What are the Currency Market Opening Hours?

Discover the ins and outs of currency market opening hours, their global structure, and how masterin...

This guide breaks down forex market hours, the rhythm of sessions and smart tactics to keep you trading like a pro all day and night.

Knowing exactly when the forex trading hours occur is important for traders who want to sharpen their strategies and keep risks in check to squeeze out better profit opportunities. Unlike stock markets that stick to fixed hours, forex operates 24 hours straight and follows the rhythms of key financial hubs around the globe. This guide dives into the nitty-gritty of these trading hours and why they matter. It also covers how different global sessions overlap and how savvy traders can leverage this knowledge to nail their timing and manage liquidity more smoothly.

The forex market runs like a vast decentralized global web where currencies are swapped round the clock across various financial hubs scattered around the world. Unlike stock exchanges that have a clear home base, forex trading happens over-the-counter with no brick-and-mortar spot to point to.

The forex market typically breaks down into four main trading sessions, each aligning with the time zones of key financial hubs: Sydney, Tokyo, London and New York. Every session has its own opening and closing bells that set the tone for liquidity and price swings. The Sydney session kicks off the trading week in UTC time with Tokyo following right after. Then comes London which overlaps with Tokyo during the morning hours and gradually winds down as New York gets its gears turning—making for lively trading windows.

| Session Name | Location | Opening Time (UTC) | Closing Time (UTC) | Overlap Periods |

|---|---|---|---|---|

| Sydney | Australia | 22:00 | 07:00 | Sydney and Tokyo (00:00 to 07:00) — a quiet start before the day's hustle kicks in |

| Tokyo | Japan | 00:00 | 09:00 | Tokyo and London (08:00 to 09:00) — just enough time for a quick handshake across time zones |

| London | UK | 08:00 | 17:00 | London and New York (13:00 to 17:00) — prime time overlap, when both sides are wide awake and bustling |

| New York | USA | 13:00 | 22:00 | New York and Sydney (22:00 to 00:00) — catching the tail end of the day, bridging continents before the clock strikes midnight |

Session overlaps when two major markets open simultaneously play a vital role for forex traders. They usually bring higher trading volumes and tighter spreads—kind of like the market’s way of throwing a little party. These periods often result in increased volatility and better liquidity which makes it easier to execute trades with less slippage and more dependable price movements.

Traders all around the world juggle different local time zones, so it’s pretty vital to translate those standard forex session times into their own clock to trade smarter. Take a trader in New York (EST) for example—they’ll quickly spot that the London session overlaps nicely with their morning grind. Meanwhile, those trading from India (IST) have to keep that quirky +5:30 offset from GMT in mind when mapping out their moves.

