What Does 'Tanked' Mean in Trading Terminology?

Discover what 'tanked' means in trading—how it describes sharp asset declines, causes behind these d...

Understanding the oto meaning can help beginners decode what might otherwise feel like alphabet soup. Getting a handle on what 'OTO' actually means can make a big difference. It lets traders set up automated conditional orders that take some weight off their shoulders. This simplifies execution and helps manage risk more smoothly.

OTO stands for "One-Triggers-Other" order. It’s a type of conditional or linked order where filling one trade automatically kicks off a follow-up trade. This clever setup lets traders line up multiple trades that hinge on specific conditions.

The best way to really get the hang of how an OTO order works is to look at a simple example. Imagine you put in a main buy order for a stock. Once that order goes through, a linked sell order—designed to either lock in your profits or cut your losses—automatically kicks into action.

The trader kicks things off by placing a main order such as buying 100 shares at a specific price laying the groundwork for what’s next.

Once this main order is fully executed it immediately triggers the next chain of events.

The secondary order springs into action automatically and could be a stop-loss or a take-profit sell order working quietly behind the scenes.

This secondary order follows its own set of rules and waits patiently for the price to reach a certain level.

Finally after the secondary order is either executed or canceled the entire OTO sequence finishes neatly with no loose ends left.

Trading can be a wild ride, but OTO (One-Triggers-Other) orders help put a little order in the chaos. These nifty tools come in handy when you want to set up a plan that kicks off one action after another without having to babysit the screen all day. Whether you are trying to lock in profits or cut losses, OTO orders let you automate follow-up moves, making life a tad easier and your strategy a bit more precise. It is like having a reliable trading buddy who’s always ready to step in when you need, even if you’re taking a quick coffee break. Traders often lean on OTOs to juggle multiple scenarios—whether the market’s behaving or throwing curveballs—helping keep emotions in check and making your approach a touch more disciplined.

Traders often lean on OTO orders to kick off a position while simultaneously setting up exit plans like stop-loss and take-profit orders. This handy approach not only automates risk management but also takes the emotional rollercoaster out of decision-making.

Using an OTO order is a bit like setting up a row of dominoes—once the first trade falls into place, the next one kicks off automatically. It’s a handy way to stay on course without having to babysit every single move, which honestly, can save you a ton of headache.

OTO orders link an initial order to a follow-up one making the process feel more seamless. On the flip side, types like OCO (One-Cancels-Other) and OSO (One-Sends-Other) have their own quirky ways of triggering and executing each with a unique twist.

| Order Type | Meaning | Trigger Condition | Execution Behavior | Typical Use Case |

|---|---|---|---|---|

| OTO | One-Triggers-Other | When the primary order gets executed, it sets off a second order like clockwork | The second order only kicks in after the first one wraps up neatly | Jumping into a trade while simultaneously lining up linked stop-loss or take-profit orders |

| OCO | One-Cancels-Other | Executing one order instantly cancels the other, avoiding any awkward overlap | As soon as one order fills, the other is politely canceled | Choosing between two exit strategies, such as stop-loss versus take-profit, without breaking a sweat |

| OSO | One-Sends-Other | Placing one order automatically fires off another one alongside it | Both orders launch together but each marches to its own beat | Kicking off conditional entry orders with linked follow-up orders, keeping things tidy |

| Standalone | Single order | Executes right away or waits for set conditions, no strings attached | Runs solo, following its own rules without linking to anyone | Straightforward buy or sell orders with no extra baggage |

Popular trading platforms like MetaTrader 4/5, Thinkorswim and Interactive Brokers typically offer OTO order features through interfaces that won’t make your head spin. Traders tend to opt for the OTO option and carefully set up their primary and secondary orders. Then they give a nod to the conditional link tying them together before hitting that all-important confirm button.

