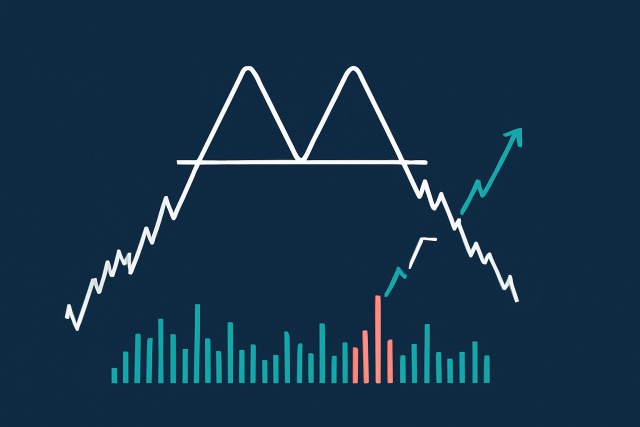

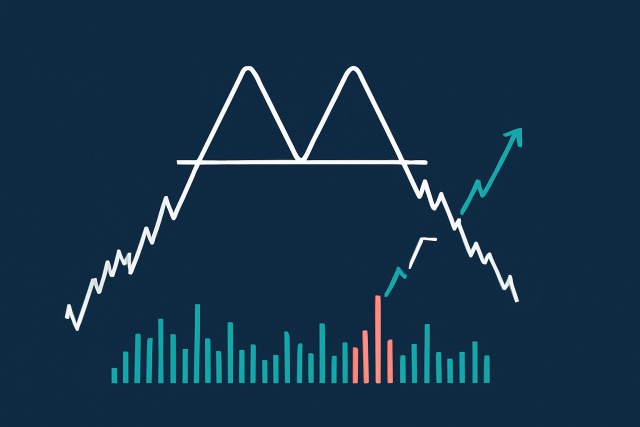

What Is a Double Top Pattern in Trading?

Discover how the double top pattern signals potential trend reversals in trading. Learn to identify,...

Position sizing is a important piece of the puzzle when it comes to managing risk in trading or investing. Using a position size calculator can really take the guesswork out of deciding how big your trade should be, based on the level of risk you are willing to stomach and where you’ve placed your stop-loss.

Before you start crunching numbers on your position size it’s important to understand how your overall trading capital, your comfortable risk per trade, and your chosen stop-loss level all interact.

Position sizing is all about figuring out how much money you throw into a particular trade, while keeping your risk limits firmly in sight. It’s a cornerstone of smart risk management because it helps shield your capital and keeps those pesky losses from running wild.

Each concept plays a important role in nailing down your position size. Your account size sets the total capital you’ve got ready to roll with. The risk per trade reflects how much you’re comfortable losing on any single trade—because hey, nobody likes surprises. Your stop-loss and entry price together sketch out the potential loss per share or contract. The pip or point value translates those market wiggles into cold, hard dollars in forex or futures. And let’s not forget volatility, which decides whether your stop-loss should be snug or a bit loose to dodge those annoying market jitters.

Figure out your total trading capital, which is basically the stash of money you’ve set aside specifically for trading adventures.

Decide on the maximum risk you’re comfortable taking on each trade usually expressed as a percentage of that total capital. Think of it as your personal safety net.

Find the right stop-loss distance by measuring the gap between your entry price and your stop-loss level. It’s a little like setting up bumpers in a bowling alley to keep things under control.

Work out the risk per unit or share, which boils down to the potential hit you’d take if your stop-loss gets triggered on just one unit. Small losses add up, so better to know upfront.

Plug these numbers into a position size calculator to dial in the ideal position size that keeps your risk comfortably within your limits no nasty surprises down the road.

Each step relies on straightforward formulas that won’t make your head spin. For example, say you’ve got $10,000 in capital and decide to risk just 1%—that means your maximum risk per trade is $100. If your stop-loss is set $2 away from your entry price the risk per unit is $2. This tells you your ideal position size is 50 units ($100 divided by $2).

Position size calculations can really differ across various markets. When it comes to stocks, you usually crunch the numbers by looking at the share price alongside your dollar risk per share—pretty straightforward stuff. Forex traders have their own language, working with pip values and stop-loss pips to nail down the right lot sizes. Futures contracts bring a bit more spice to the mix, since knowing point values and keeping an eye on volatility are key—they directly influence how you set your stop-loss distances.

| Market | Account Size | Risk % per Trade | Entry Price | Stop-Loss Distance | Unit Value (per share/pip/point) | Position Size | Max Risk ($) |

|---|---|---|---|---|---|---|---|

| Stocks | $10,000 | 1% ($100) | $50 | $2 | $1 (per share) | 50 shares | $100 |

| Forex | $10,000 | 1% ($100) | 1.2000 | 50 pips | $10 (per standard lot) | 0.2 lots | $100 |

| Futures | $10,000 | 1% ($100) | 3000 | 10 points | $10 per point | 1 contract | $100 |

This table lays out the key inputs and resulting position sizes, giving a clear picture of how these calculations shift when dealing with various asset types. It’s a handy little snapshot that reminds us just how different each market can be, even when playing with the same risk parameters.

Visual representation of position sizing principles across various financial markets

Catching these pitfalls early and tweaking your calculations can save you from costly blunders down the road. Be sure to factor in pesky transaction costs and pick stop-loss levels that reflect the market’s mood swings. Keep your risk percentages cautious and tailor your strategy to fit each market’s unique vibe.

Incorporating position sizing as a regular part of your trading routine - perhaps using a position size calculator - can really help build consistency and keep those pesky emotional decisions at bay. When you mix it up with smart stop-loss placement and take the time to carefully review your trades, you’re steadily improving your knack for managing risk and protecting your hard-earned capital over the long haul. Platforms like TradingView come packed with sophisticated charting tools that make analyzing stop-loss levels a bit more of a breeze, while Binance and Coinbase offer handy options that let you customize position sizes in crypto trading.

Are you tired of juggling multiple tools for your trading needs? TradingView is the all-in-one platform that streamlines your analysis and decision-making.

With its powerful charting capabilities, real-time data, and vibrant community, TradingView empowers traders like you to stay ahead of the market. Join thousands who trust TradingView for their trading success.

Are you ready to elevate your trading game? Binance, the leading cryptocurrency exchange, offers a seamless platform for traders of all levels. With its user-friendly interface and powerful tools, you can navigate the dynamic world of digital assets with confidence.

23 posts written

With 15 years of experience in commodity markets, Leila Amiri is transforming the field with her unique perspectives on sustainable investing and ESG integration.

Read Articles

Discover how the double top pattern signals potential trend reversals in trading. Learn to identify,...

Discover how the doji candlestick reveals moments of market indecision and learn to use these signal...

Discover how understanding and managing notional value empowers Binance traders to accurately assess...

Unlock the power of the double bottom pattern to spot bullish trend reversals. Understand its struct...