Free Forex Pip Calculator

Understanding pip values is vital for forex traders. Discover how a free forex pip calculator can si...

Getting a handle on forex market times is a must for anyone dipping their toes into currency trading. Unlike many financial markets, the forex market doesn’t take a break during weekdays. It hums along nonstop, giving traders across the globe the freedom to buy and sell currencies whenever the mood strikes. This nonstop action happens because the market is truly global. Trading sessions pass the baton from one time zone to the next in a seamless relay.

The forex market, short for foreign exchange market, is a sprawling decentralized global stage where currencies are constantly bought and sold. It’s a melting pot that brings together players from banks and governments to giant corporations and everyday retail traders trying their luck. Unlike traditional stock markets that stick to fixed hours and have bustling trading floors, forex trading happens electronically over-the-counter and hums along almost nonstop. What really makes it tick is how deeply it’s tied to global economic currents and that it effortlessly spans multiple time zones.

Forex market times refer to the hours when the big financial hubs around the globe open for currency trading. While the forex market technically never sleeps during the weekdays, trading action tends to ebb and flow with the opening and closing of these key sessions. The magic lies in the fact that as one major market wraps up another opens somewhere else, creating a smooth relay race of trading activity.

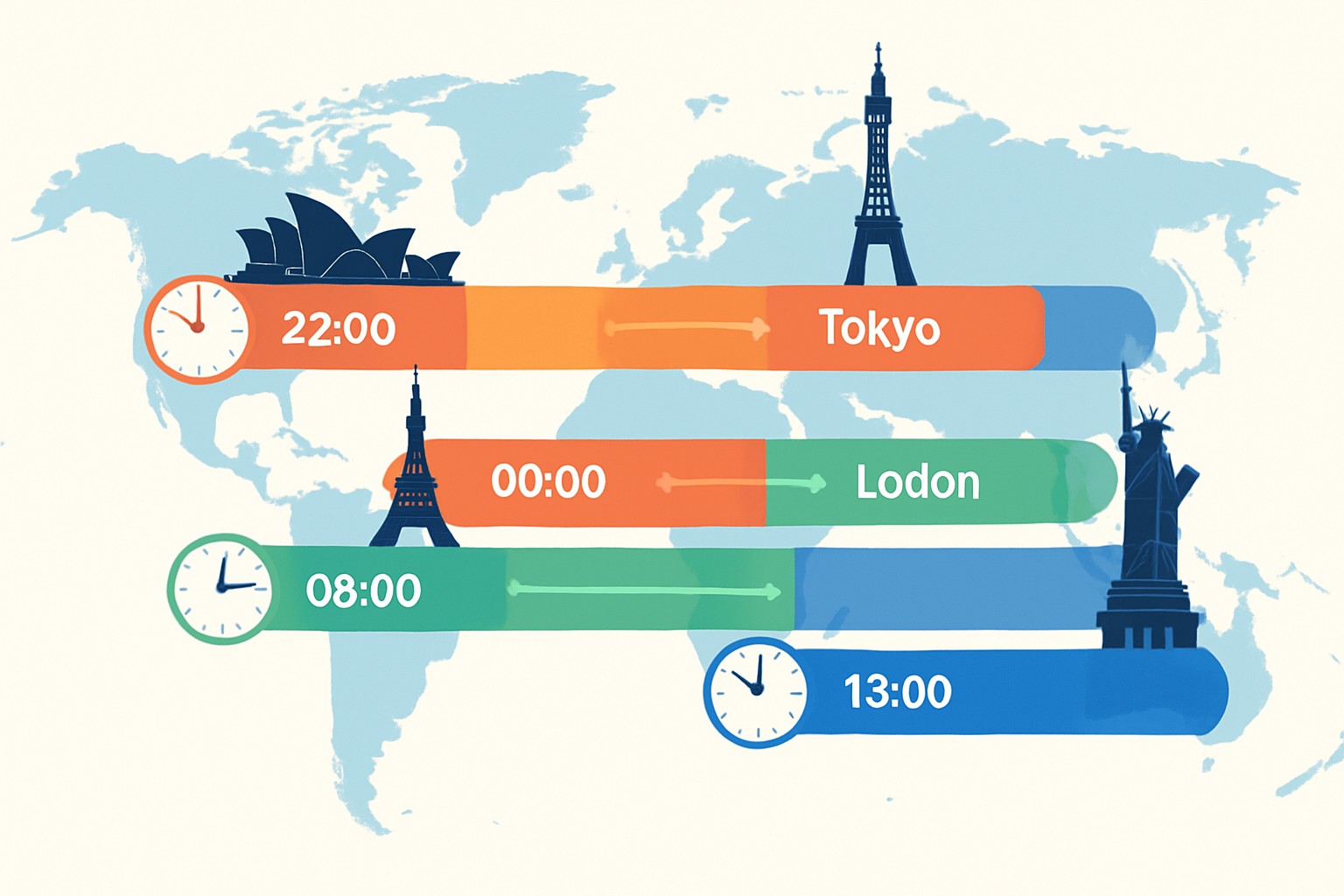

Visual representation of forex market sessions overlapping across the globe

| Session | Time (UTC) | Volatility | Volume | Key Currency Pairs |

|---|---|---|---|---|

| Sydney | 22:00 - 07:00 | Usually on the low to moderate side | Moderate | AUD, NZD, JPY |

| Tokyo | 00:00 - 09:00 | Generally moderate | Moderate | JPY, USD, CHF, AUD |

| London | 08:00 - 17:00 | Often pretty lively | High | EUR, GBP, CHF, USD |

| New York | 13:00 - 22:00 | Frequently quite active | High | USD, CAD, EUR, GBP |

Trading conditions shift with each session and for those just starting out getting a handle on when these sessions kick off and wrap up can make a world of difference in spotting opportunities or dodging risks. Take the London and New York sessions, for example. They usually bring more price movement to the table, which can mean fatter profit margins but also increases the risk.

