Profiting from Head and Shoulders Patterns in Any Market

Unlock the power of the head and shoulders pattern with this complete guide. Learn to spot, trade, a...

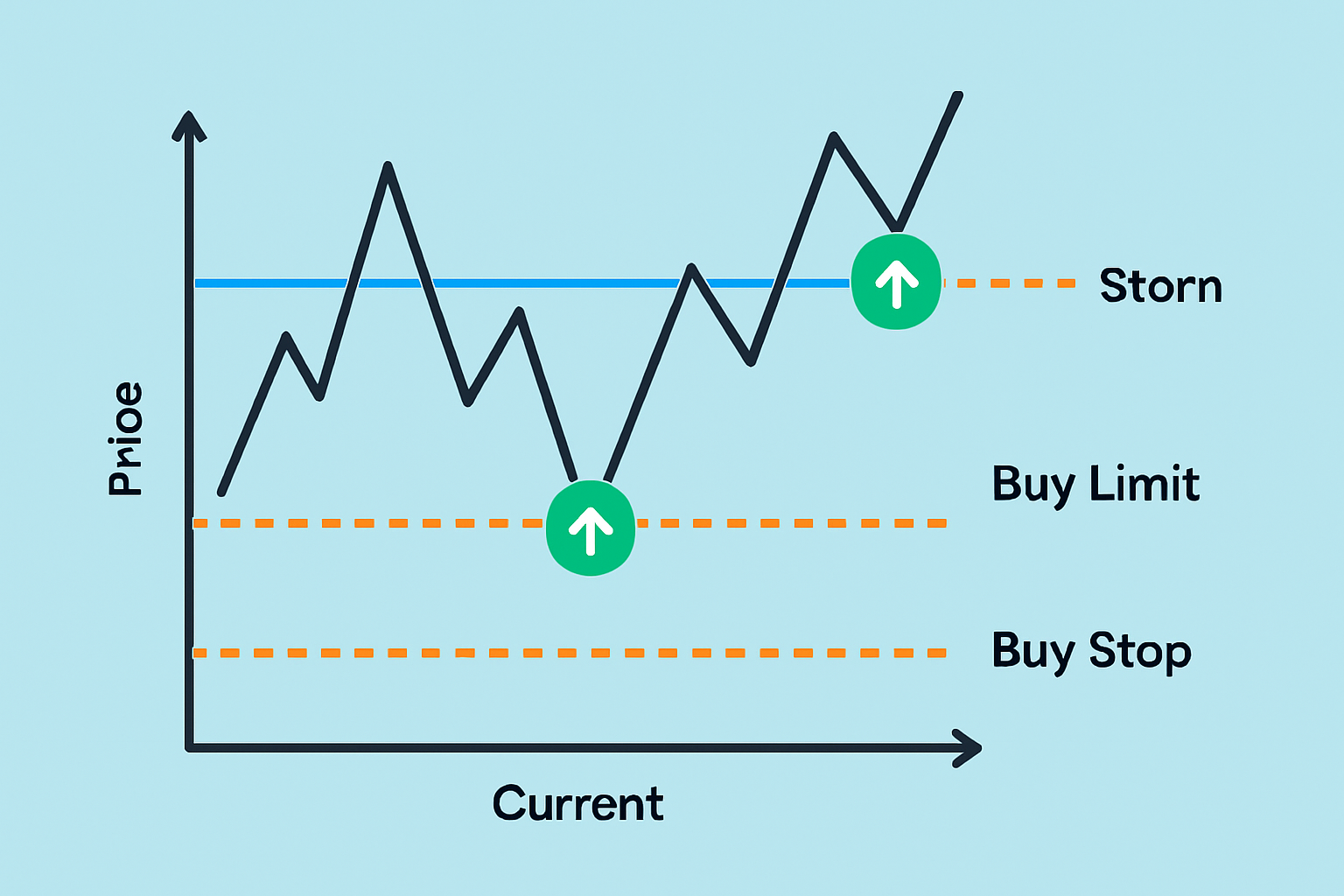

Grasping the basics of buy limit and buy stop orders is absolutely essential for traders aiming to sharpen their entry points and manage risk like a pro.

Buy limit and buy stop orders are two types of pending orders that traders commonly use to jump into positions once specific market conditions fall into place. Both essentially kick off a buy, but the key difference lies in the price points that set them off and the distinct market scenarios where each one really shines.

Buy limit and buy stop orders operate by setting precise price points that automatically spring trading actions into motion. Once the market hits these levels, the orders kick in—either opening new positions or simply getting activated.