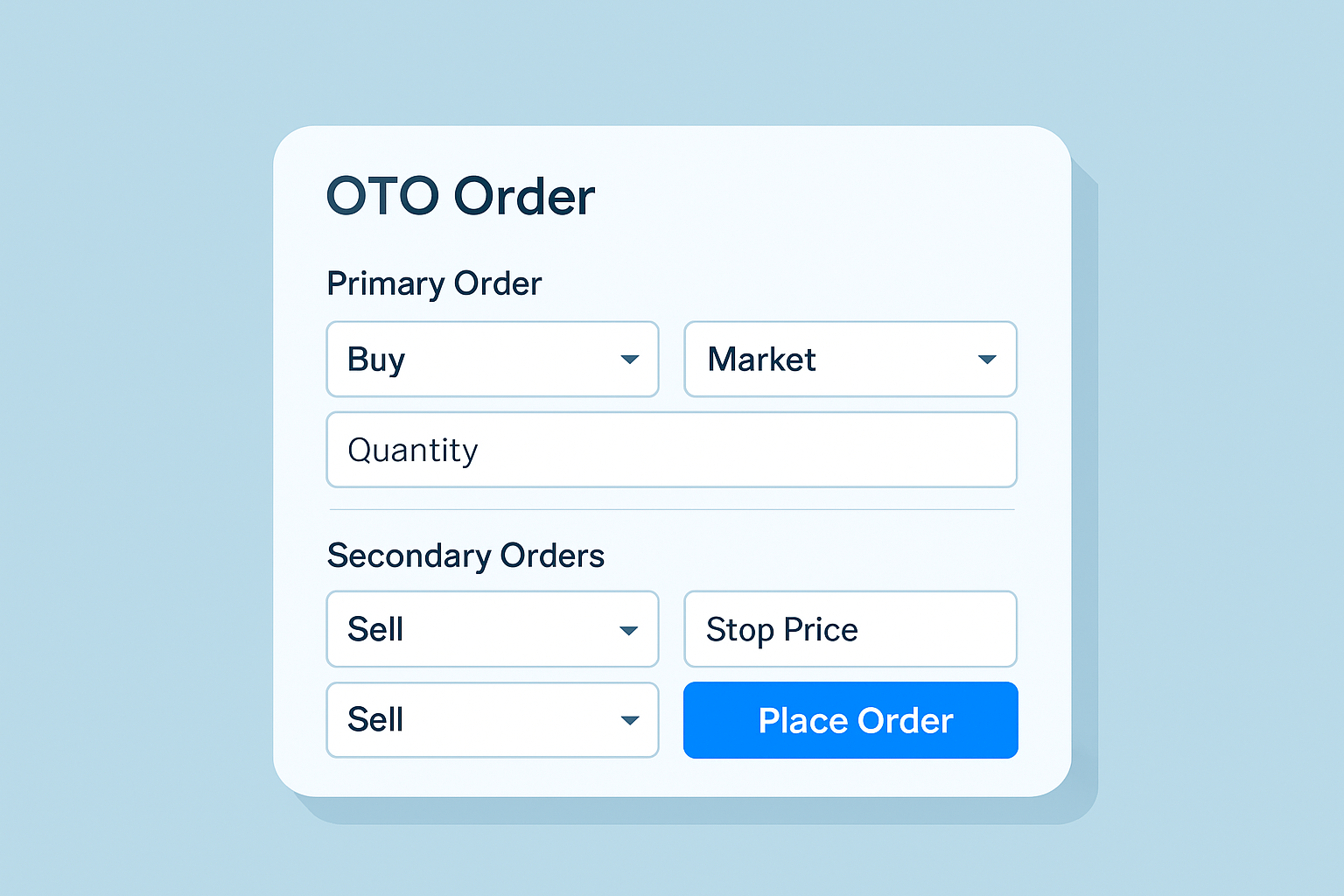

Screenshot of a trading platform’s OTO order entry screen highlighting linked order setup options

OTO orders offer handy automation but traders should keep a few things in mind like relying too heavily on automated triggers and the sneaky risk of missing executions when the market gaps. Platform-specific quirks can also throw a wrench into how orders actually play out.

To really understand the oto meaning and make the most of OTO orders without unnecessary risks, traders often find it smart to start with demo accounts. It’s best to keep trade setups simple, set clear exit points and watch their linked open orders carefully.

17 posts written

Driven by her passion for empowering individual traders, Annika Eriksson is a renowned educator, offering practical strategies and actionable insights for successful trading.

Read Articles

Discover what 'tanked' means in trading—how it describes sharp asset declines, causes behind these d...

Understanding 'ATH' or All-Time High is essential in crypto trading. Learn what it means, why it mat...

Explore the dovish meaning in trading—understand its origins, market implications, and why recognizi...

Understanding the bid-ask spread is essential for any trader. This article breaks down its meaning,...