How to approach Forex trading for beginners?

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

Forex day trading can open the door to impressive profit opportunities by riding the waves of short-term price shifts in the currency markets. It’s no walk in the park—it calls for razor-sharp precision and unwavering discipline plus a solid grasp of the basics to sidestep the usual pitfalls. Many traders make mistakes that nibble away not just at their capital but also at their confidence, often faster than they’d like. This article shines a light on key forex day trading blunders you’ll want to avoid and shares practical strategies to help you kick those habits to the curb starting right now.

Before you dive into sharpening your forex day trading skills, it’s really important to keep an eye out for the common mistakes that tend to trip traders up.

Overtrading happens when you dive into too many trades without a solid game plan and slowly nibble away at your profits because of transaction costs and less-than-perfect entry points. More often than not it’s born out of impatience or the urge to jump on every shiny opportunity. This ends up clouding your judgment and frankly burning you out.

Less is often more.

So you’re not caught off guard, reacting like a deer in headlights to every little market twitch.

Zero in on high-quality trade setups that really count.

Keep your mind fresh and sidestep the all-too-common burnout that sneaks up on many traders.

A solid trading plan is truly the backbone of successful forex day trading. It ties together your trading goals with the level of risk you are comfortable handling and spells out clear trade setups, money management guidelines and routine performance checks. Having a plan in place helps build discipline and takes the guesswork out of the equation.

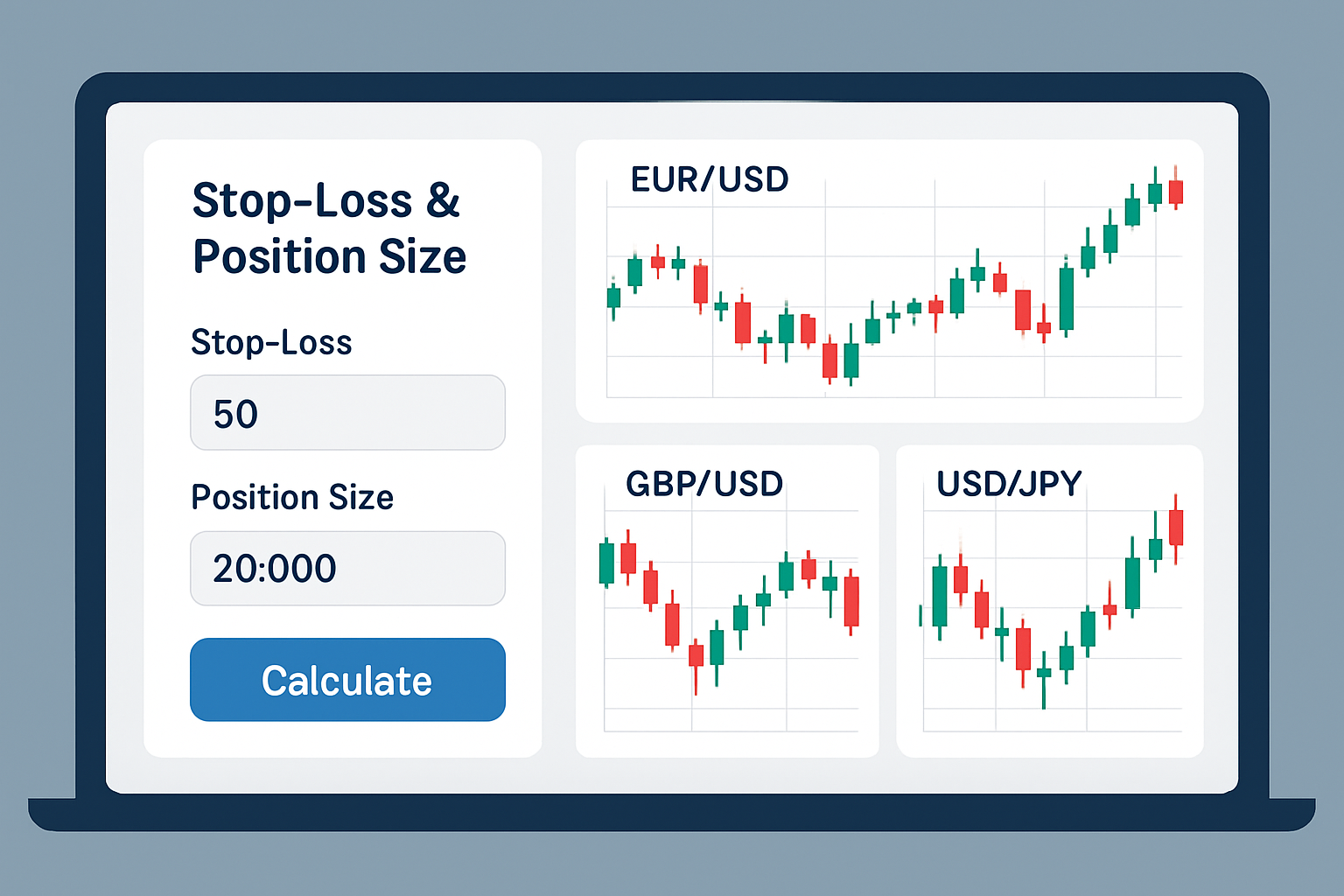

Managing risk well is important to keeping your success alive in forex day trading. It means picking position sizes with care, setting stop-loss orders at the right spots and resisting the temptation to put too much into any single trade. These steps help dodge painful, wallet-busting losses and guard your trading funds while stacking the odds for steady long-term profits.

