Understanding the Bid and Ask Price Spread for Traders

Understanding the bid-ask spread is essential for any trader. This article breaks down its meaning,...

In the fast-moving world of Forex trading, understanding key terms like the 'pip meaning' is vital for success. Take the term "pip" for example. It seems simple but often trips up beginners. We’ll explain what a pip really is, why traders rely on it like their favorite tool, and how it can influence your trading strategy.

A "pip," short for "percentage in point" or "price interest point," is the tiniest standard unit used to gauge price changes in Forex trading. It’s not a fixed sum of money but a handy way to track how much a currency pair’s price has shifted.

Think of pips as little units kind of like inches or centimeters when you’re measuring length. Each change might seem tiny on its own, but those small moves can really pile up into something meaningful—whether that’s profit or loss in the Forex world. It’s not so much about a single pip’s size, but more about how a bunch of them stack together to reveal the real shifts happening in Forex prices.

Forex currency pairs are quoted with several decimal places and each tiny step at a specific decimal point represents a one pip move. For most pairs you’ll spot the pip at the fourth decimal place. When the price nudges from 1.2345 to 1.2346, that’s a one pip change.

| Currency Pair | Typical Quote Format | Pip Size | Decimal Precision |

|---|---|---|---|

| EUR/USD | 1.12345 | 0.0001 | 5 decimal places |

| USD/JPY | 110.25 | 0.01 | 2 decimal places |

| GBP/USD | 1.30567 | 0.0001 | 5 decimal places |

Currency pairs involving the Japanese Yen (JPY) have the pip at the second decimal place instead of the usual fourth. For example, if USD/JPY is quoted at 110.25 a pip move happens when the price ticks over to 110.26.

Pip value is basically the dollar amount attached to a one-pip move and it isn’t set in stone. It changes depending on the currency pair, your trade size and the currency of your trading account. Understanding this value is vital since it tells you how much you could win or lose with every pip the price moves.

A simple way to calculate pip value is by using this handy formula: One Pip divided by Exchange Rate multiplied by Lot Size. For instance, one pip equals 0.0001. If you’re dealing with a standard lot of 100,000 units and the exchange rate is 1.1000, the pip value works out to roughly $9.09.

Measuring price movements in pips is like having a trusty ruler in the wild world of trading. It helps traders manage risk with pinpoint precision and set clear stop loss and take profit points. It also allows them to assess trade outcomes in a consistent way.

Forex traders would really be up the creek without a paddle trying to measure their gains and losses accurately if it weren’t for the concept of pips, which makes making informed decisions a whole lot easier in the long run.

Let's unravel some of the most persistent myths about pips that often trip up even seasoned traders. These misconceptions can sometimes cloud judgment, so it is worth setting the record straight once and for all.

Many beginners often jump to the conclusion that a pip means instant profit or that every pip carries the same value. But if you dig deeper, the worth of a pip hinges on trade size and your account specifics. Also, not fully understanding decimal places especially with yen pairs can lead to painful and avoidable mistakes.

Pinpoint the currency pair you are trading and jot down the current bid and ask prices—keeping an eye on these numbers is key.

Figure out the pip size based on the pair’s decimal setup—most of the time it’s the fourth decimal place that matters but for JPY pairs it’s usually the second. Little quirks like this keep you on your toes.

Calculate the difference in pips between your entry and exit prices. It’s a simple step but don’t underestimate its importance.

Plug everything into the pip value formula—remember to factor in your lot size and account currency to see how those pips translate into actual dollars and cents or possibly a few lost sleep hours.

Take a good careful look at the results. This reflection moment can really steer your future trades in the right direction or give you a clear picture of how things shook out.

