What are Forex market hours?

Discover everything about forex market hours in this definitive guide. Understand session timings, o...

Foreign exchange trading hours reveal when currency markets buzz with activity around the world.

Foreign exchange trading hours are the windows when the forex market truly comes alive. Unlike stocks that trade on a single exchange, forex never sleeps. It runs 24 hours a day across the world’s major financial hubs. The trading day is sliced into sessions that line up with the opening bells of these key markets.

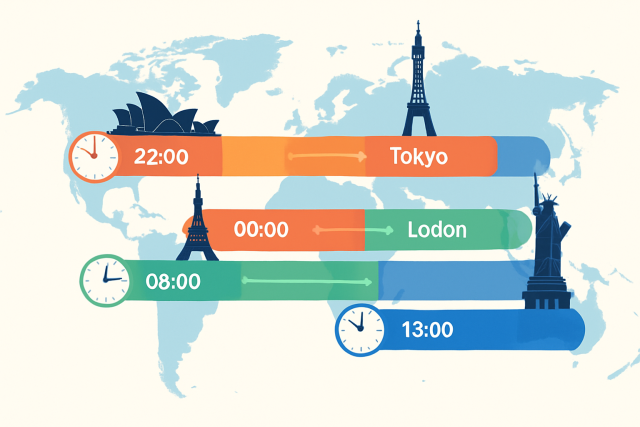

The forex market is typically broken down into four main trading sessions: Sydney, Tokyo, London and New York. The Sydney session gets the global trading day rolling in the Asia-Pacific region and is followed closely by Tokyo, which covers East Asia thoroughly. London then takes the reins during European trading hours. Finally, New York steps into the spotlight representing the Americas.

| Trading Session | Local Time (Start - End) | GMT/UTC Offset | Key Characteristics |

|---|---|---|---|

| Sydney | 10:00 PM – 7:00 AM | GMT+10 | Usually quieter with lower volume and less volatility; tends to be the sweet spot for AUD and NZD pairs |

| Tokyo | 12:00 AM – 9:00 AM | GMT+9 | Offers moderate activity, often buzzing more around JPY pairs |

| London | 8:00 AM – 5:00 PM | GMT+1 (DST) | The heavy hitter of the day with the highest volume and liquidity; mainly focuses on EUR, GBP, and CHF |

| New York | 1:00 PM – 10:00 PM | GMT-4 (DST) | Usually comes in second for volume but brings frequent volatility; USD pairs take center stage |

Note: Times include daylight saving adjustments where applicable, so no surprises there.

Trading volume in forex has this curious habit of ebbing and flowing throughout the day, typically syncing up with the market hours like clockwork. The busiest times often pop up around the regional market openings, which tends to bring better liquidity and those all-important narrower spreads—something traders quietly love.

Session overlaps happen when two major forex markets are open at the same time and tend to bring the highest liquidity and volatility you’ll find in the trading day. These windows often offer some of the best trading conditions if you know when to jump in. Take the overlap between the London and New York sessions for example.

Time zone differences and daylight saving time adjustments can really throw a wrench into the plans for forex traders. It’s absolutely important to convert trading session times accurately to a trader’s local time if you want to stay ahead of the game.

Different trading styles tend to shine during specific forex trading hours. Scalpers usually chase the most volatile and liquid windows, often when sessions collide. Swing traders prefer quieter stretches that give them more breathing room to keep risks in check.

Focus on the London and New York session overlap since it usually dishes out high liquidity and solid price moves, making it a favorite playground for scalpers and day traders alike.

When working with JPY pairs, the Tokyo session tends to fit swing trading strategies like a glove.

It’s generally wise to steer clear of the Sydney session for trading because the lower volume there can sneakily hike up spread costs.

Always keep an eye on economic news releases, which often pop up around the London and New York sessions—these can shake things up unexpectedly.

Adjust your trading approach before and after major session overlaps to better manage the risks that come along with surging volatility.

Public holidays and central bank holidays along with important economic announcements often throw a wrench into the usual rhythm of forex trading. Liquidity tends to take a nosedive during these periods. Spreads typically widen quite a bit and price gaps seem to pop up more often than not.

Trading the forex market can feel like catching a fast-moving train—it’s all about timing and knowing when to jump on board. Here are some handy tips that I have found helpful when navigating those busy trading hours.

Getting the most out of forex trading often boils down to knowing when the market is really buzzing. Traders usually find that the sweet spot for entering trades is during those high-liquidity windows, while it is a good idea to tread carefully and manage risk during the more unpredictable overlap periods.

Set up alerts for when sessions open and close so you’re always ready to ride the wave of increased market activity.

Zoom in on those session overlaps because liquidity and volatility usually increase, creating better trading opportunities.

Try to avoid starting trades during quieter sessions since it’s smart to dodge the troublesome, unfavorable spreads.

Keep a sharp eye on economic calendars to stay one step ahead of any volatility events that might come your way.

Adjust your risk management and position sizes to match how volatile the session is expected to be. No one likes surprises when money is on the line.

Global forex trading sessions visually mapped with their respective trading hours and overlaps

A common misunderstanding about foreign exchange trading hours is that the forex market keeps buzzing around the clock without missing a beat. In reality, liquidity and volatility shift quite a bit depending on the time of day. Another misconception is thinking traders can jump into any trade at any moment and expect spreads and price movements to stay steady as if by magic. But that overlooks how much the trading session really calls the shots. Overlooking these finer points can lead to higher costs and less-than-stellar trade execution.

"Successful forex trading often boils down to getting a feel for the market’s natural rhythms. Even though the forex market never sleeps and runs 24 hours straight, liquidity and volatility tend to ebb and flow depending on which trading session is in full swing. In my experience, mastering these hours can be the secret sauce to sidestepping costly blunders and seeing your results climb steadily."

17 posts written

Born in Athens, Ariadne Petrou is a leading expert in behavioral finance, exploring the psychological factors that influence trading decisions and market dynamics.

Read Articles

Discover everything about forex market hours in this definitive guide. Understand session timings, o...

El Salvador blends traditional dollars with Bitcoin in a pioneering monetary system, reshaping how m...

Discover the essentials of forex market times, including when and how the global currency market ope...

Understanding pip values is vital for forex traders. Discover how a free forex pip calculator can si...