Streamline Portfolio Management with Edgewonk Software

Portfolio management with Edgewonk is revolutionizing how investors tackle their portfolios with data-driven insights and tailored strategies. In today’s fast-paced financial landscape, investors must stay ahead of market trends and adjust their approaches in real-time. Edgewonk Software offers a comprehensive suite of analytic tools designed to empower both novice and experienced traders. By integrating quantitative analysis with behavioral analytics, Edgewonk enhances portfolio management while providing a clear window into your trading performance and psychology. In this article, we will explore every nuance of portfolio management with Edgewonk, delving into its features, benefits, and practical applications. We will also examine case studies, actionable strategies, and expert recommendations to help traders streamline their investment decisions.

Introduction: The Evolving Landscape of Portfolio Management

Investment management has evolved dramatically over recent decades, driven both by technological advancements and changing market dynamics. Portfolio management no longer involves simply choosing stocks and bonds based on market sentiment; it requires a sophisticated understanding of risk management, strategy testing, and systematic analysis.

In this digital age, traders and investors demand responsive tools that go beyond conventional charting software. Edgewonk Software is one of those tools that meet this demand by introducing innovative metrics and performance measurement techniques. By combining psychological insights with detailed trading statistics, Edgewonk creates a unique approach to portfolio management that factors in behavioral biases and helps optimize trade decisions. This article explores the intricacies of portfolio management with Edgewonk and outlines how this tool enhances trading outcomes.

For those seeking to refine their trading strategies, better understand trade performance, and elevate their investment results, understanding Edgewonk’s features becomes an essential step in harnessing modern portfolio management techniques.

Understanding Edgewonk Software

Edgewonk Software is not just another trading tool; it is an integrated system that serves as a comprehensive trading journal and analysis engine. Its core features are built around the idea that successful trading demands both quantitative rigor and introspective analysis. In the following sections, we detail the major functions and benefits that make Edgewonk a standout choice for portfolio management.

Core Functionalities of Edgewonk

Edgewonk offers an array of tools geared towards refining the way you manage your portfolio:

Comprehensive Trading Journal: Edgewonk allows you to log every trade detail, including entry and exit points, trade size, and underlying market conditions. This complete archival process makes it easier to review performance over time.

Behavioral Analysis: The software highlights psychological biases and patterns in your trading behavior. By identifying consistent mistakes, investors can modify strategies and minimize emotional decision-making, which is a common pitfall in high-stress market conditions.

Performance Metrics: It provides a deep dive into metrics like win/loss ratios, risk/reward dynamics, and trade expectancy. These numerical insights empower you to determine which strategies work best under specific market conditions.

