How to use supply and demand zones when trading options?

Discover practical strategies for using supply and demand zones in options trading. This guide break...

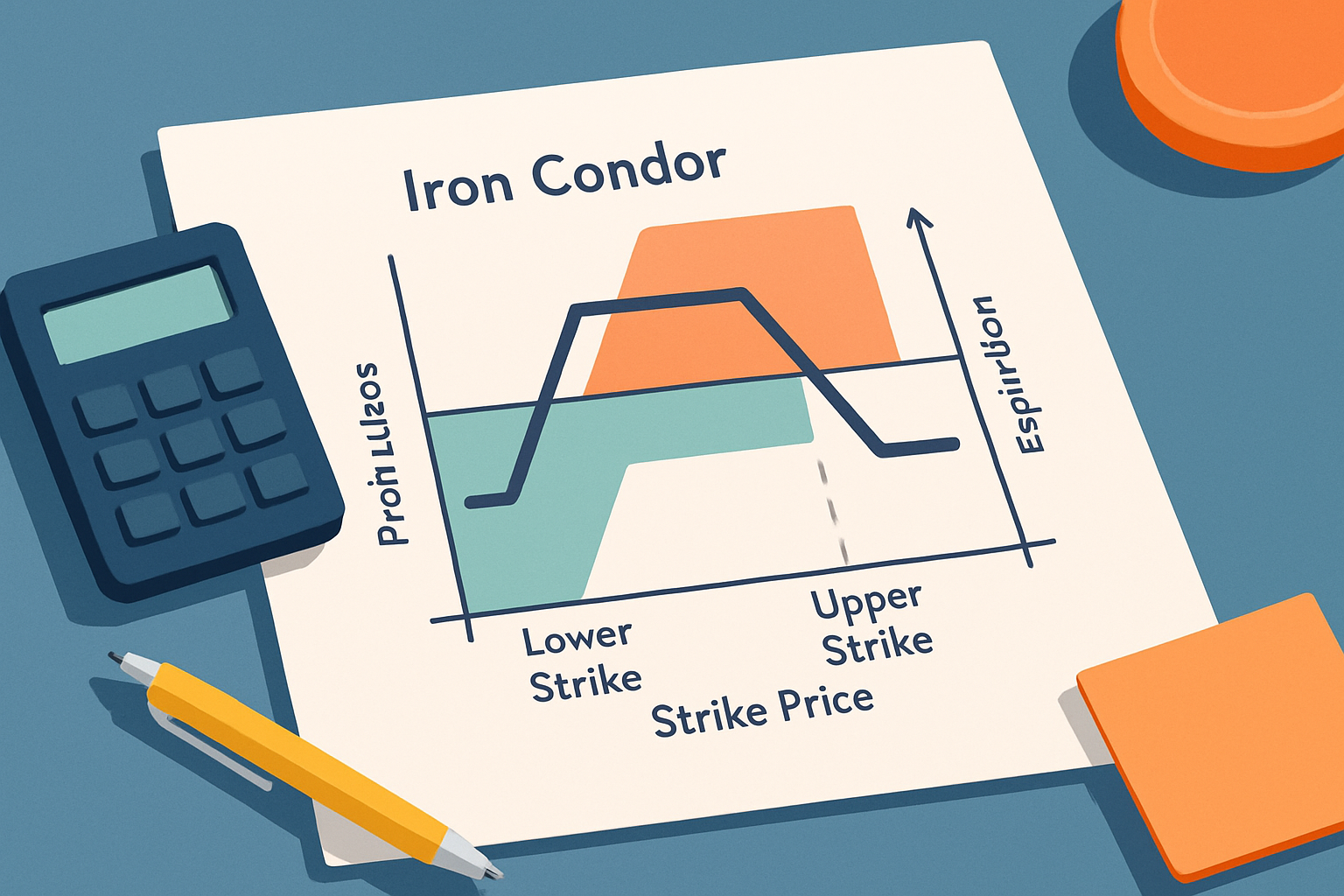

The iron condor option trading strategy has earned quite the reputation among options traders, mainly because it offers defined risk and the potential for steady income. This flexible approach tends to shine in low volatility markets, helping traders keep losses in check while aiming for those dependable returns.

An iron condor is a clever options trading strategy where you sell an out-of-the-money call spread and at the same time an out-of-the-money put spread tied to the same underlying asset and expiration date. You sell one call and buy another with a higher strike price. On the flip side, you sell one put and buy another with a lower strike price—this creates two vertical spreads. The whole idea is to pocket a profit when the underlying asset stays within a certain range. You’re essentially banking on time decay and low volatility to work in your favor because the premiums you collect usually outpace potential losses, assuming the asset doesn’t wander off too far.

Pick the underlying asset and choose an expiration date that fits your market view and trading horizon—no point rushing or dragging this part out.

Pinpoint the short call and short put strike prices that are comfortably out-of-the-money while keeping an eye on where you expect the price to hang out until expiration.

