The Jordanian Dinar's Role in the Middle East

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...

The currency market, often called forex, hums along 24 hours a day as it spans financial hubs around the world, making currency market opening hours crucial to track. For anyone in the forex game—traders, investors or financial pros—keeping an eye on when these markets kick off and wrap up is key. These trading hours play a big role in driving liquidity and volatility and set the stage for those sweet spots when opportunities tend to pop up.

The forex market runs as a decentralized global playground where currencies exchange hands nonstop on weekdays. Thanks to key trading hubs scattered across continents, the market hums around the clock for five days straight.

Knowing the exact opening and closing times of currency markets across different regions really gives forex traders a leg up when planning their trades. Each session tends to follow local business hours, typically kicking off bright and early and winding down by late afternoon. Sticking to GMT/UTC times offers a handy common reference point, smoothing out the chaos of coordinating trades around the world.

| Market/Session Name | Local Opening Hour | Local Closing Hour | Timezone | Equivalent GMT/UTC Times |

|---|---|---|---|---|

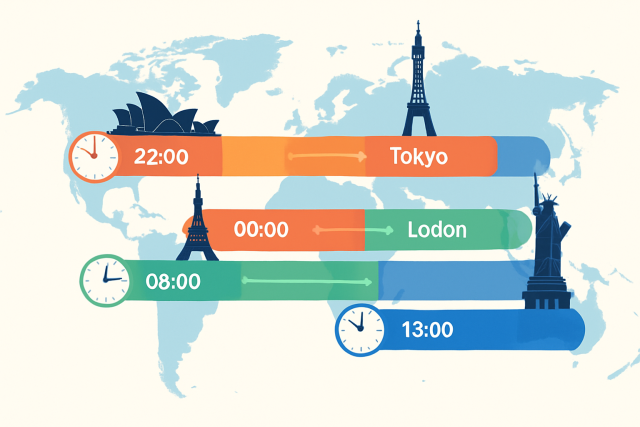

| Sydney | 8:00 AM | 4:00 PM | Australian Eastern Standard Time (AEST) / Australian Eastern Daylight Time (AEDT) | 10:00 PM – 6:00 AM (UTC +10; +11 during daylight saving) |

| Tokyo | 9:00 AM | 5:00 PM | Japan Standard Time (JST) | 12:00 AM – 8:00 AM (UTC +9) |

| London | 8:00 AM | 4:00 PM | Greenwich Mean Time (GMT) / British Summer Time (BST) | 8:00 AM – 4:00 PM (UTC; +1 during daylight saving) |

| New York | 8:00 AM | 5:00 PM | Eastern Standard Time (EST) / Eastern Daylight Time (EDT) | 1:00 PM – 10:00 PM (UTC -5; -4 during daylight saving) |

If you’ve ever tried catching the Sydney Forex market, you know timing is everything. This session typically kicks off at 10 PM GMT and wraps up at 7 AM GMT. It might sound like odd hours, but hey, that’s the trick to getting in early on Asia-Pacific action. Whether you’re a night owl or just someone who likes to get a jump on the day, these hours can be a golden window for trading currency pairs influenced by the Aussie and Kiwi dollars. Just a heads up though—market activity can sometimes feel like a rollercoaster in those hours, so buckle up and stay alert.

The Sydney session kicks off the forex trading day and typically runs from 8:00 AM to 4:00 PM local time (AEST/AEDT). This time frame mainly involves currencies tied to the Asia-Pacific region like the AUD and NZD. While volatility here usually takes a breather compared to other sessions, price movements still get nudges from regional economic data, commodity prices and occasional geopolitical shake-ups.

The Tokyo forex session runs from 9:00 AM to 5:00 PM JST and mainly involves currencies like the JPY, AUD and NZD. Volatility during this window tends to be moderate—not too wild but enough to keep you on your toes. The session often starts off slow, like someone easing into their morning coffee. It usually picks up steam as the day rolls on. Keep an eye on key Asian economic reports and geopolitical happenings.

The London session kicks off at 8:00 AM and wraps up at 4:00 PM GMT/BST, making it hands down the busiest and most liquid forex market on the planet.

The New York session runs from 8:00 AM to 5:00 PM Eastern Time, fitting neatly into the bustling workday hours. Traders find this period key because it overlaps with the London session for a few hours, sparking some of the most exciting and liquidity-packed moments in the market. Whether you are a night owl or early bird, knowing these hours helps you catch key market moves without chasing your tail.

The New York trading session unfolds from 8:00 AM to 5:00 PM EST/EDT and steals the spotlight because it overlaps with the London session. This overlap usually sparks some of the highest daily liquidity and volatility you will see all day. Key events like US economic reports and Federal Reserve announcements along with interesting geopolitical developments tend to set the stage for noticeable price swings during this window.

Trading sessions really shape the market's mood—think liquidity, volatility and trading volume— all the big players that set the stage. Seasoned forex traders know to tweak their game plans depending on the time of day. They jump on the hustle and bustle of busy periods for slicker trades while cautiously navigating quieter spells.

Traders around the globe really have to keep an eye on those pesky time zone differences and daylight saving time changes, both of which can sneakily shift when currency markets kick off and wrap up. These shifts have a nasty habit of causing mix-ups about when sessions actually start and finish.