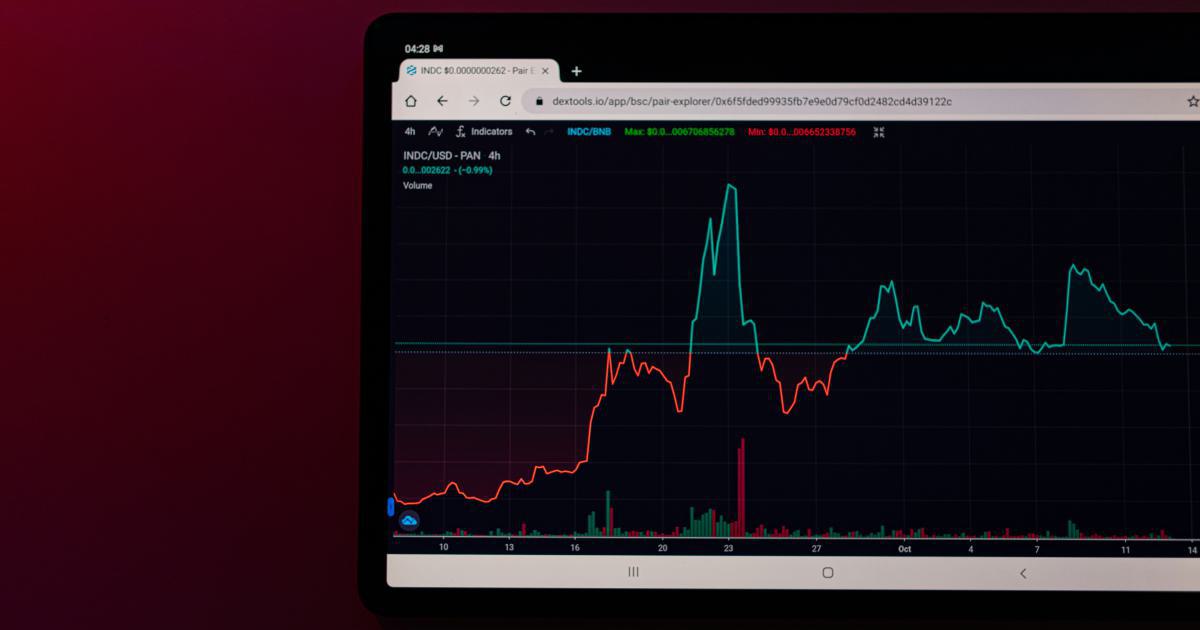

Visual Analytics: With charts and graphs that clearly depict the performance trends, Edgewonk enables traders to visualize data in a way that simplifies decision-making processes. The visual tools help spot long-term trends in performance and risk.

Customizable Analysis: The flexibility of Edgewonk means you can tailor the metrics to your own trading style. Whether you are a day trader focusing on minute-by-minute fluctuations or a long-term investor analyzing macro trends, the software adapts to your needs.

Edgewonk’s multi-faceted approach to analysis is what sets it apart from other portfolio management software. It not only tracks traditional financial metrics but also incorporates an understanding of trading psychology. This hybrid approach is particularly effective in portfolio management with Edgewonk, offering a 360-degree view of your trading landscape.

Historical Perspective and Technological Evolution

Historically, portfolio management has gone through significant shifts with the emergence of computerized systems. Initially, investors relied on rudimentary spreadsheets and manual records. Over time, the introduction of automated trading systems and algorithmic models has transformed the investment landscape.

Edgewonk builds on this evolution by combining historical data with cutting-edge technology, offering individualized insights that traditional systems often miss. The idea is not to replace human judgment, but to enhance it through detailed analytics and trend detection. Many modern investors now integrate software like Edgewonk to gain precise control over their portfolios and to develop strategies that align with both market behavior and personal risk tolerance.

The Role of Data in Modern Portfolio Management

The backbone of any effective trading strategy is data. In portfolio management, structured data analysis can provide critical insights into market dynamics. Edgewonk emphasizes recordkeeping with a depth that allows traders to understand historical performance and project future trends. This forward-looking approach comes from a close analysis of both market data and internal trading performance.

Data-driven portfolio management with Edgewonk involves several key components:

- Quantitative Analysis: Utilizing statistical methods to predict market behavior and simulate trading scenarios.

- Historical Comparisons: Analyzing past performance to inform current strategies.

- Risk Assessment: Using data to predict and mitigate potential losses, thereby enhancing the overall resilience of the portfolio.

Such a data-centric methodology not only streamlines operations but also provides a solid foundation on which traders can build and refine their strategies over time.

Enhancing Portfolio Management with Advanced Features

In portfolio management with Edgewonk, the incorporation of advanced analytics is central to making informed decisions. This section explores some of the advanced features that Edgewonk offers and how these can be leveraged for a more efficient trading experience.

Trade Analytics and Strategy Integration

Edgewonk's analytics tools are purpose-built for deep-dive analysis of individual trades and overall portfolio performance. Here are some ways these features empower investors:

- Detailed Trade Breakdown: Each trade logged in Edgewonk is broken down into multiple components (entry, exit, slippage, etc.), enabling traders to overview every aspect of their performance.

- Strategy Performance Metrics: Beyond individual trades, the software aggregates data to provide insights on long-term strategy efficiency. Investors can compare different strategies, understand their risk profiles, and decide which methods yield the best results.

- Backtesting Capabilities: Some versions of Edgewonk include backtesting functionalities, letting traders simulate historical trades with current strategies to better understand what might work in future conditions.

- Risk Management Tools: Integrated risk assessment features ensure that potential portfolio adjustments are mathematically sound. By analyzing factors such as volatility, exposure, and beta factors, the software helps traders manage their risk proactively.

These features are particularly beneficial for active portfolio management with Edgewonk, enabling both short-term adaptation and long-term success.

