Understanding the Bullish Harami Candlestick Pattern

Discover the bullish harami candlestick pattern—a key technical signal that can hint at trend revers...

This article breaks down how to trade inside bar patterns in a way that brings you clearer entries and keeps your risk tighter than ever.

Inside bar setups are solid technical patterns that savvy traders often lean on to pinpoint clearer entry points with a bit less risk. When you catch these tight little formations, it’s like having a heads-up that lets you plan your trades more thoughtfully and nail your timing.

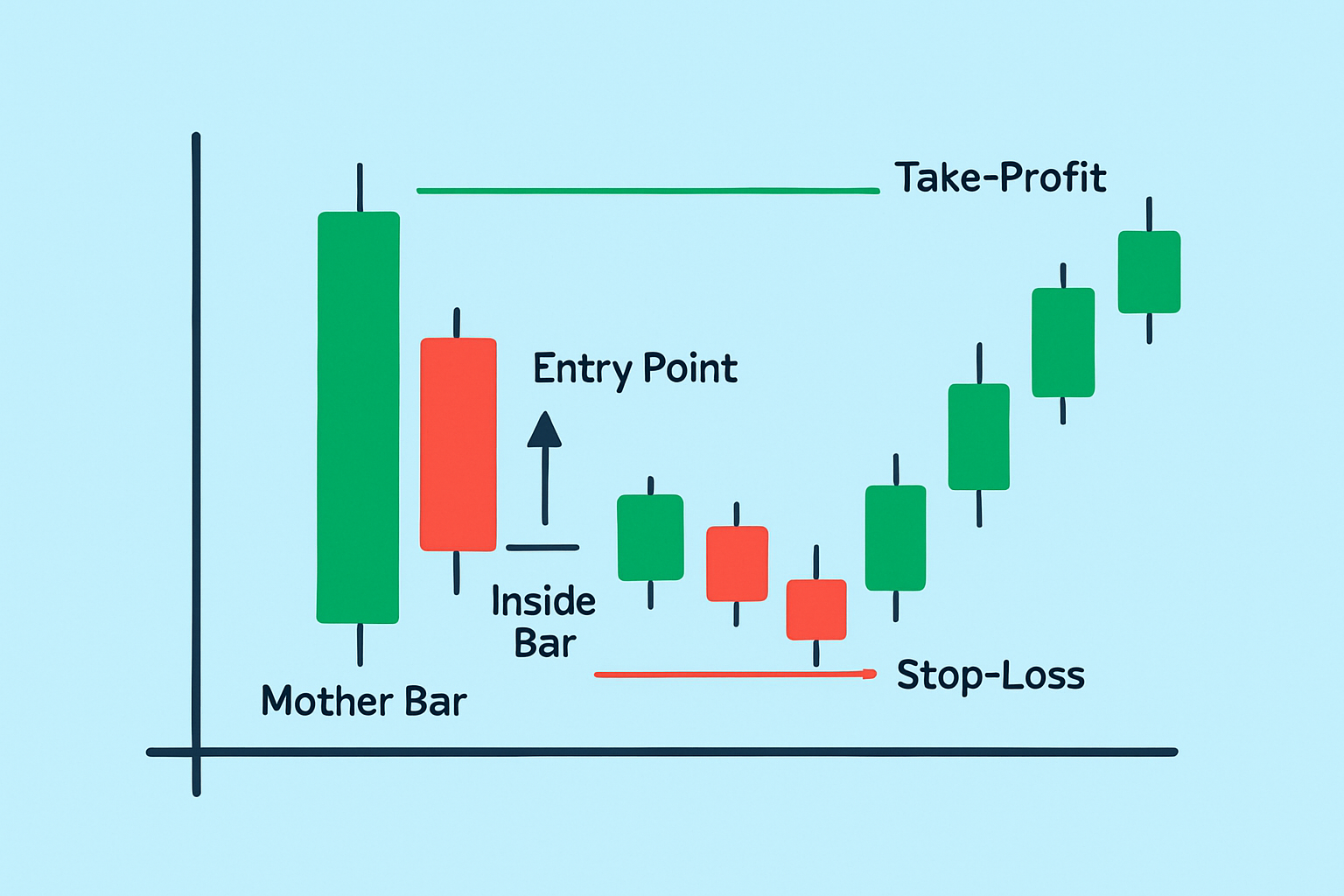

A price bar snugly fits within the range of the bar that came before it known as the mother bar. This setup often points to some market indecision or consolidation because neither buyers nor sellers managed to grab the reins during the inside bar's timeframe. Psychologically speaking, inside bars represent a momentary pause or a close tug-of-war between bulls and bears just before the market decides which way to break out.

