Master the Bear Flag Setup

Unlock the power of the bear flag pattern with our practical, step-by-step guide. Understand market...

This article unpacks what an IOU really means and how it plays out in personal and business finance—no jargon just the essentials.

An IOU, short for "I owe you," is a simple no-frills note someone writes to admit they owe money to another person, providing the basic iou meaning. Think of it as a friendly nudge or casual reminder of a debt rather than a heavyweight legal contract.

An IOU is basically a straightforward note acknowledging a debt without getting bogged down in the nitty-gritty like repayment schedules or interest rates. Unlike promissory notes or loan agreements, IOUs typically don’t hold much legal clout but rather capture a mutual understanding that the creditor is expecting to be paid.

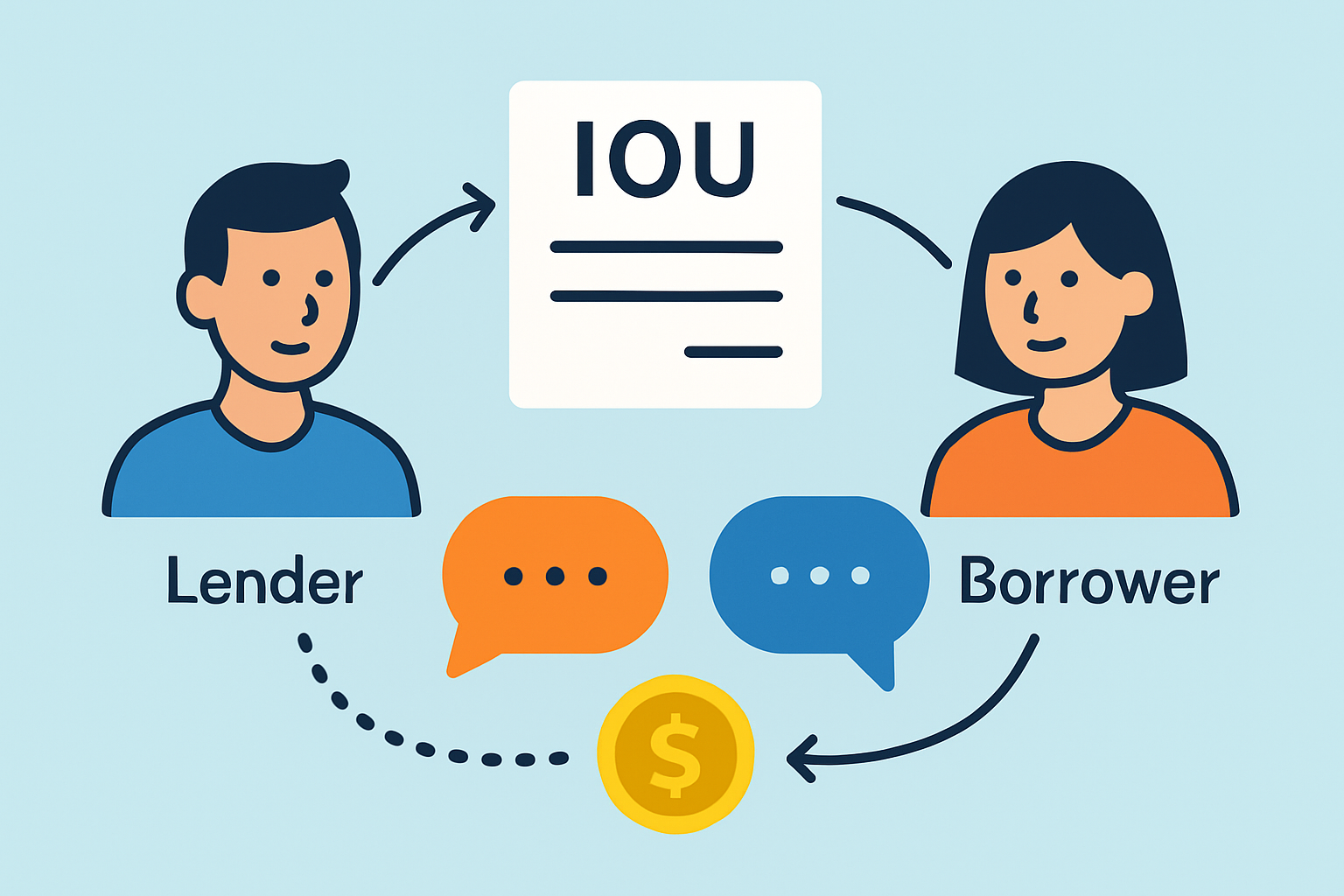

IOUs often pop up in the everyday shuffle of money matters, especially when formal loan agreements would feel like bringing a sledgehammer to crack a nut. They serve as simple, no-fuss promises from the borrower to repay the lender and usually come into play when there’s a decent level of trust between the two parties.