Understanding forex market hours is vital for beginners looking to get the most out of their trading strategies. When the market is busy, trades usually execute faster and at better prices. Conversely, trading during quieter periods often means wider spreads and thinner liquidity, which increases risk.

Forex market times are typically listed in Coordinated Universal Time (UTC) or Greenwich Mean Time (GMT). For beginners, trading successfully often means rolling up their sleeves and converting these times into their own local time zone. It is about figuring out the time difference between where you are and UTC, then tweaking the session start and end times accordingly. Thankfully, there are plenty of online time zone converters and forex market time tools out there that can take a lot of the headache away.

Find the trading session that suits you best by tuning into when you actually feel sharp and comfortable, keeping your time zone and daily routine firmly in mind. After all, nobody trades well when running on empty.

Keep a keen eye on key economic news releases during your chosen sessions because these little fireworks often set off some pretty wild market swings.

Aim to trade during overlapping sessions, especially the London-New York overlap. This window tends to offer better liquidity and clearer price action, making life a bit easier for traders.

Avoid trading during periods of thin liquidity, like the late Sydney session or holiday times. It feels a bit like trying to catch a greased pig with slippage and wider spreads lurking about.

Stick to a regular trading schedule that fits snugly into your lifestyle. This is one of the best ways to build discipline and keep stress from sneaking up on you.

Timing your learning and trading to line up with the forex market times can really help you build confidence without feeling overwhelmed. Once you get the hang of spotting the more active sessions and start to understand their usual quirks, making informed decisions becomes a bit less of a puzzle. Remember, mastery isn’t an overnight guest—it's more like a slow burner.

17 posts written

Driven by her passion for empowering individual traders, Annika Eriksson is a renowned educator, offering practical strategies and actionable insights for successful trading.

Read Articles

Understanding pip values is vital for forex traders. Discover how a free forex pip calculator can si...

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...