The inside bar pattern involves two main candles: the larger mother bar that sets the stage by defining the range and the inside bar that fits entirely within that range. Sometimes you will spot multiple inside bars or more elaborate setups that keep things interesting.

Traders often find themselves caught in the trap of leaning too heavily on inside bars without stepping back to see the bigger picture, which can lead to false breakouts or simply misreading the signal altogether. Keeping an eye on the overall trend and double-checking indicators like volume or momentum usually does the trick to sift out the weaker signals.

Before diving into trading an inside bar setup it’s important to keep an eye out for those sweet spots in the market—think moderate volatility paired with a clear trend or range. Using volatility filters is a great way to dodge those messy, choppy markets that make you want to pull your hair out.

Scan your charts for recent inside bar patterns paying extra attention to higher timeframes such as the 4-hour or daily because they often provide stronger signals based on my experience.

Double-check that the mother bar is significant by looking for a wide range and seeing if it fits snugly around key levels like support or resistance.

Choose your entry trigger carefully. Consider going long when the price breaks above the mother bar’s high or short if it drops below the low.

Place your stop-loss just beyond the opposite end of the mother bar. This is a useful trick to help prevent fakeouts from disrupting your trade.

Set profit targets that seem realistic based on nearby support or resistance zones or use a solid risk-to-reward ratio such as 1 to 2 or 1 to 3.

Stay alert during the trade. Move stops up to breakeven once price starts moving in your favor and don’t hesitate to take partial profits when you reach those ideal levels.

Snag cleaner entries and cut down on slippage, it’s usually smarter to lean on limit orders near breakout points rather than diving in with market orders.

Crunch the risk-to-reward ratio before jumping into any trade. When you are working with inside bars, it’s wise to size your position according to the snug range of the mother bar.

Annotated chart example of a successful inside bar trade setup showing entry, stop-loss, and take-profit points.

Traders often run into hurdles such as false breakouts that flip on you almost immediately. They also face long stretches of sideways markets that leave you scratching your head and frustrating periods of low liquidity where prices behave like they’re on a wild rollercoaster.

Adding tools like moving averages or Fibonacci retracement levels can give inside bar analysis extra muscle. Trendlines also back up the overall trend and highlight key price levels.

To really sharpen your skills and build up that all-important confidence, give practicing inside bar setups on demo accounts or with small position sizes a shot. It’s a smart way to fine-tune your approach without throwing a lot of capital on the line.

Are you tired of juggling multiple tools for your trading needs? TradingView is the all-in-one platform that streamlines your analysis and decision-making.

With its powerful charting capabilities, real-time data, and vibrant community, TradingView empowers traders like you to stay ahead of the market. Join thousands who trust TradingView for their trading success.

Are you ready to elevate your trading game? Binance, the leading cryptocurrency exchange, offers a seamless platform for traders of all levels. With its user-friendly interface and powerful tools, you can navigate the dynamic world of digital assets with confidence.

16 posts written

With over two decades of experience navigating volatile markets, Ludovik Beauchamp provides invaluable guidance on risk management, portfolio optimization, and adaptability in the face of uncertainty.

Read Articles

Discover the bullish harami candlestick pattern—a key technical signal that can hint at trend revers...

Unlock the power of the head and shoulders pattern with this complete guide. Learn to spot, trade, a...

Learn how the harami candlestick pattern signals potential market reversals. This guide breaks down...

Master the hammer candlestick pattern—a key indicator for market reversals. This beginner-friendly g...