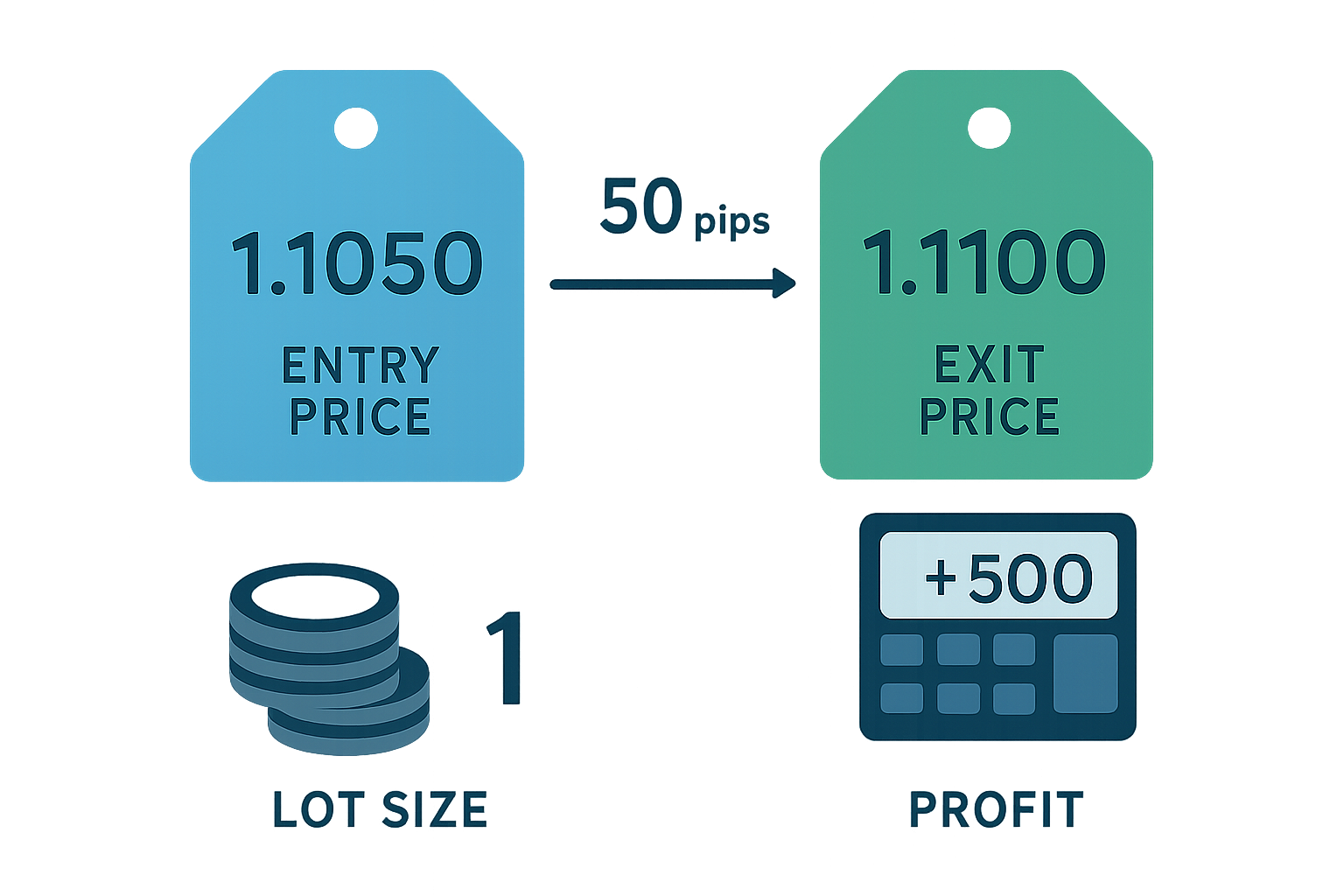

Imagine you buy EUR/USD at 1.1200 and then sell it at 1.1250. That’s a neat 50 pip gain right there. When you’re trading one standard lot, you multiply those 50 pips by the pip value—usually about $10 a pip.

Infographic illustrating step-by-step pip calculation with example currency pair and trade details

Forex markets have started quoting prices with an extra decimal place beyond the usual pip. This tiny unit called a "pipette" or fractional pip is basically one-tenth of a pip. It lets traders zero in on price changes with sharper precision and enjoy tighter spreads.

While a typical pip in EUR/USD sits neatly at the fourth decimal place, prices now often get quoted to the fifth decimal like 1.12345.

In Forex trading, the spread—that little gap between the bid and ask price—is typically measured in pips. Brokers set these spreads based on the current market mood and just how much liquidity is floating around. Getting a handle on the spread in pips is pretty important because it helps traders pin down the true cost of jumping in and out of trades.

Some brokers like to sneak in commissions on top of their spreads, so it is not always as straightforward as it seems. Understanding the pip meaning is absolutely key when you are trying to wrap your head around the full picture of your trading costs and fees.

14 posts written

Born in a family of traders, Emily Leroux combines inherited wisdom with modern approaches, seamlessly bridging the gap between traditional and innovative trading methodologies.

Read Articles

Understanding the bid-ask spread is essential for any trader. This article breaks down its meaning,...

Ever wondered what a pip means in trading? This article explains pips clearly, showing how they meas...

Understanding 'ATH' or All-Time High is essential in crypto trading. Learn what it means, why it mat...

Discover how Fitch Ratings assess credit risk and influence trading decisions in stocks and bonds. L...