How to use supply and demand zones when trading options?

Discover practical strategies for using supply and demand zones in options trading. This guide break...

Understanding what is volatility in options trading is key, as it's the heart and soul of this market - though it can feel like a tricky beast for those just dipping their toes in. This article breaks down what volatility actually means and why it matters so much. It also explains how it shapes both options pricing and trading strategies.

Volatility gives you a sense of how much the price of a financial asset bounces around over time. It reveals how far and how quickly prices can shift, shedding light on the degree of uncertainty or risk that’s hanging over that asset.

Options traders usually keep an eye on two main flavors of volatility. Historical volatility takes a look back over the shoulder, showing how prices have jiggled and shifted in the past. On the flip side, implied volatility springs from today's market prices and tries to capture the market’s collective guess about where prices might head next.

Volatility is one of the star players among the main input variables in options pricing models like Black-Scholes. It helps us size up the odds of the underlying stock price hitting certain levels before the option’s expiration date. When volatility cranks up the chance of an option finishing in-the-money usually goes up too, which often means you’re looking at a heftier option premium.

Option sellers usually want a heftier premium, since the chance of wild price swings sends the risk of big losses through the roof. For option buyers, higher volatility often feels like a golden ticket. It means a better shot at turning a profit because the underlying asset might just swing in their favor.

| Feature | Low Volatility | High Volatility |

|---|---|---|

| Option Premiums | Usually lower premiums thanks to those steady, predictable prices | Typically higher premiums that reflect the market's butterflies and jitters |

| Price Swings Likelihood | Price changes tend to be small and infrequent—easy on the nerves | Price moves can be quite dramatic and pop up more often than you would like |

| Risk Profile | Carries lower risk but also keeps profit opportunities on the modest side | Comes with higher risk, but hey, the potential rewards can be pretty enticing |

| Suitable Strategies | Strategies aimed at steady income, like selling options to collect premium | Plays that lean into volatility, such as straddles or strangles, where the action lives |

| Market Sentiment | Generally calm, like a quiet morning with few surprises | Often jittery and uncertain, sort of like waiting for the storm to break |

Options traders tend to keep a sharp eye on volatility as it helps them nail down the best moments to buy or sell options and choose strategies that really jive with the current or expected volatility levels.

