Options Trading Platforms

Unlock the potential of cryptocurrency options trading with our authoritative guide reviewing leadin...

This article breaks down Bitcoin Dominance (BTCD) and why it’s key to understanding the crypto market’s ups and downs.

Bitcoin Dominance (BTCD) is a key metric that shows how much of the entire cryptocurrency market capitalization Bitcoin commands. This BTCD guide explains why it matters and how it is calculated with some number crunching. It also covers its practical uses and how it can quietly steer your trading and investment choices.

Bitcoin launched in 2009 by the enigmatic Satoshi Nakamoto was the first decentralized cryptocurrency and still holds the top spot by market capitalization. Its groundbreaking blockchain technology shook up digital finance and quickly set Bitcoin apart as the gold standard. Keeping a close eye on Bitcoin’s dominance often gives investors a good read on market sentiment, altcoin strength and overall risk appetite.

Bitcoin Dominance often abbreviated as BTCD represents Bitcoin’s market value as a slice of the entire cryptocurrency market cap pie. It gives a solid sense of Bitcoin’s stake and influence in the sprawling world of digital assets. It offers a handy lens to spot market trends and see how capital tends to shift around.

Since Bitcoin first burst onto the scene, its dominance has been on a roller coaster ride influenced by fresh innovations and shifts in regulations. Other cryptocurrencies have risen trying to make their mark. Back in Bitcoin's early days, BTCD reached a lofty 90% but it hasn’t stayed put. It has danced up and down as altcoins have their moments in the spotlight and the market takes its inevitable twists and turns.

| Year | Bitcoin Dominance (%) | Notable Market Events | Impact on Crypto Market Sentiment |

|---|---|---|---|

| 2013 | 94 | Bitcoin was just getting its footing, with only a handful of altcoins popping up | Bitcoin held its ground firmly as the crypto world was still in its infancy, a real pioneer in uncharted territory |

| 2017 | 65 | Bitcoin rode a massive bull run fueled by an ICO frenzy | Altcoins started stealing some of the spotlight, shaking up market interest and expanding the crypto playground |

| 2018 | 60 | A harsh crypto winter set in, accompanied by tighter regulations | Bitcoin often wore the cloak of a safe haven while many altcoins took a serious hit, a tough season indeed |

| 2020 | 70 | DeFi projects skyrocketed just as institutional investors began to warm up to Bitcoin | Confidence in Bitcoin bounced back strong, even as the altcoin scene blossomed in new directions |

| 2021 | 45 | The NFT and DeFi crazes exploded, sparking rallies all across many altcoins | Altcoins grabbed a larger chunk of the pie, nudging Bitcoin’s share downward—change was definitely in the air |

| 2023 | 48 | The market found its footing with steady growth across a range of blockchains | Bitcoin dominance found a new balance, reflecting a maturing and more diversified crypto landscape |

Bitcoin Dominance holds a significant spot for traders, investors and analysts alike. It offers a neat window into market sentiment and helps you size up risk appetite. It often steers expectations around those tricky altcoin cycles.

Calculate BTCD by taking Bitcoin’s market cap and dividing it by the total cryptocurrency market cap then multiplying that figure by 100. It’s a straightforward formula but here’s the catch: using reliable and up-to-date data is key.

BTCD trends often serve as a window into some deeper market movements. When dominance climbs, it’s usually a sign that Bitcoin is flexing its muscles while altcoins are hanging back a bit.

