How to approach Forex trading for beginners?

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

Back in 2021 El Salvador made waves by becoming the first country to embrace Bitcoin as legal tender alongside the US dollar and grabbed headlines worldwide. This bold move created a unique financial landscape where traditional cash and digital assets coexist. Nowadays, money in El Salvador isn’t just the usual paper bills; it includes digital wallets, Bitcoin transfers and an economy unfolding under the watchful gaze of the globe.

Before Bitcoin made its entrance, El Salvador’s monetary landscape was dominated by dollarization. Since 2001, the United States dollar has been the go-to currency. It brought welcome stability but also tied the nation’s economy to U.S. policy and currency moves.

Bitcoin is a digital currency that operates without any central bank or authority, leaning on blockchain technology to keep transactions safe and sound. El Salvador took a bold step by making Bitcoin legal, aiming to shake up its financial system.

El Salvador currently runs a dual currency system where Bitcoin coexists with the good old US dollar. Individuals and businesses are free to use whatever suits them, which certainly offers plenty of flexibility but also means getting used to Bitcoin's sometimes wild value swings.

Citizens go ahead and download the government-issued Chivo wallet, which makes it surprisingly easy to handle Bitcoin transactions right from their mobile devices.

The government sweetens the deal with a $30 Bitcoin bonus—kind of like a welcome mat made of digital coins.

Users can quickly swap Bitcoin for dollars inside the wallet, or spend Bitcoin directly at merchants that are on board. It’s as simple as grabbing a coffee, really.

Businesses jump on the bandwagon by signing up to accept Bitcoin payments, steadily adding more merchants to the growing network.

When the need for cold hard cash strikes, people can conveniently withdraw from Bitcoin ATMs or designated cash-out points without much fuss.

Chivo is the official digital wallet rolled out by El Salvador’s government to make using Bitcoin for everyday purchases more doable. It lets people send, receive and convert Bitcoin smoothly while juggling US dollar transactions without breaking a sweat. Chivo plays a important role in weaving Bitcoin into daily life but, like any new tech, users sometimes hit a few technical hiccups.

Bitcoin ATMs and cash conversion centers have popped up all over the country, making it a whole lot easier for people to swap their Bitcoin for good old US dollars and actually walk away with cash in hand. These handy spots act as a bridge between the digital world of cryptocurrency and the familiar feel of traditional money, which really opens the door for people who might still be a bit wary of diving into mobile wallets.

A Bitcoin ATM serving users in El Salvador’s marketplace, illustrating crypto-to-cash conversion in everyday settings

Bitcoin adoption opens the door to some pretty promising opportunities, though it’s not without its fair share of hurdles. You’ll often see remittance costs dropping and maybe even a boost in financial inclusion, which is a bright spot. Still, the rollercoaster ride of Bitcoin’s price and mixed feelings from the public keep things interesting.

"Bitcoin is quietly shaking up how Salvadorans see and manage their money, mixing the old ways with fresh, high-tech flair. Sure, there are bumps along the road to adoption, but it also opens a rare door for genuinely inclusive financial growth in the region," says Mariana Ruiz, an economist based in San Salvador.

Bitcoin has shaken up the way money flows in El Salvador and left its mark on remittances, saving habits, business transactions, and how the government handles payments. Its faster transactions and lower fees take the hassle out of sending money. Whether it catches on broadly depends on how comfortable people feel with the tech and how well digital infrastructure is set up.

| Aspect | Before Bitcoin Adoption | After Bitcoin Adoption |

|---|---|---|

| Remittance Costs | Traditional services used to hit people with steep fees | Bitcoin remittance services often help keep those costs nice and low |

| Remittance Speed | International transfers dragged on for several days | Bitcoin transfers usually wrap up within minutes to just a few hours, which is a huge time saver |

| Access to Banking | Lots of people had little to no access to bank accounts | Digital wallets like Chivo have made banking way more reachable for many |

| Currency Acceptance | Mostly stuck accepting only US dollars | Now both dollars and Bitcoin get the official green light for acceptance |

| Government Payments | Mostly handled with cash or traditional bank transfers | Digital payments, Bitcoin included, have stepped in to offer smoother options |

Lots of individuals are buzzing about Bitcoin's role in El Salvador but there’s quite a bit of misinformation floating around. Some believe Bitcoin has kicked the US dollar to the curb or that every Salvadoran uses it daily. Using Bitcoin is optional. Cash remains the main payment method and a mix of legal, social and practical hurdles shapes how people handle their money.

El Salvador seems poised to double down on Bitcoin's role in its financial system, forging more ties with global crypto platforms and pouring resources into infrastructure and education. These steps could really shake up money in El Salvador, transforming monetary policy and financial services while potentially turning the country into a standout player in the crypto world.

Tired of missing out on lucrative trading opportunities? Elevate your game with Binance, the leading crypto exchange trusted by millions worldwide.

With lightning-fast execution, institutional-grade security, and a user-friendly interface, Binance empowers you to seize market moves with confidence. Plus, enjoy access to 100+ cryptocurrencies and cutting-edge tools. Join now and experience the future of trading.

Are you ready to elevate your trading game? Binance, the leading cryptocurrency exchange, offers a seamless platform for traders of all levels. With its user-friendly interface and powerful tools, you can navigate the dynamic world of digital assets with confidence.

16 posts written

With over two decades of experience navigating volatile markets, Ludovik Beauchamp provides invaluable guidance on risk management, portfolio optimization, and adaptability in the face of uncertainty.

Read Articles

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

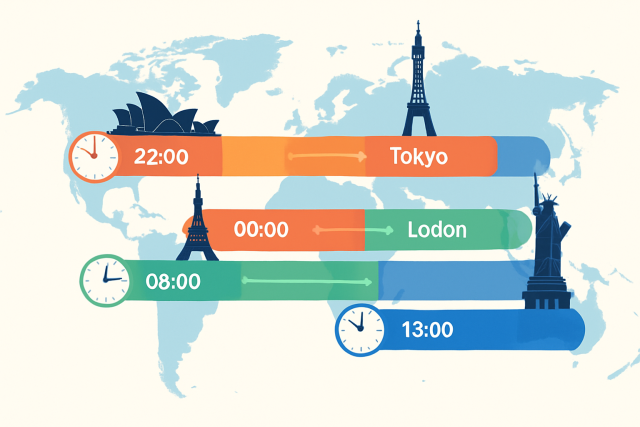

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

Discover the essentials of forex market times, including when and how the global currency market ope...

Discover everything about forex market hours in this definitive guide. Understand session timings, o...