Behavioral Insights and Decision-Making

Emotional decision-making is one of the primary factors that lead to suboptimal trading results. Recognizing this, Edgewonk focuses on behavioral insights to support smarter decision-making. Some critical components include:

- Emotional Tracking: Edgewonk helps identify patterns in trading behavior linked with particular market events or stressors. If an investor repeatedly makes poor decisions after a market downturn, the software flags these patterns.

- Performance Reviews: By periodically reviewing trade outcomes, the software provides suggestions for improvement. These reviews help traders identify overconfidence or panic-driven trades.

- Mindset Shifts: Over time, the integration of behavioral analytics encourages a disciplined approach to trading. By observing how emotional responses correlate with trade performance, investors can adjust their decision-making processes to become more data-driven and less reactive.

Behavioral feedback is invaluable, especially when combined with quantifiable data, helping investors refine their methods over the long term and reduce the impact of emotions on portfolio management.

Practical Applications and Real-World Examples

Real-world applications of Edgewonk underline its immense value across various trading strategies. Through detailed case studies and anecdotal evidence from traders around the globe, the practical benefits of portfolio management with Edgewonk become clear.

Case Study: A Day Trader's Journey

Consider the journey of a day trader named Alex. Initially, Alex struggled with tracking performance and was prone to impulsive decisions during volatile market periods. After integrating Edgewonk into his daily routine, several significant improvements emerged:

- Alex began by logging every single trade, no matter how small, into Edgewonk. Over time, this practice unearthed patterns in trade performance that were previously obscured by emotion.

- Using the software's detailed breakdown of his trade statistics, he identified that his losses were particularly high during specific market hours. This prompted a restructuring of his trade timing.

- Moreover, the risk management tools alerted Alex to overexposure in certain volatile stocks. By adjusting his portfolio coverage, Alex successfully reduced his risk and entrenched stronger safeguards for his fund.

This case study is a clear testament to the role of empirical feedback in refining strategies. Now, Alex’s disciplined approach and data-informed decisions have significantly improved his win ratio and his overall portfolio management with Edgewonk is exemplary.

Institutional Applications: Hedge Funds and Professional Traders

Beyond individual traders, professional investors and hedge fund managers have also reaped the benefits of Edgewonk. Institutions have started to incorporate the software into their routine evaluations for several reasons:

- Streamlined Reporting: Edgewonk facilitates comprehensive portfolio reporting, which is essential for compliance and auditing.

- Enhanced Transparency: Detailed trade logs ensure that all investment decisions are transparent and supported by data, thereby building trust within teams.

- Portfolio Optimization: Institutions routinely use backtesting features to calibrate new strategies against historical data, ensuring maximum efficiency in portfolio performance.

- Training and Development: For new team members, Edgewonk serves as an educational tool, demonstrating effective trading practices through historical data review and performance analytics.

These advantages have led several institutional investors to adopt Edgewonk as a core component of their trading strategies. The tool’s interdisciplinary approach combining behavior, analytics, and risk management is key in portfolio management with Edgewonk across various investment paradigms.

Emerging Markets and Adaptive Strategies

Edgewonk’s flexibility has also made it popular in rapidly evolving markets. Traders focusing on emerging economies face unique challenges such as market instability and liquidity issues. Edgewonk’s dynamic tools empower these traders by:

- Offering real-time risk alerts based on market volatility.

- Allowing rapid adjustments to trading strategies grounded in real-time and historical data.

- Helping to navigate uncertain market conditions through adaptive analytics that forecast potential market responses.

This adaptability ensures that investors are not caught off guard by rapid market changes. In emerging markets, where the margin for error is small, portfolio management with Edgewonk provides a sophisticated buffer against unpredictable volatility.

Best Practices for Implementing Edgewonk in Your Portfolio Management Strategy

Integrating Edgewonk Software into your trading regimen is not simply about installation—it requires a strategic approach to realize its full potential. Below are actionable solutions and recommendations for traders looking to optimize their portfolio management with Edgewonk.

