What Affects the Saudi Arabian Riyal Currency Movements

Understand what drives the Saudi Arabian Riyal's fluctuations, from oil prices and monetary policy t...

Interest rates have their fingers in many pies, influencing everything from loans and mortgages to investments and the broader economy. Yet, the idea of a "terminal rate" can sometimes feel a bit like chasing shadows—elusive and tricky to pin down.

Let's take a moment to untangle the basics of the terminal rate—a key concept that often sneaks into economic conversations. While it might sound a bit dry at first, getting a handle on this can really shine a light on where interest rates are headed when all the dust settles.

The terminal rate is basically the estimated steady level of the policy interest rate that central banks hope to lock in at the tail end of a tightening or easing cycle.

Central banks often zero in on the terminal rate as a important benchmark when crafting their policies. By shooting for this elusive number, they try to strike a delicate balance that keeps the economy humming along smoothly while keeping inflation in check.

Estimating the terminal rate is a bit of a guessing game since you cannot see it firsthand. Economists and analysts usually roll up their sleeves and blend economic models, market signals and changing trends in inflation and growth to piece together an educated guess.

| Economy | Current Policy Rate | Market-Implied Terminal Rate | Central Bank Projection |

|---|---|---|---|

| United States | 5.25% | 5.50% | Sitting somewhere between 5.00% and 5.25%, give or take |

| Eurozone | 4.00% | 3.75% | Likely to hover around 3.75% to 4.00%, according to forecasts |

| United Kingdom | 5.50% | 5.75% | Expected to land between 5.50% and 5.75%, more or less |

The terminal rate acts as a key milestone signaling roughly how much more central banks might tinker with interest rates. When policy rates inch closer to this magic number, markets and borrowers often start bracing for a breather or perhaps even a pivot in the rate cycle.

"> The terminal rate often serves as a handy compass for investors and policymakers alike, gently steering their expectations about when interest rate tweaks might finally pause or take a new turn — offering a reliable anchor for those tough decisions aimed at keeping the economy on steady ground. — Economist Jane Morris"

There are a few common misunderstandings about the terminal rate that tend to trip people up. It’s worth remembering the terminal rate isn’t set in stone forever. It doesn’t mean interest rates will suddenly freeze once that number is hit. Plus, it varies depending on the country and the current economic cycle. This adds a bit of flavor to the mix.