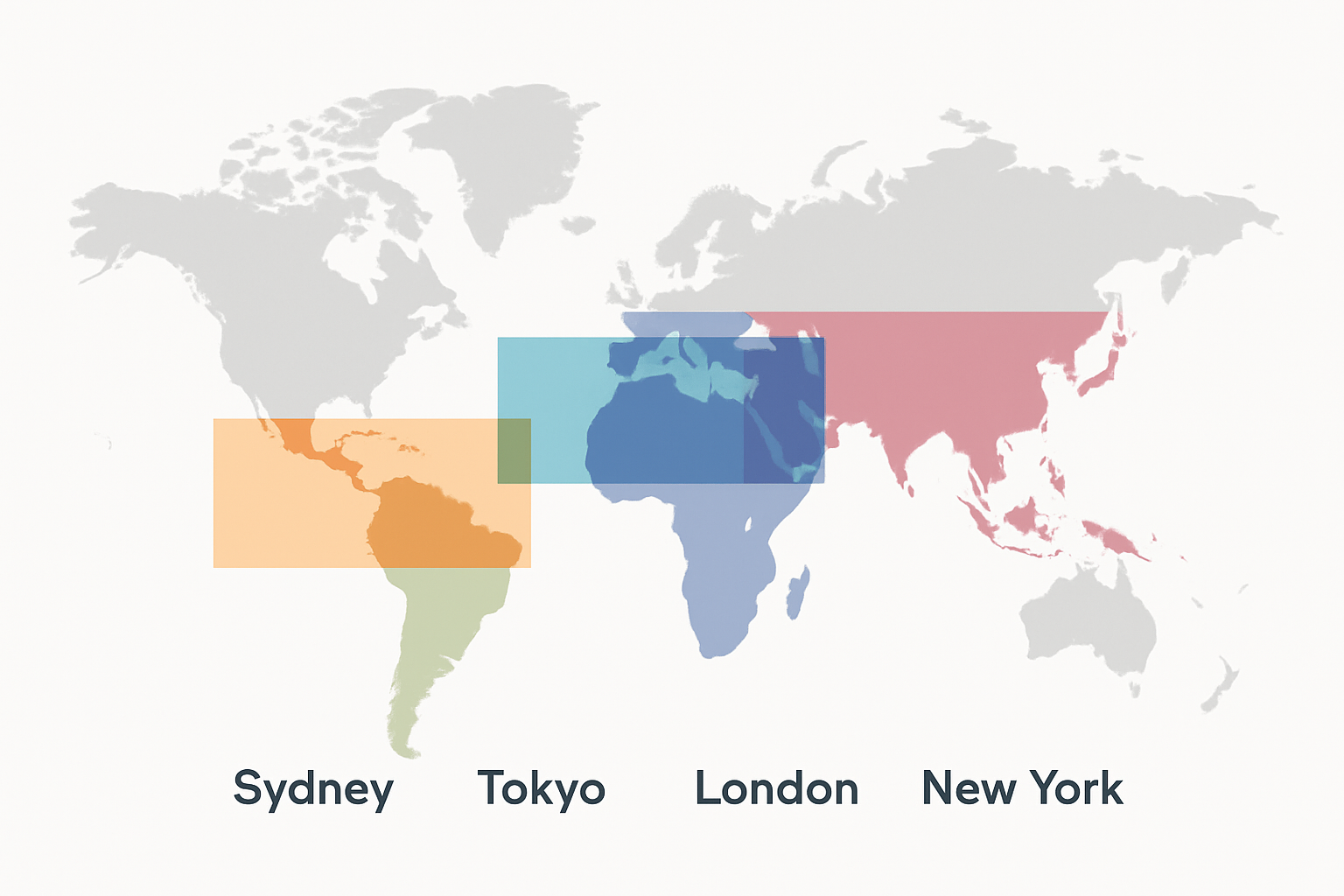

Visual world map showing forex trading sessions and overlaps by time zones around the globe

Market behavior tends to shift quite a bit depending on the trading session since liquidity and volatility ebb and flow throughout the day. When sessions overlap like London and New York, liquidity usually spikes. Markets often make more decisive moves while spreads tighten up nicely. These moments can offer good opportunities for those with a solid game plan. On the flip side, during quieter stretches—say when the Sydney session is ending and Tokyo is just starting—price moves are generally more modest.

Successful forex trading often hinges on syncing your strategies with the market's natural rhythm like catching the tide just right. Scalpers, for instance, thrive on lightning-fast price jumps that pop up when volatility runs high, especially during hectic moments when trading sessions overlap. Meanwhile, range traders usually find their sweet spot in quieter stretches and patiently navigate price movements that stick to a steady band.

Keep an eye out for moments when sessions overlap like between London and New York because that’s when volatility tends to increase.

Watch liquidity levels closely to find the best trading windows as this helps you avoid nasty slippage.

Adjust your position sizes based on how much the market usually moves during each session. It’s like sizing your sails to match the wind.

Focus on currency pairs that are active in the current session. For example, JPY pairs usually come alive during Tokyo hours.

Time your news trades around major session openings. That’s when economic reports are released and markets can really take off so you want to be ready to ride those sharp moves.

Forex markets usually take a break over the weekend. You might notice trading hours shrink or liquidity dry up around certain public holidays across the globe during the week. Big holidays like Christmas and New Year's Day in major financial centers tend to cause liquidity to drop and spreads to widen.

Since global trading hours stretch across a patchwork of time zones it can feel like juggling flaming torches to keep track of session timings and market holidays. There are many handy online tools and apps designed to make this dance easier. For instance, platforms like TradingView add session overlays directly onto your charts. This makes it easy to see what is what at a glance.

Adding session tracking tools and alerts for forex trading hours to your daily routine can streamline decision-making and reduce the chances of slipping up on important moves. When you set up notifications for key session openings and closings, it acts like a helpful nudge that keeps you sharp during hectic and volatile periods. It also gently reminds you to stick to your plan about when to jump in or bow out of trades.

Let's dive into some of the common queries that pop up when people start dealing with forex trading hours. Whether you are a newbie trying to make sense of the trading clock or just brushing up your knowledge, these FAQs will hopefully clear the fog a bit.

Are you tired of juggling multiple tools for your trading needs? TradingView is the all-in-one platform that streamlines your analysis and decision-making.

With its powerful charting capabilities, real-time data, and vibrant community, TradingView empowers traders like you to stay ahead of the market. Join thousands who trust TradingView for their trading success.

Are you ready to elevate your trading game? Binance, the leading cryptocurrency exchange, offers a seamless platform for traders of all levels. With its user-friendly interface and powerful tools, you can navigate the dynamic world of digital assets with confidence.

10 posts written

Combining cutting-edge mathematical models with a deep understanding of market dynamics, Shion Tanaka has revolutionized algorithmic trading strategies, yielding unprecedented returns for global financial institutions.

Read Articles

Discover the ins and outs of currency market opening hours, their global structure, and how masterin...

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

Discover everything about forex market hours in this definitive guide. Understand session timings, o...

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...