Sell both the out-of-the-money call spread and put spread by offloading the closer strike options and snapping up the farther out-of-the-money options as a safety net—think of it as your insurance policy.

Crunch the numbers: figure out the maximum potential profit, the maximum loss (the spread width minus that premium) and the breakeven points. This will give you a crystal-clear snapshot of your trade’s risk and reward.

Place the iron condor order through your brokerage platform, double-checking that all legs are lined up correctly and making sure the commissions won’t sneakily eat up your gains.

Choosing strike prices really boils down to your market outlook and just how much risk you’re comfortable juggling. A wider gap between strikes can fatten your potential payday, but it also ups the ante if the underlying asset starts to dance around unpredictably. The trick is to strike a balance where there is a decent shot the asset stays put within your range—letting you rake in those premiums without biting off more risk than you can chew.

Visual representation of an iron condor option trading setup highlighting strike prices and P&L zones

| Strategy | Max Profit | Max Loss | Breakeven Points | Probability of Profit | Risk-to-Reward Ratio |

|---|---|---|---|---|---|

| Iron Condor | Premium collected, capped | Spread width minus premium | Short put strike minus premium, | ||

| Short call strike plus premium | Usually pretty decent (think 60-75%) | Fairly balanced (1:1 to 1:2) | |||

| Long Call Spread | Limited to the difference between strikes minus premium | Premium paid | Strike plus premium | On the lower side (around 30-40%) | Can be quite rewarding (up to 5:1) |

| Short Put Spread | Premium collected | Difference between strike price and underlying | Strike minus premium | A moderate shot (50-65%) | Reasonably balanced |

| Covered Call | Premium plus any gains on the stock | Risk can run wild if the stock dives | Varies depending on position | Somewhere in the middle | Fairly moderate |

The iron condor comes with capped risk thanks to the spreads bought on both sides that define a clear maximum loss upfront. While the potential reward might not set the world on fire like some directional options, iron condors usually deliver modest gains when markets are steady or stuck in a range.

Sometimes, timing really is everything—especially when it comes to deploying an iron condor. Knowing when to jump in can make all the difference, and there are a handful of solid reasons that nudge traders toward this strategy. It’s kind of like knowing when to bring out your umbrella not too early, not too late, but just when the skies start looking a little cloudy. Whether you are seeking steady income with a bit of a safety net or aiming to profit from markets expected to take it slow and steady, the iron condor has got your back. In my experience, patience and a keen eye on volatility are your best friends here—because this isn’t a sprint, more a calculated walk through the market’s ups and downs.

Iron condors usually shine brightest in calm, range-bound markets since they rake in premium income while keeping risk in check. I have found it’s wise to steer clear when volatility decides to throw a tantrum or the market is on a strong trend, because those sudden breakouts can gobble up profits faster than you would like.

Keep a sharp eye on the underlying asset's price and implied volatility because these changes can sneak up on you when things seem calm.

Set clear rules for tweaking the trade like rolling spreads closer to expiration or stretching out strike distances if the asset starts flirting with breakeven points.

Figure out if it’s worth locking in profits early by closing the position or if you’d rather ride it out until expiration. Carefully weigh potential gains against the risks.

Use stop-loss orders or protective option strategies to keep losses in check if the price moves outside your comfort zone.

Always be on your toes for assignment or exercise risks especially as expiration looms by understanding how your brokerage handles options settlement. This knowledge often pays off more than you’d think.

Managing iron condor trades can be a bit like riding a rollercoaster especially when volatility decides to spike out of nowhere or the underlying price zips toward those short strikes faster than you would hoped. To keep losses from sneaking up on you, it really pays off to set clear exit points ahead of time and lean on advanced trading tools that catch changes in real time. Platforms like Binance don’t just offer basic order types—they bring sophisticated options to the table along with solid risk management features.

These common slip-ups often lead to slimmer profits or surprise losses, especially for traders just dipping their toes into the iron condor option trading strategy. Wrangling volatility, picking the right strikes and staying on top of trade management are vital moves if you want better results with this approach.

Struggling to improve your trading performance? Edgewonk's advanced analytics tools are designed to give you the edge you need.

With detailed trade journaling, robust strategy analysis, and psychological insights, you'll gain a comprehensive understanding of your strengths and weaknesses. Don't miss out on this game-changing opportunity.

Traders, it's time to elevate your game. Edgewonk is the ultimate trading journal software designed to empower you with data-driven insights and personalized strategies. Take control of your trading journey and maximize your potential.

11 posts written

With over a decade of experience navigating the intricate world of trading, Quentin Merriweather's expertise lies in developing innovative strategies that harness the power of cutting-edge technologies.

Read Articles

Discover practical strategies for using supply and demand zones in options trading. This guide break...

LEAPS options provide a longer-term, less stressful way to trade options compared to regular short-t...

Explore the detailed contrasts between day trading and options trading, highlighting how each strate...

Discover the key differences between options trading and day trading. This in-depth analysis helps t...