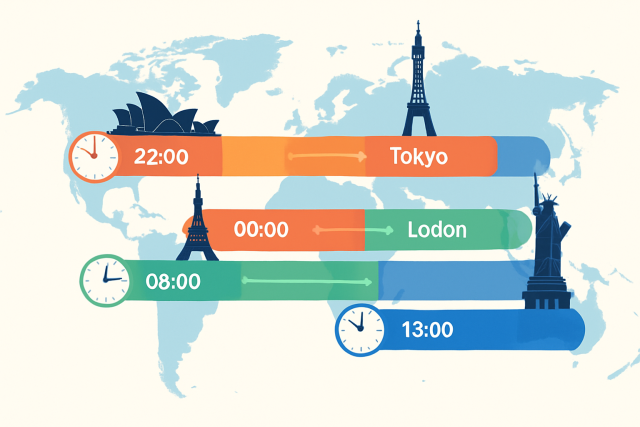

What is Foreign Exchange Trading Hours?

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

Currencies are far more than just tools for everyday transactions. They carry the weight of national identity and pride and play a vital role in economic stability and growth. In the Middle East, a region where geopolitics and economic ties are closely connected, the Jordanian dinar holds its own as a strong currency with special significance.

The Jordanian dinar (JOD) has been Jordan’s official currency since it was introduced in 1950 to replace the Palestinian pound. It is at the heart of Jordan’s financial system and keeps the wheels turning in trade, savings and government dealings.

The Jordanian dinar holds a key place in Jordan's economy. It keeps daily transactions running smoothly, supports families through steady incomes and enables the government to manage public debt carefully.

The Central Bank of Jordan keeps a keen eye on the dinar by holding hefty foreign currency reserves and pegging the currency to the US dollar within a snug range. Every now and then they jump into the market to smooth out those pesky swings. This helps keep prices steady and bolsters confidence in the economy.

"Keeping the currency stable is absolutely key for Jordan's economic mojo and its trade ties worldwide. The Central Bank’s careful handling of the dinar really helps it remain a trusted form of payment, both at home and throughout the region — a steady hand in sometimes choppy financial seas."

In the tangled web of Middle Eastern currencies the Jordanian dinar holds its own alongside dollar-pegged heavyweights like the Saudi Riyal and Emirati Dirham. The US dollar acts like the puppet master behind the scenes and pulls the strings for trade and investment decisions while keeping currency values steady.

| Currency | Country | Exchange Rate to USD (approx.) | Peg Status | Volatility Level |

|---|---|---|---|---|

| Jordanian Dinar (JOD) | Jordan | 0.71 | Pegged to USD | Low |

| Saudi Riyal (SAR) | Saudi Arabia | 3.75 | Pegged to USD | Very Low |

| Emirati Dirham (AED) | UAE | 3.67 | Pegged to USD | Very Low |

| Egyptian Pound (EGP) | Egypt | 30.90 | Managed Float | Moderate |

Here is a quick snapshot of some Middle Eastern currencies and how they stack up against the US dollar. Notice how the pegged currencies like the Jordanian Dinar and Saudi Riyal tend to keep things pretty steady—volatility is low to very low, which in my experience, makes business a lot less of a nail-biter. The Egyptian Pound, on the other hand, takes a bit more of a dance with the dollar, thanks to its managed float status, leading to moderate ups and downs. Nothing too wild, but enough to keep traders on their toes.

Many Middle Eastern currencies like the Jordanian dinar are pegged to the US dollar to keep exchange rates stable in a region known for sudden and unpredictable shifts. This connection is more than just a financial detail because it helps reduce the risk of trade disruptions and capital flight.

Map highlighting Jordan and key Middle Eastern trading partners with currency symbols overlayed.

Although the Jordanian dinar remains a rock-solid and vital player in the region, it is surprising how many myths still swirl around it.

Knowing that the Jordanian dinar is pretty stable and pegged to the US dollar really gives forex traders and businesses a leg up when it comes to planning their trades.

Keep a keen eye on the dinar’s exchange rate against the US dollar. Small fluctuations often come from Central Bank moves so spotting them early can make a big difference.

Businesses dealing with contracts in JOD should remember the fixed peg when setting prices and planning hedges because it prevents currency risk from sneaking up on you.

Traders often rely on platforms like Binance since they offer solid liquidity and competitive fees, making it easier to trade and hedge JOD positions without hassle.

Stay informed about regional geopolitical developments. They may seem distant but can quietly affect the dinar by influencing its USD peg so it is wise to keep an eye on them.

When exchanging dinars, use reputable institutions and trusted platforms to avoid counterfeit problems and secure fair rates. Tools like TradingView are useful for supporting your market moves with solid analysis.

The future of the Jordanian dinar seems to hang on global economic twists, regional political shifts and the ever-evolving landscape of domestic policies. While it has certainly held its ground over time, it is no stranger to the ups and downs brought on by changing market trends and rapid advances in forex technology that often shape how it plays in Middle East trade and finance.

Are you tired of juggling multiple tools for your trading needs? TradingView is the all-in-one platform that streamlines your analysis and decision-making.

With its powerful charting capabilities, real-time data, and vibrant community, TradingView empowers traders like you to stay ahead of the market. Join thousands who trust TradingView for their trading success.

Are you ready to elevate your trading game? Binance, the leading cryptocurrency exchange, offers a seamless platform for traders of all levels. With its user-friendly interface and powerful tools, you can navigate the dynamic world of digital assets with confidence.

16 posts written

With over two decades of experience navigating volatile markets, Ludovik Beauchamp provides invaluable guidance on risk management, portfolio optimization, and adaptability in the face of uncertainty.

Read Articles

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

El Salvador blends traditional dollars with Bitcoin in a pioneering monetary system, reshaping how m...

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

Discover the essentials of forex market times, including when and how the global currency market ope...