Visual diagram comparing order triggers for buy limit vs buy stop on a price chart

| Feature | Buy Limit Order | Buy Stop Order |

|---|---|---|

| Definition | An order to buy at or below a set price, usually lower than the current price, aiming to snag a better deal | An order to buy at or above a set price, typically higher than the current price, hoping to catch a wave of upward momentum |

| Order Trigger Price | Always below the current market price, waiting patiently for a dip | Set above the current market price, ready to jump in when things start to look promising |

| Typical Use Cases | Great for buying on dips or during those pesky retracements when prices take a little breather | Perfect for entering breakouts or confirming that bullish momentum is actually sticking around |

| Risk Level | Generally carries lower risk of overpaying, but timing those retracements can be a bit of a tricky dance | Comes with more risk due to slippage or false breakouts, so buckle up |

| Execution Conditions | Kicks in when the price drops down to your limit price | Takes action when the price climbs to or above your chosen stop price |

| Trader Intent | Looks to buy at a price better than what is currently on the table | Plans to dive in once the bulls have clearly taken the reins |

Choosing between buy limit and buy stop orders usually boils down to a trader’s strategy and market outlook. Buy limits often shine when buying on dips and catching bargain moments. Buy stops come into play to ride the wave of breakouts or sudden price jumps.

The risk profiles of buy limit and buy stop orders tend to shift depending on the market’s mood and how these orders function in real time. Buy limit orders are like your savvy friend who will not let you pay too much—they aim for better prices. On the flip side, buy stops carry their own baggage including slippage and false breakouts that can catch you off guard.

Buy stop orders often run into delays and slippage, especially when the market is racing ahead since they kick in only after the price climbs to a higher level—typically riding the wave of strong upward momentum. On the flip side, buy limit orders tend to have steadier execution timing because they patiently wait for the price to dip back.

Buy stop orders can be a great tool for riding the momentum wave, though they definitely demand a careful touch to keep slippage from creeping up, especially when markets get a bit wild. Buy limit orders, on the other hand, give you pinpoint accuracy but watch out — if you set them too ambitiously, you might just find yourself watching the move from the sidelines. – Maria Chen, Professional Trader

To get the most out of buy limit and buy stop orders traders usually combine these tools with good old-fashioned technical analysis and well-placed stop-losses. They try to time their orders just right to match the current market rhythm.

Nail down your trading goal with crystal clarity and then choose buy limit or buy stop orders that genuinely match your market outlook and overall strategy. There is no point in forcing a square peg into a round hole.

Pay close attention to technical indicators like moving averages or support and resistance zones because they are your best friends when scouting for the perfect trigger prices.

Use stop-loss orders as a safety net to help keep potential losses in check, especially when you dive in with buy stop orders during wild volatile market swings.

Keep your finger on the pulse of market volatility and be ready to adjust your order placements accordingly. When the market is choppier, giving your margins a bit of breathing room usually saves you from having orders activated too soon.

Major trading platforms like MetaTrader, Thinkorswim and Interactive Brokers generally have your back with both buy limit and buy stop orders. You’ll notice their order placement interfaces and execution rules each have their own quirks. Platforms such as TradingView and TrendSpider step up the game by offering advanced charting tools and automated alerts.

| Platform | Order Placement Interface | Execution Policies | Additional Features |

|---|---|---|---|

| MetaTrader | Classic order window where you can set limit and stop orders without any fuss | Supports pending orders; execution speed depends quite a bit on your broker’s response time | Lets you run expert advisors to automate trading, which I have found can save a ton of time |

| Thinkorswim | Friendly, intuitive interface with handy drag-and-drop order entry that just feels natural | Executes orders in real time and gives you a heads-up about slippage, so you’re never caught off guard | Comes packed with advanced order management tools and direct access to the market for pros and beginners alike |

| Interactive Brokers | A no-nonsense interface that lets you craft flexible orders to suit your style | Uses FIFO matching and packs in some pretty smart risk controls, making it a solid choice for careful traders | Offers a broad array of order types plus conditional orders, so you can get as creative as you like |

| TradingView | Allows you to send orders right from the charts using easy visual triggers, making trading almost effortless | Execution relies on the brokers you link up with and benefits from integrated alert systems | Famous for its powerhouse charting, social trading options, and a treasure trove of technical indicators |

| TrendSpider | Automatically suggests orders by crunching data with AI analysis, cutting down the guesswork | Executes orders in lockstep with your linked broker accounts, keeping things smooth and synced | Boasts AI-driven pattern detection and alerts that cover multiple timeframes, which can really up your game |

Are you tired of juggling multiple tools for your trading needs? TradingView is the all-in-one platform that streamlines your analysis and decision-making.

With its powerful charting capabilities, real-time data, and vibrant community, TradingView empowers traders like you to stay ahead of the market. Join thousands who trust TradingView for their trading success.

As a trader seeking opportunities in the dynamic crypto market, you need a reliable and secure platform to execute your strategies. Coinbase, the leading cryptocurrency exchange, offers a seamless trading experience tailored to your needs, empowering you to navigate the market with confidence.

19 posts written

Combining his expertise in finance and blockchain technology, Keval Desai is known for his groundbreaking work on decentralized trading platforms and digital asset markets.

Read Articles

Unlock the power of the head and shoulders pattern with this complete guide. Learn to spot, trade, a...

Unlock the power of candle patterns to decode market psychology and improve your trading precision....

Discover what IOUs mean in finance, their role as informal debt acknowledgments, and how understandi...

Master the hammer candlestick pattern—a key indicator for market reversals. This beginner-friendly g...