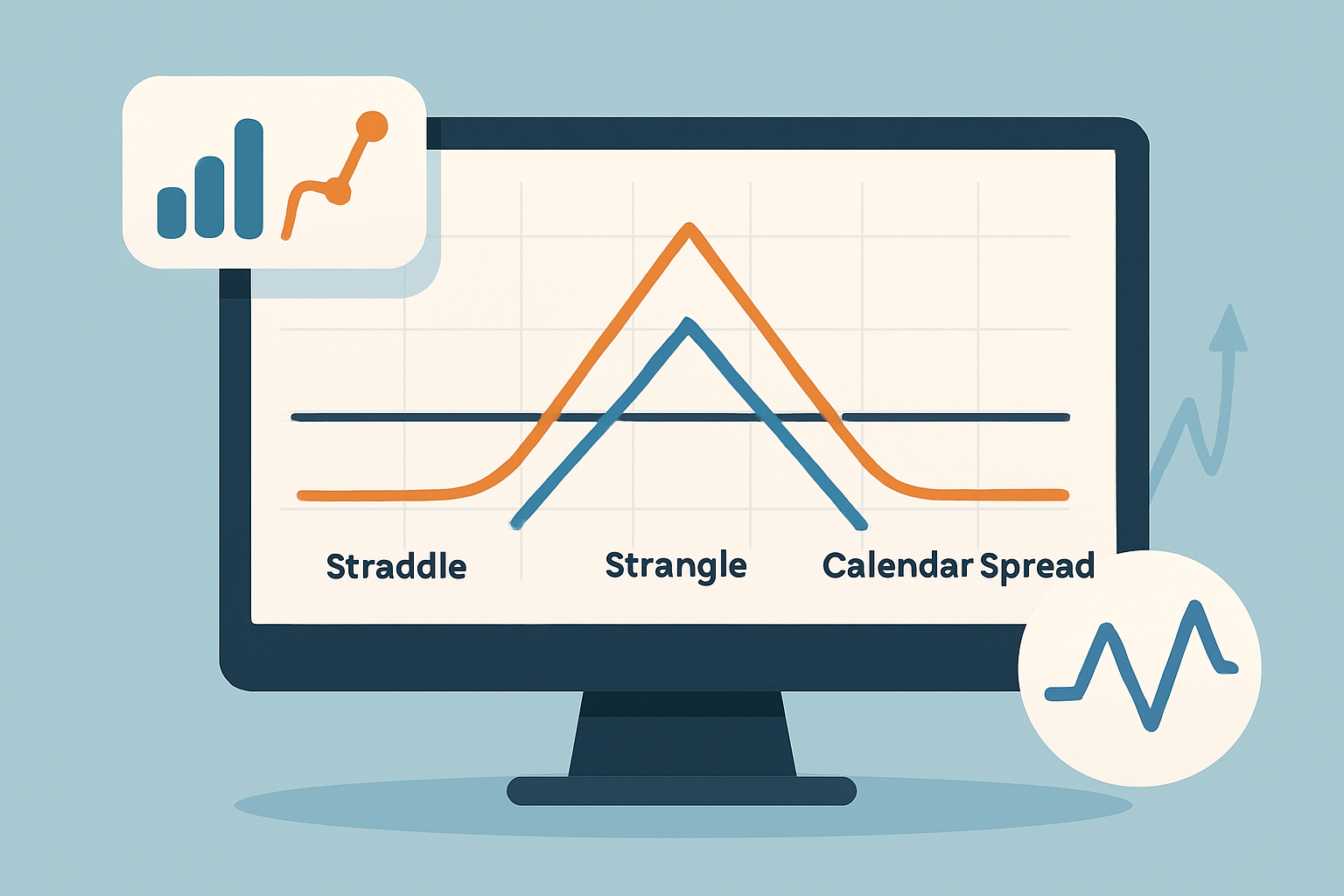

Many option strategies focus on capitalizing when volatility throws a curveball. Techniques like straddles, strangles and calendar spreads give traders a chance to benefit from sudden spikes or shifts in volatility's dance regardless of whether the underlying asset moves up or down.

A Straddle means buying both a call and a put option at the same strike price and expiration date. It’s a classic play that can really pay off when the market decides to throw a curveball in either direction, especially if volatility decides to ramp up unexpectedly.

The Strangle is kind of like a Straddle’s laid-back cousin—it uses out-of-the-money options, which usually helps keep the upfront cost down. This strategy shines when there are big price swings, giving you a chance to catch those dramatic moves.

Calendar Spreads involve buying and selling options that share the same strike price but have different expiration dates. This one’s a neat trick, capitalizing on differences in volatility and the way time decay sneaks into option premiums—sort of like playing the clock to your advantage.

Visual diagram illustrating how straddles, strangles, and calendar spreads operate within different volatility environments

Volatility often gets a bad rap and tends to be misunderstood by traders, whether they’re just starting out or have been around the block a few times. Some individuals assume it only matters when prices are jumping all over the place, or they take implied volatility as a crystal ball that perfectly predicts future moves.

Traders lean on a variety of tools to get a handle on volatility and understand its twists and turns. The VIX index captures the implied volatility of the S&P 500 and is one of the go-to gauges in the room. They also rely on software platforms to monitor historical and implied volatility trends because having the full picture never hurts.

Interpreting volatility data really shines when you take a step back and look at the bigger picture—think current market happenings alongside historical trends—and then use those nuggets of insight to steer your risk management and trade planning. Platforms like TradingView come to the rescue here, offering user-friendly charting tools and handy volatility indicators.

Trading options amidst volatility can feel a bit like surfing a wild wave—exciting but full of surprises. So, when you are diving into this arena, a few key things are definitely worth remembering.

Understanding what is volatility in options trading is crucial for managing risk in volatile markets. Traders often adjust position sizes and spread their strategies to avoid knee-jerk reactions triggered by sudden spikes in volatility.

Are you tired of juggling multiple tools for your trading needs? TradingView is the all-in-one platform that streamlines your analysis and decision-making.

With its powerful charting capabilities, real-time data, and vibrant community, TradingView empowers traders like you to stay ahead of the market. Join thousands who trust TradingView for their trading success.

Elevate your trading game with TradingView, the ultimate platform for technical analysis and market insights. Gain access to advanced charting tools, real-time data, and a vibrant community of traders worldwide. Discover new opportunities and refine your strategies today.

17 posts written

Born in Athens, Ariadne Petrou is a leading expert in behavioral finance, exploring the psychological factors that influence trading decisions and market dynamics.

Read Articles

Discover practical strategies for using supply and demand zones in options trading. This guide break...

Discover the iron condor option trading strategy—a flexible approach for steady income and controlle...

Explore the detailed contrasts between day trading and options trading, highlighting how each strate...

Discover the key differences between options trading and day trading. This in-depth analysis helps t...