How to approach Forex trading for beginners?

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

The Myanmar currency known as the kyat has been catching the eye of forex traders and investors as Myanmar carves out a bigger role in Southeast Asia's economy. With the country steadily opening its markets and linking closer to regional trade, the kyat has started to dance to a livelier, sometimes unpredictable tune. Its value sways with a mix of local reforms and the ever-shifting winds of global forces.

Forex trading basically boils down to swapping one currency for another. When you dive into emerging market currencies like Myanmar's kyat, you sign up for a wild ride with unique risks and rewards. These currencies tend to be more volatile than usual and often swing sharply in response to economic and political changes.

Myanmar’s currency history is quite a tale marked by long spells of isolation and tight capital controls that kept it away from the global forex markets. Starting in the early 2010s the country slowly began loosening the reins by unifying different exchange rates and rolling out a managed float system. These shifts didn’t come without headaches. There was plenty of volatility as traders found their footing in this new environment. The kyat has taken some sharp nosedives especially during bouts of political unrest and sanctions creating a trading scene that’s part cautious optimism and part occasional rollercoaster ride.

A handful of key macroeconomic indicators usually call the shots when it comes to the value and ups and downs of the Myanmar kyat. Inflation rates don’t just mess with your purchasing power—they also steer what the central bank decides to do next. GDP growth offers a peek under the hood of the entire economy, often swaying how confident investors feel. Trade balances reveal the appetite for the kyat in the global marketplace, while fiscal policy moves play a big role in shaping liquidity and coloring opinions about sovereign risk.

Myanmar’s political landscape calls the shots on how the kyat moves in the forex market. Shifts in government and military takeovers trigger sudden jolts in the currency’s value—like a rollercoaster you didn’t sign up for. Sanctions from foreign governments act like a roadblock by limiting market access and scaring off foreign investment, which naturally ramps up the volatility.

"> Political uncertainty in Myanmar has carved out a uniquely tricky risk profile for the kyat, where sudden regulatory curveballs tend to trigger rapid capital outflows. This definitely sets it apart from many other emerging markets and puts geopolitical factors front and center when it comes to currency swings. — Dr. Aye Min, Southeast Asia Currency Analyst"

Myanmar's kyat tends to be quite sensitive to global economic shifts and regional developments. Since the economy leans heavily on commodities any change in global prices—especially for natural gas and agricultural goods—hits export income and currency demand directly. The US dollar’s performance is important here because many regional currencies including the kyat often move opposite the dollar. Shifting trade relationships within ASEAN and the ongoing geopolitical tensions in the Asia-Pacific region continue to shape foreign investment and trade flows.

| Currency | Average Annual Change (2018-2023) | Key External Influences |

|---|---|---|

| Myanmar Kyat (MMK) | -4.8% USD depreciation | A rollercoaster ride with commodity price swings, plus the ever-present cloud of political sanctions |

| Indonesian Rupiah (IDR) | -3.2% USD movement | Heavily shaped by trade ties and ups and downs in commodity exports |

| Thai Baht (THB) | -1.1% Export strength | Bouncing back thanks to a tourism rebound, while keeping an eye on the US dollar’s moods |

| Vietnamese Dong (VND) | -2.5% Manufacturing exports | Shifts in regional supply chains throwing their weight around |

| Philippine Peso (PHP) | -2.8% OFW remittances | Steady as she goes with US dollar trends and the occasional political stability hiccup |

Note: Negative values indicate depreciation against the USD.

Technical analysis is steadily carving out a bigger role in trading Myanmar currency pairs as liquidity starts to pick up. Price charts frequently reveal familiar patterns like support and resistance levels that often emerge during political shifts or big economic announcements. Keeping an eye on volume can shed light on how actively traders are jumping in while sentiment indicators give a glimpse into the market’s mood swings—whether optimism is high or fear is creeping in.

Traders keeping an eye on the Myanmar currency really have to roll with the punches and adjust their strategies to handle the uptick in volatility and geopolitical risks. It usually comes down to mixing a solid grasp of economic indicators with a keen watch on political shifts because those headlines can move markets like nothing else. Throw in smart risk management and a bit of portfolio diversification and savvy use of technical tools.

Make it a habit to regularly check key macroeconomic indicators like inflation, GDP and trade data.

Keep a close watch on political events and regulatory updates because these can cause wild price swings during the trading day. It pays to stay alert.

Lean on advanced charting and technical analysis tools such as TradingView or TrendSpider to help you spot trends and find those sweet entry points.

Think about spreading your bets by including correlated ASEAN currencies.

Do not forget to use hedging strategies like options or futures contracts to shield yourself from unexpected and painful adverse moves in the kyat.

Forex trader reviewing Myanmar currency charts and real-time data to make strategic trading decisions.

Myanmar's ongoing economic reforms and its steadily growing ties with the global economy appear to be nudging the Myanmar currency (kyat) toward a slow but steady stabilization. Political uncertainty and simmering regional tensions keep things lively, causing the forex markets to dance with short-term fluctuations now and then.

Struggling to improve your trading performance? Edgewonk's advanced analytics tools are designed to give you the edge you need.

With detailed trade journaling, robust strategy analysis, and psychological insights, you'll gain a comprehensive understanding of your strengths and weaknesses. Don't miss out on this game-changing opportunity.

Traders, it's time to elevate your game. Edgewonk is the ultimate trading journal software designed to empower you with data-driven insights and personalized strategies. Take control of your trading journey and maximize your potential.

17 posts written

Born in Athens, Ariadne Petrou is a leading expert in behavioral finance, exploring the psychological factors that influence trading decisions and market dynamics.

Read Articles

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

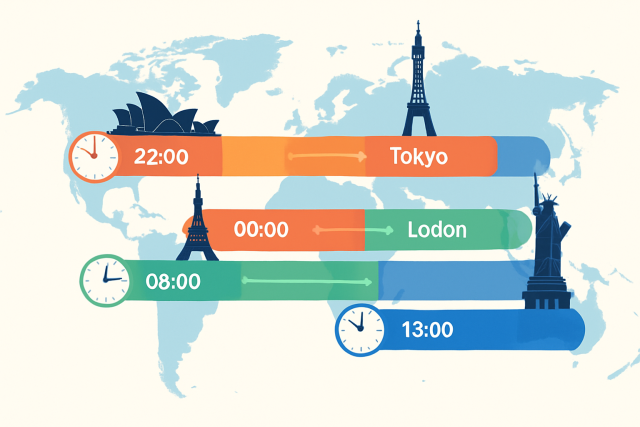

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...

Discover the essentials of forex market times, including when and how the global currency market ope...