One person or group hands over money or resources to another without expecting payment immediately.

The borrower then provides an IOU, a neat little note saying "Yep, I owe you this" to make things clear.

Usually both parties have a friendly chat and agree on how the repayment will roll out.

The borrower pays back what’s owed or if life throws a curveball they work out new terms to keep things fair.

Diagram illustrating the flow of an IOU from issuer to receiver, including informal communication and repayment

IOUs are like the casual nod of the debt world—less formal than promissory notes, loans and bonds because they skip the whole business of structured terms or legal obligations. Think of them as straightforward acknowledgments of debt while the others come dressed up with repayment plans and interest details plus a whole menu of legal options.

| Type of Instrument | Formality Level | Legal Enforceability | Typical Use Case | Presence of Repayment Terms |

|---|---|---|---|---|

| IOU | Informal | Low | A straightforward nod to owed money, nothing fancy | Often missing |

| Promissory Note | Formal | High | Commonly used for loans or credit agreements, laying out the payment plan upfront | Includes a clear repayment plan |

| Loan Agreement | Highly Formal | High | The go-to for bank or personal loans, packed with all the nitty-gritty details and possible penalties | Contains detailed terms and possible penalties |

| Bond | Formal (securities) | High | Favored in corporate or government borrowing, spelling out fixed payments and when they’re due | Specifies fixed payments and maturity dates |

| Contract | Formal legal document | High | Covers a wide range of business commitments, with payment terms spelled out nice and clear | Payment terms are clearly defined |

IOUs are pretty common among friends and family when it comes to informal lending—after all, trust tends to cut down on the need for piles of legal paperwork. When it comes to businesses, they often lean on IOUs for short-term credit or to shuffle owed amounts between departments or related companies.

IOUs usually aren’t considered legally binding contracts since they’re pretty informal and often skip clear repayment terms.

"Recognizing the limits of IOUs can save you from those all-too-common costly financial disagreements and steer both individuals and businesses toward choosing the smartest tools for keeping track of debt."

Keep risks at bay when dealing with IOUs by being crystal clear and nitpicky on the details. Spell out exactly who’s involved and the precise amount owed. If you can swing it, add a date and some signatures for good measure.

Write out the full names of both the lender and borrower clearly on the document so there’s no room for mix-ups.

Spell out the exact amount of money or value owed to keep everyone on the same page and avoid any confusion later.

Note the date when the IOU is created. This simple step helps prevent headaches down the road.

Make sure both parties sign the IOU to seal the deal and confirm they agree with the terms.

If possible, include a brief note about the repayment timeline or any conditions as a heads-up to keep things running smoothly.

When debts call for clearer legal protection and sturdier guarantees, formal documents such as promissory notes or loan agreements usually steal the spotlight. These papers spell out the nitty-gritty of repayment terms and interest rates and come with enforceability that’s hard to beat, which is why understanding the true iou meaning matters when choosing between informal acknowledgments and formal contracts.

Tired of missing opportunities and making suboptimal trading decisions? TrendSpider's cutting-edge platform automates complex technical analysis, saving you time and reducing human error.

With multi-timeframe analysis, dynamic alerts, backtesting, and customizable charting, you'll gain a competitive edge in identifying trends and making informed trades across global markets.

As a trader seeking opportunities in the dynamic crypto market, you need a reliable and secure platform to execute your strategies. Coinbase, the leading cryptocurrency exchange, offers a seamless trading experience tailored to your needs, empowering you to navigate the market with confidence.

17 posts written

Born in Athens, Ariadne Petrou is a leading expert in behavioral finance, exploring the psychological factors that influence trading decisions and market dynamics.

Read Articles

Unlock the power of the bear flag pattern with our practical, step-by-step guide. Understand market...

Master the hammer candlestick pattern—a key indicator for market reversals. This beginner-friendly g...

Discover the bullish harami candlestick pattern—a key technical signal that can hint at trend revers...

Learn how the harami candlestick pattern signals potential market reversals. This guide breaks down...