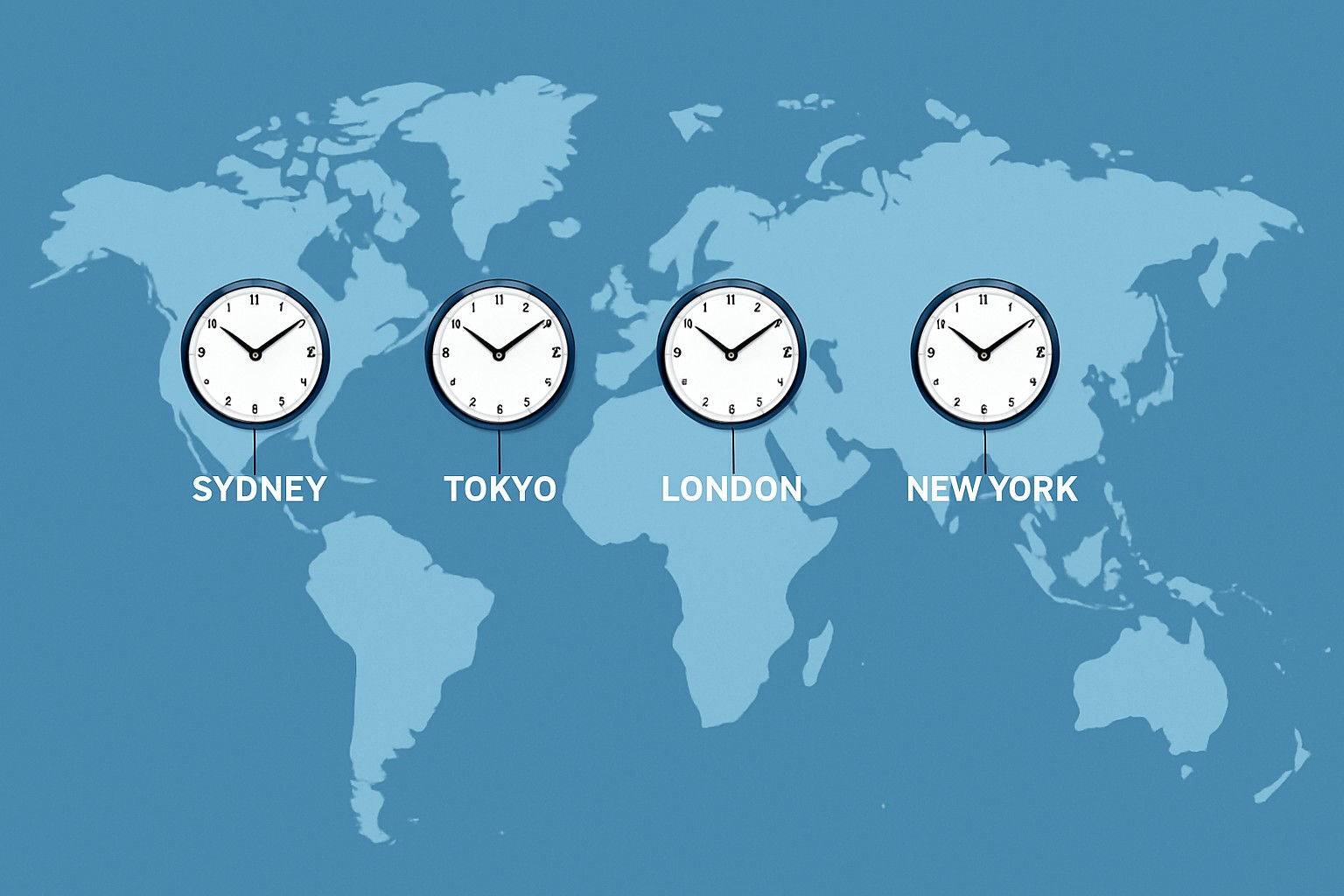

Visual representation of global currency market opening hours across different time zones.

To boost your forex trading results, it really pays off to align your strategies with the market's opening and closing times so you can make the most of liquidity and volatility. Dodging trading during those sleepy low liquidity periods or right at session closes can seriously reduce your risk—it’s a smart move. On the flip side, keeping an eye on session overlaps often reveals more trading chances than you might expect.

Keep a close eye on key economic news and announcements that come out just before or right as the session starts. This helps you understand how they might affect the market.

Focus on trading during high-volume periods especially when sessions overlap because spreads usually tighten and your trades go through more smoothly.

Avoid opening new trades near session closing times since liquidity often dries up and this increases the chances of slippage.

Prepare well in advance for economic releases during busy sessions by using tools that send real-time alerts. Trust me this makes a big difference.

Take advantage of session overlaps like the London-New York window since volatility tends to rise and profit opportunities become more available.

"Getting a handle on when the forex market opens is more important than it might seem at first glance. It usually means better liquidity, which can help lower your risk and, frankly, gives traders a real shot at seizing the best opportunities when they pop up." – Forex Market Analyst

There are plenty of myths floating around about forex market hours, like the notion that the market takes a nap at night or that every currency pair dances to the same beat during each session.

Trusted websites, apps and trading platforms usually offer real-time updates on currency market opening hours and session activity. This makes life a bit easier for traders.

10 posts written

Combining cutting-edge mathematical models with a deep understanding of market dynamics, Shion Tanaka has revolutionized algorithmic trading strategies, yielding unprecedented returns for global financial institutions.

Read Articles

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...

Discover the essentials of forex market times, including when and how the global currency market ope...

Understanding pip values is vital for forex traders. Discover how a free forex pip calculator can si...

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...