Nail down your risk per trade as a small fixed slice, usually somewhere around 1-2% of your total capital. This helps keep things manageable without causing too much stress.

Use trailing stop orders to lock in profits while still giving the price some room to move in your favor. It’s like keeping your foot on the gas but not flooring it.

Spread your exposure across a handful of currency pairs thoughtfully to help reduce the impact of correlated risks. Diversification isn’t just a buzzword, it acts as your safety net.

Avoid heavy trading during major news events unless you have carefully analyzed and understand how your strategy holds up when the market throws a curveball.

A comprehensive forex risk management dashboard displaying key metrics like position sizing and stop-loss placements to illustrate effective capital protection

A solid trading strategy usually mixes technical indicators with fundamental analysis tailored for the forex market. Running it through the wringer with historical data and then testing it in demo accounts lets you iron out the kinks before putting real money on the line.

Emotions like fear and greed often sneak in as the biggest hurdles in forex day trading. If you don’t manage to keep them on a short leash, they have a knack for prompting impulsive moves that can throw your strategy off course and nibble away at your hard-earned capital.

Stick closely to your trading plan to help keep emotions from running the show and steering your decisions sideways.

Take a deliberate pause after big wins or losses. It is a great way to hit the mental reset button and keep your cool.

Consider adding a bit of mindfulness or meditation into the mix because I’ve found it really helps sharpen focus and keep those pesky emotions in check.

Keep a detailed trading journal that not only tracks your trades but also captures how you’re feeling. This is a subtle trick to boost your self-awareness over time.

Forex markets react almost immediately to economic data and geopolitical twists. Announcements from central banks are also very important. Keeping tabs on these news sources without letting the flood of info drown you can help you get ahead of market swings and avoid trades based on guesswork rather than strategy.

Keeping a detailed trading journal can be a game changer for long-term improvement. Jotting down your trade entries and exits along with the reasons behind each move and how you’re feeling gives you practical insights into where you shine and where you might be tripping up.

Make sure to jot down the exact entry and exit points along with the size of each trade. Details matter more than you think.

Scribble down the reasons behind each trade, especially the signals that nudged you to act. It’s like telling the story of your strategy in your own words.

Keep an eye on your feelings before, during and after trades because those gut reactions can reveal more than numbers.

Set aside time each week to review your journal. Spotting recurring patterns can be a game changer and help you tweak your approach for better results.

| Mistake | Why It Hurts | Immediate Action | Expert Tip |

|---|---|---|---|

| Overtrading | High costs and scattered focus quietly chip away at your profits | Limit the number of trades per day and schedule regular breaks — give your brain a breather | Stick to clear, tested entry and exit rules to avoid those impulsive knee-jerk decisions |

| Lack of Trading Plan | Leads to inconsistent results and a trading approach that’s all over the map | Create a written plan outlining entry, exit, and risk rules – it’s your trading roadmap | Review and adjust your plan monthly to keep pace with the ever-shifting market tides |

| Ignoring Risk Management | Can land you in hot water with severe losses | Always set stop-loss orders and risk only a tiny slice of your capital — better safe than sorry | Use trailing stops to lock in profits on winning trades and keep the good times rolling |

| Trading Without Strategy | Usually ends in guesswork and random losses that sting | Develop and thoroughly test a strategy before going live; it’s like a dress rehearsal for the real deal | Practice on demo accounts until your approach feels solid and second nature |

| Emotional Trading | Clouds judgment and often leads you down a costly rabbit hole | Stick closely to your trading plan and take breaks when the pressure mounts | Cultivate mindfulness to keep calm and focused—even when the market’s doing somersaults |

| Neglecting News | Means missing key market moves and getting blindsided by unexpected risks | Use an economic calendar religiously to stay ahead of important events | Avoid trading during volatile news releases unless you’ve been around the block a few times |

| Poor Record Keeping | Makes it tricky to learn from past wins and, more importantly, losses | Keep a detailed journal logging trades and your gut feelings on the day | Review your journal weekly to catch and correct recurring slip-ups—trust me, it pays off |

Putting these practical steps into action sooner rather than later can really boost your forex day trading results. When you keep a close eye on trade volume and stick to a clear plan while putting risk management front and center, you’re laying down a solid foundation for consistent profits.

Struggling to improve your trading performance? Edgewonk's advanced analytics tools are designed to give you the edge you need.

With detailed trade journaling, robust strategy analysis, and psychological insights, you'll gain a comprehensive understanding of your strengths and weaknesses. Don't miss out on this game-changing opportunity.

Traders, it's time to elevate your game. Edgewonk is the ultimate trading journal software designed to empower you with data-driven insights and personalized strategies. Take control of your trading journey and maximize your potential.

23 posts written

With 15 years of experience in commodity markets, Leila Amiri is transforming the field with her unique perspectives on sustainable investing and ESG integration.

Read Articles

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...

Understand the key drivers behind Myanmar currency fluctuations in forex trading, from domestic refo...