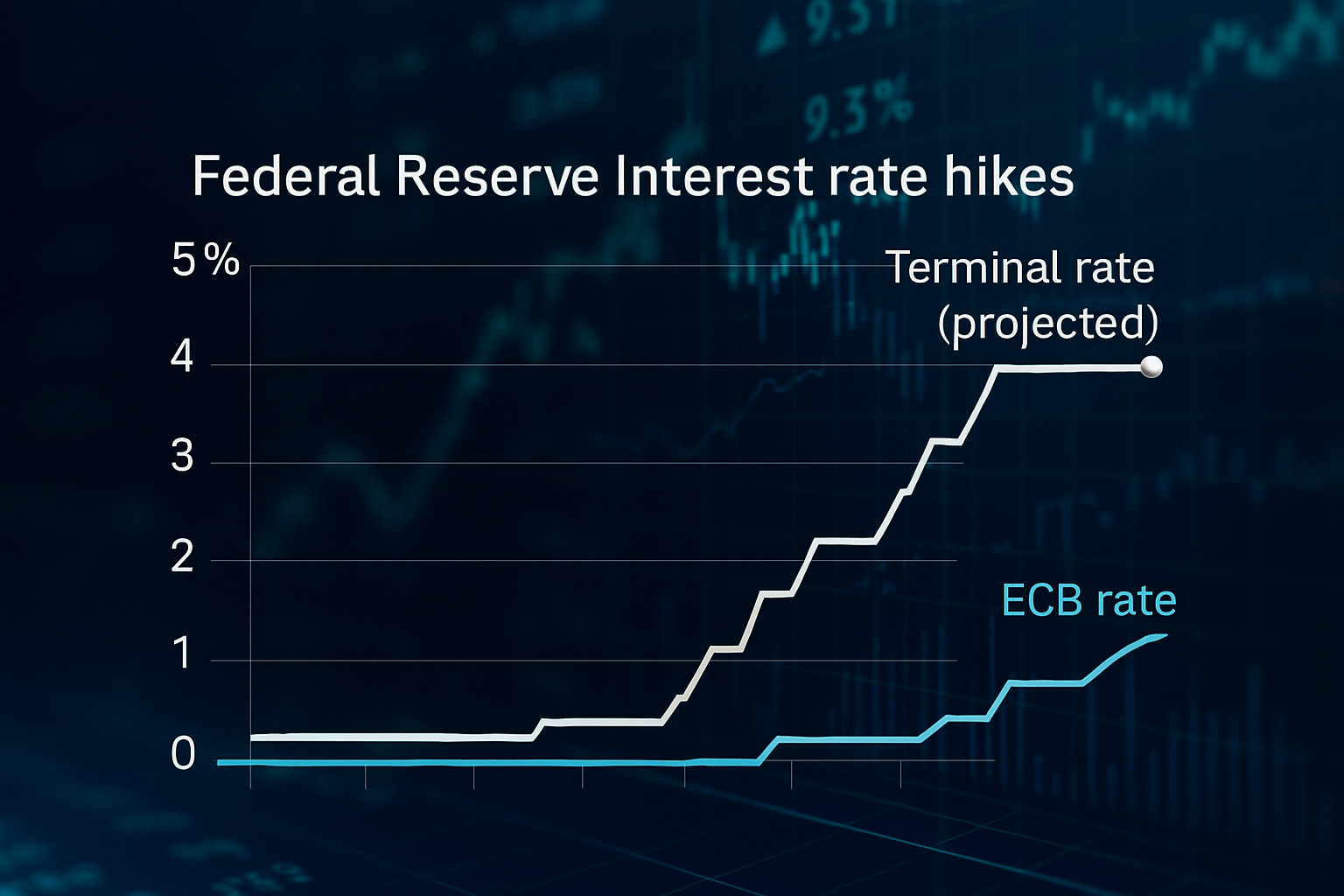

Recent monetary policy cycles show how much estimates of the terminal rate tend to steer decision-making. The Federal Reserve's rate hikes in 2018 and from 2021 through 2023 followed expectations about where the terminal rate would settle. Similarly, the European Central Bank's steady march toward rate normalization focused on its own terminal rate forecasts.

Graph illustrating recent Federal Reserve and European Central Bank interest rate hikes with terminal rate projections.

Understanding the terminal rate can seriously shake up how we make personal finance decisions. It’s a behind-the-scenes guide that helps borrowers figure out the best time to take out loans or refinance. For investors, it’s a handy tool to tweak their portfolios just right. And savers? Well, it sets the stage for realistic expectations when it comes to returns as rates shift.

The terminal rate isn’t fixed. It tends to change as inflation trends and economic growth expectations develop along with global events.

Struggling to improve your trading performance? Edgewonk's advanced analytics tools are designed to give you the edge you need.

With detailed trade journaling, robust strategy analysis, and psychological insights, you'll gain a comprehensive understanding of your strengths and weaknesses. Don't miss out on this game-changing opportunity.

Traders, it's time to elevate your game. Edgewonk is the ultimate trading journal software designed to empower you with data-driven insights and personalized strategies. Take control of your trading journey and maximize your potential.

23 posts written

Driven by a passion for uncovering the hidden patterns that underlie market dynamics, Isla Wyndham brings a unique perspective to the realm of trading, blending quantitative analysis with a keen intuition for human behavior.

Read Articles

Understand what drives the Saudi Arabian Riyal's fluctuations, from oil prices and monetary policy t...

Understanding dovish vs hawkish policy shifts is essential for market participants as these changes...

Discover the main factors that influence the Honduras country currency, the lempira, and understand...

Learn how hawkish and dovish Federal Reserve communications impact forex markets. This guide breaks...