Contrarian Investing Using the AAII Sentiment Survey

Unlock the power of contrarian investing by leveraging the AAII Sentiment Survey. Learn how investor...

You’ve probably heard the term NFP when traders and investors chat, but many newcomers might still wonder what it means or why it matters. This article explains what NFP means in trading, explores its origins, and shows why it acts as a key economic indicator that can shake up global financial markets.

NFP stands for Non-Farm Payrolls. It is a monthly report from the U.S. Bureau of Labor Statistics. It captures the net change in jobs across the U.S. economy but skips farming, government, nonprofits and private households. This exclusion helps keep the spotlight on trends in private-sector employment.

The NFP report holds the spotlight when revealing how robust the U.S. labor market is and offers a clear snapshot of the economy's health. Employment numbers steer consumer spending and business investments, which drive economic growth. Traders keep a close eye on this report like their morning coffee. It helps them gauge market sentiment, anticipate changes in monetary policy, and predict trends across stocks, forex and commodities.

When it comes to Forex markets, few things stir the pot quite like NFP data. This monthly snapshot of nonfarm payrolls often sends traders into a frenzy, and for good reason. It offers a pretty clear peek into the health of the U.S. labor market, and when that number deviates from expectations, you can bet the currency values won’t just sit still. In my experience, watching the market react to NFP releases is a mix of science and a bit of art—it’s never just black and white. The swings can be wild, but that’s exactly what keeps traders glued to their screens, hoping to catch that perfect wave. So, whether you are a seasoned pro or just dipping your toes in, understanding how NFP data nudges Forex is key to staying ahead of the game.

Forex traders usually keep a close eye on the NFP report since it can spark sudden moves in the US Dollar. When job growth is stronger than expected, the USD tends to flex its muscles, hinting at a robust economy and possible higher interest rates. On the flip side softer numbers can put a damper on the dollar and ripple through currency pairs worldwide, especially those tied to the USD like EUR/USD and USD/JPY.

The NFP report drops every month, usually on the first Friday at 8:30 AM EST and it’s definitely one of those moments that grabs a ton of eyeballs.

Traders keep a close watch on how actual job growth stacks up against forecasts. When the numbers beat expectations the USD often gets a boost while weaker stats can put a damper on its mood.

After the release markets can swing wildly without much warning. It can be a rollercoaster bringing both higher risks and some tempting opportunities for the savvy trader.

Over the long haul repeated surprises in the NFP data aren’t just noise. They can nudge broader trends and shape how individuals expect monetary policy and currency values to evolve.

The Federal Reserve is all ears when it comes to NFP numbers because they tie employment figures closely to inflation and the overall health of the economy. This influences their decisions on interest rates.

Forex market volatility around the time of the NFP report release, illustrating sharp USD value fluctuations.

Forex markets usually jump in first. The NFP report also sends ripples through stock indices, commodities and bond yields. Strong employment figures tend to lift overall confidence in the economy and often nudge stock prices upward. This can put a bit of a squeeze on safe-haven assets like gold.

The NFP report dives into more than just the headline jobs number. It also provides key labor market indicators like the unemployment rate and average hourly earnings. The report covers the labor force participation rate and updates to earlier reports. Each piece offers a unique glimpse into different corners of the economy.

| Component | Description | Why It Matters |

|---|---|---|

| Non-Farm Payrolls | The number of jobs gained or lost in sectors outside of agriculture | This gives a pretty good pulse on the job market's health and often sets the tone for growth forecasts |

| Unemployment Rate | The share of the labor force currently without a job | Sheds light on how much breathing room there is in the labor market and the economy’s overall wellbeing |

| Average Hourly Earnings | Tracks wage growth across various industries | Serves as a key inflation barometer that can nudge consumer spending and shape Fed decisions |

| Labor Force Participation | The percentage of working-age people actively working or looking for work | Offers insight into how engaged individuals are in the workforce and hints at the economy’s real potential |

| Previous Month Revisions | Updates to past employment numbers based on new data | Helps us fine-tune our expectations about where the job market really stands |

Because the NFP report tends to unleash serious market fireworks, traders need to buckle up by managing risk and watch for potential opportunities. It’s all about having a solid grasp on what the market’s whispering about expectations, plotting sharp entry and exit points and setting up safety nets like stop-loss orders.

Scope out consensus estimates and the freshest forecasts to get a real feel for what the market’s expecting.

Set clear entry and exit points upfront, depending on whether the report comes in stronger or weaker than anticipated.

Use stop-loss orders as your safety net to manage any sudden, heart-stopping price swings once the report drops.

Keep leverage in check—nobody wants to bite off more risk than they can chew during those wild, volatile stretches.

Keep a close eye on price movements after the release so you can nimbly adjust your positions as the market digests all the new info.

"Trading around the NFP report can open the door to some pretty rewarding opportunities, but let us be honest, it also comes with its fair share of risks since the market tends to jump around quickly and unpredictably. Keeping your cool, sticking to a solid game plan, and managing your risks like a pro usually make all the difference when navigating this economic rollercoaster."

The NFP report is definitely a big deal but there’s a fair share of myths floating around about its impact on trading markets. Some individuals seem to believe it always nails the market direction or that it’s something only forex traders need to worry about. In reality, things aren’t quite that black and white.

Understanding what NFP means and its true impact really hits home when you take a step back and look at past releases that sparked some serious market fireworks.

Tired of missing opportunities and making suboptimal trading decisions? TrendSpider's cutting-edge platform automates complex technical analysis, saving you time and reducing human error.

With multi-timeframe analysis, dynamic alerts, backtesting, and customizable charting, you'll gain a competitive edge in identifying trends and making informed trades across global markets.

As a dedicated trader, you know the power of technical analysis in navigating the financial markets. TrendSpider is the cutting-edge tool you need to take your trading strategies to new heights. With its advanced charting capabilities and automated pattern recognition, TrendSpider empowers you to make informed decisions faster.

10 posts written

Combining cutting-edge mathematical models with a deep understanding of market dynamics, Shion Tanaka has revolutionized algorithmic trading strategies, yielding unprecedented returns for global financial institutions.

Read Articles

Unlock the power of contrarian investing by leveraging the AAII Sentiment Survey. Learn how investor...

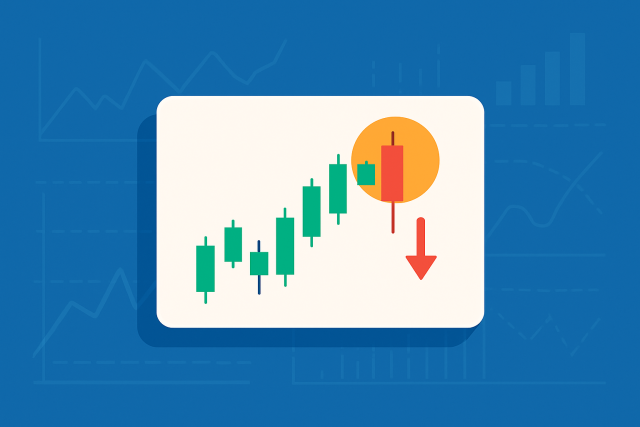

Hammer candle patterns are essential for spotting trend reversals. This guide simplifies their meani...

Discover how the DEM indicator offers a smoother, more responsive view of market trends. This guide...

Master the hanging man formation to spot potential bearish reversals confidently. This guide breaks...