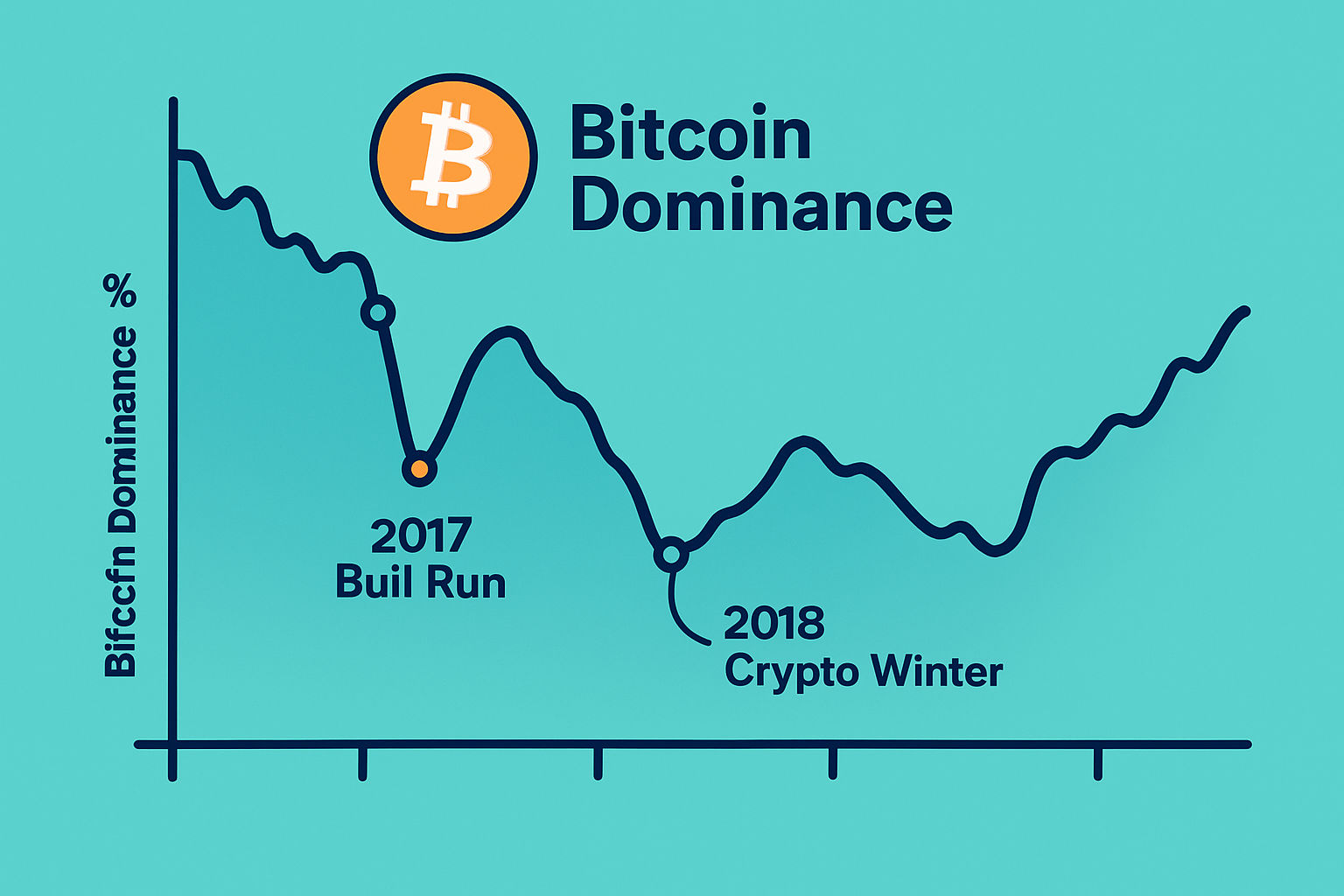

During the 2017 Bitcoin rally, BTCD took a nosedive while altcoins surged dramatically. This was fueled by the ICO frenzy that had everyone buzzing about new projects. Then came the 2018 crypto winter when Bitcoin's dominance tightened its grip as altcoin prices took a sharp tumble. This signaled a return to Bitcoin's reputation as the 'safe harbor' in a stormy sea.

"Bitcoin Dominance usually plays a pretty key role as a market compass, revealing how investor confidence swings and lending a hand when navigating the often tangled web of crypto cycles. Getting a handle on BTCD can offer some surprisingly good clues on when to make a move and how to spread assets just right." — Crypto Market Analyst, Jane Doe

Back in 2017, even though Bitcoin’s price was shooting through the roof its dominance took a noticeable dip from over 80% down to about 65%. Meanwhile, hundreds of altcoins were popping up fueled by a flood of investment through ICOs.

During the 2018 bear market, Bitcoin clawed its way back to dominance while altcoins took a serious nosedive and lost a good chunk of their investor trust.

Graph showing Bitcoin Dominance percentage over time highlighting key events

Investors and traders often lean on BTCD as a handy tool to sharpen portfolio performance and keep risk in check. When paired with technical analysis, BTCD can really help in making those well-timed calls—especially when pinpointing the right moments to jump into or bail out of altcoin seasons.

Keep a close eye on BTCD trends regularly to catch the early signs of altcoin seasons. Those moments can really shine a light on opportunities beyond Bitcoin that you might otherwise miss.

Shift your portfolio weights between Bitcoin and altcoins as BTCD fluctuates and market sentiment changes because a bit of flexibility often pays off.

Pair BTCD with technical indicators from handy platforms like TradingView and TrendSpider to create a more complete and nuanced picture of what’s happening in the market.

When sizing up market cycles, consider BTCD together with broader macroeconomic factors and the ebbs and flows of investor behavior. It’s like reading the room before making your move.

BTCD certainly offers some valuable insights but leaning on it alone can be a gamble due to market manipulation and shady data inconsistencies and the unpredictable antics of altcoins.

There are a few common misconceptions about BTCD, like the notion that it flawlessly predicts Bitcoin’s price or that it ignores the impact of the multi-chain ecosystem. Market manipulation and shaky market cap numbers throw a wrench into how reliably BTCD can be read. It also tends to overlook stablecoins.

The future of BTCD will probably hinge on the ever-evolving worlds of decentralized finance (DeFi) and non-fungible tokens (NFTs) as well as the rapid surge of fresh blockchains. As cryptocurrency continues to grow and intertwine with traditional finance, Bitcoin's dominance looks set to hold its ground.

Experts generally expect Bitcoin to maintain a solid grip on the market, largely due to its head start and its iconic brand name that everyone seems to recognize. While rising competition from altcoins and fresh protocols could nudge the BTCD metric downward over the long haul, Bitcoin's dominance remains strong.

Struggling to improve your trading performance? Edgewonk's advanced analytics tools are designed to give you the edge you need.

With detailed trade journaling, robust strategy analysis, and psychological insights, you'll gain a comprehensive understanding of your strengths and weaknesses. Don't miss out on this game-changing opportunity.

Traders, it's time to elevate your game. Edgewonk is the ultimate trading journal software designed to empower you with data-driven insights and personalized strategies. Take control of your trading journey and maximize your potential.

17 posts written

Driven by her passion for empowering individual traders, Annika Eriksson is a renowned educator, offering practical strategies and actionable insights for successful trading.

Read Articles

Unlock the potential of cryptocurrency options trading with our authoritative guide reviewing leadin...

Discover how central banks' hawkish and dovish stances shape financial markets and affect your inves...

El Salvador's adoption of Bitcoin as legal tender marks a groundbreaking experiment in national curr...

Discover the bullish harami candlestick pattern—a key technical signal that can hint at trend revers...