Step-by-Step Guide to Getting Started

Initial Setup and Data Import:

Customizing Your Dashboard:

Setting Performance Benchmarks:

Regular Review Sessions:

Integrating Behavioral Metrics:

Expert Tips for Maximizing Efficiency

- Diversify Analysis:

- Leverage Backtesting:

- Focus on Continuous Improvement:

- Engage with the Community:

- Utilize Custom Alerts:

Advanced Customization Tactics

For those who are well-versed in both trading strategies and the technical aspects of portfolio management, Edgewonk offers advanced customization options:

- Scripting and API Integrations:

- Personalized Metrics:

- Continuous Strategy Tweaks:

By following these best practices, you integrate a robust framework into your portfolio management routine, ensuring that every trade is informed by comprehensive analysis.

Challenges and Considerations in Adopting Edgewonk

While Edgewonk brings numerous benefits, adopting any new tool involves a learning curve and certain challenges. It is important to understand and address these challenges to maximize the software's potential.

Common Challenges

Data Overload:

Time Commitment:

Technical Adaptations:

Integration Complexity:

Strategies to Overcome Challenges

- Educational Resources:

- Incremental Adoption:

- Regular Feedback Loops:

- Customization to Simplify:

Employing these strategies helps mitigate the initial frustrations associated with adopting a new tool like Edgewonk, and sets the stage for streamlined and effective portfolio management.

The Future of Portfolio Management with Edgewonk

The financial landscape is in constant flux, and tools like Edgewonk must evolve to meet emerging trends and investor demands. As technology integrates even deeper with financial analysis, we can expect continuous enhancements in the way data is analyzed and strategies are formulated.

Innovations on the Horizon

Artificial Intelligence Integration:

Enhanced Behavioral Analytics:

Comprehensive API Ecosystems:

Mobile Optimization:

Preparing for the Future

Investors who embrace new technologies early often have a competitive advantage. By integrating Edgewonk into your portfolio management strategy and staying updated with new features, you set the stage for long-term success:

- Regularly update your software to take advantage of the latest features.

- Participate in beta programs or user feedback initiatives to shape future updates.

- Continue your education on emerging financial technologies to adapt your strategies as needed.

The future of portfolio management with Edgewonk is bright, and its continuous evolution promises to deliver tools that are not only advanced but also increasingly indispensable for smart traders.

Conclusion

Edgewonk Software transforms the landscape of portfolio management by merging rigorous data analytics with profound behavioral insights. The dynamic approach of Edgewonk equips investors with the analytical tools they need to navigate volatile markets, making portfolio management with Edgewonk a critical asset for those looking to maximize returns while minimizing risks.

Throughout this article, we have explored:

- The core functionalities and benefits of Edgewonk.

- Real-world case studies that highlight tangible improvements in trading performance.

- Best practices and advanced strategies to integrate Edgewonk into your daily trading routine.

- The challenges associated with adopting new technologies and practical steps to overcome them.

- Future trends that promise even more robust capabilities in portfolio management.

From the detailed trade analytics to the insightful behavioral feedback, Edgewonk equips traders with the precision and insight needed to make data-informed decisions. Whether you are an individual trader hungry for improvement or a professional managing multi-million-dollar portfolios, Edgewonk provides actionable insights, systematic assessments, and a clear path towards enhanced performance.

Harnessing Edgewonk’s powerful features, and integrating them carefully into your trading strategy, will undoubtedly pave the way for better decision-making, improved risk management, and ultimately, a more streamlined approach to portfolio management. As financial markets continue to evolve, having a reliable tool like Edgewonk to navigate complexities is not just an advantage—it’s a necessity for sustained success.

Adopt this comprehensive tool, continue fine-tuning your strategies, and let data-driven insights lead you towards consistent profitability. With maturity in the methods fueled by portfolio management with Edgewonk, your trading journey can be transformed from a series of uncertain bets to a well-calibrated strategy based on deep, insightful analysis.

May your trades be informed, your risks minimized, and your portfolios grow steadily as you embrace the cutting-edge approach to managing your investments with Edgewonk.

Unleash the Power of Automated Trading Analysis

Are you struggling to keep up with the fast-paced trading world? TrendSpider empowers you with cutting-edge tools for optimal strategy execution.

Our automated technical analysis suite eliminates guesswork, backtests strategies, and delivers real-time alerts, saving you valuable time and effort.

Sophia Dekkers

52 posts written