Most Important Candle Patterns Every Trader Should Know

Unlock the power of candle patterns to decode market psychology and improve your trading precision....

The ascending wedge is a key bearish reversal pattern that every trader should learn to spot early on, if only to protect hard-earned profits and keep losses in check. Catching it before the breakdown can often be a real lifesaver.

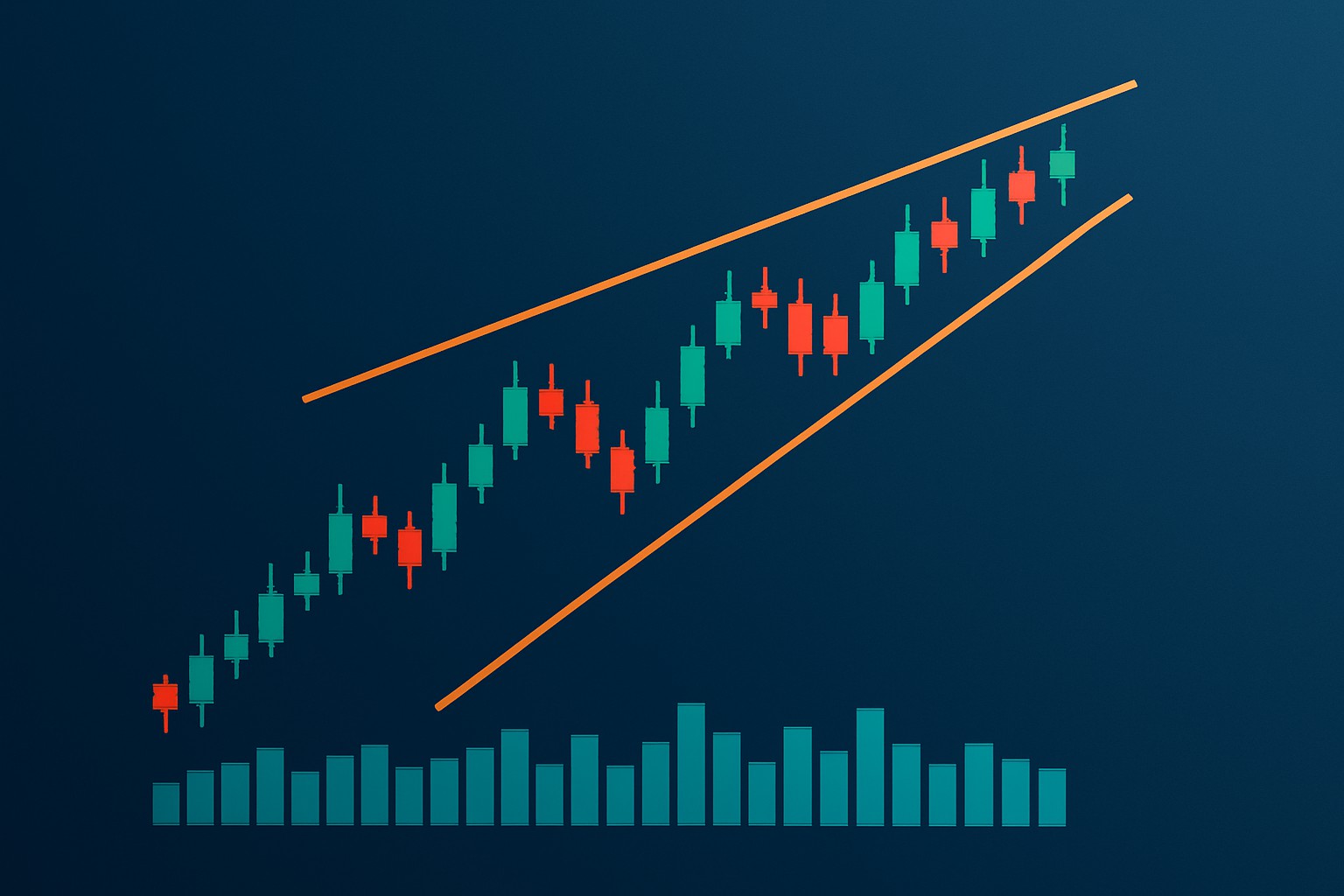

An ascending wedge is a classic technical chart pattern where the upward sloping trendlines start to inch closer together. It shows up when the price keeps pushing higher highs and higher lows but those gains begin to lose steam, resulting in a tightening range.

Chart illustrating an ascending wedge pattern with converging trendlines and price action forming higher highs and higher lows

Ascending wedges tend to break down quite often because the initial burst of buying momentum starts to fizzle out even though prices keep climbing. Buyers keep nudging prices higher but with less punch since those higher lows don’t drum up enough demand to keep the uptrend fully charged. Meanwhile, sellers quietly ramp up their pressure, almost sniffing out that the price gains might be running on fumes. This tug-of-war between supply and demand slowly shifts market sentiment. Early optimism begins to dwindle and more cautious traders start locking in profits to play it safe. As the wedge tightens, you’ll notice price swings shrinking and signaling hesitation before the usual breakdown.

Keep an eye out for converging upward trendlines marked by classic higher highs and higher lows as the price range squeezes tighter.

Take a peek at volume patterns during the wedge formation. Usually, a downward trend here hints that buyer enthusiasm is fading.

Observe the price action closely for hesitation signals such as smaller candlestick bodies or refusal to break out to fresh highs.

Lean on momentum indicators like RSI and MACD to back up your read, especially when they show bearish divergences or momentum running out of steam.

It’s key to spot an ascending wedge from similar patterns like channels or flags if you want to avoid false signals. Take a close look at how the trendlines come together. Unlike channels where the lines run parallel, wedges slowly squeeze toward a point. Volume usually takes a nosedive in ascending wedges while channels keep volume steadier. Pairing these visual clues with momentum indicators can boost your accuracy and save you from jumping to conclusions about whether the trend will keep rolling.

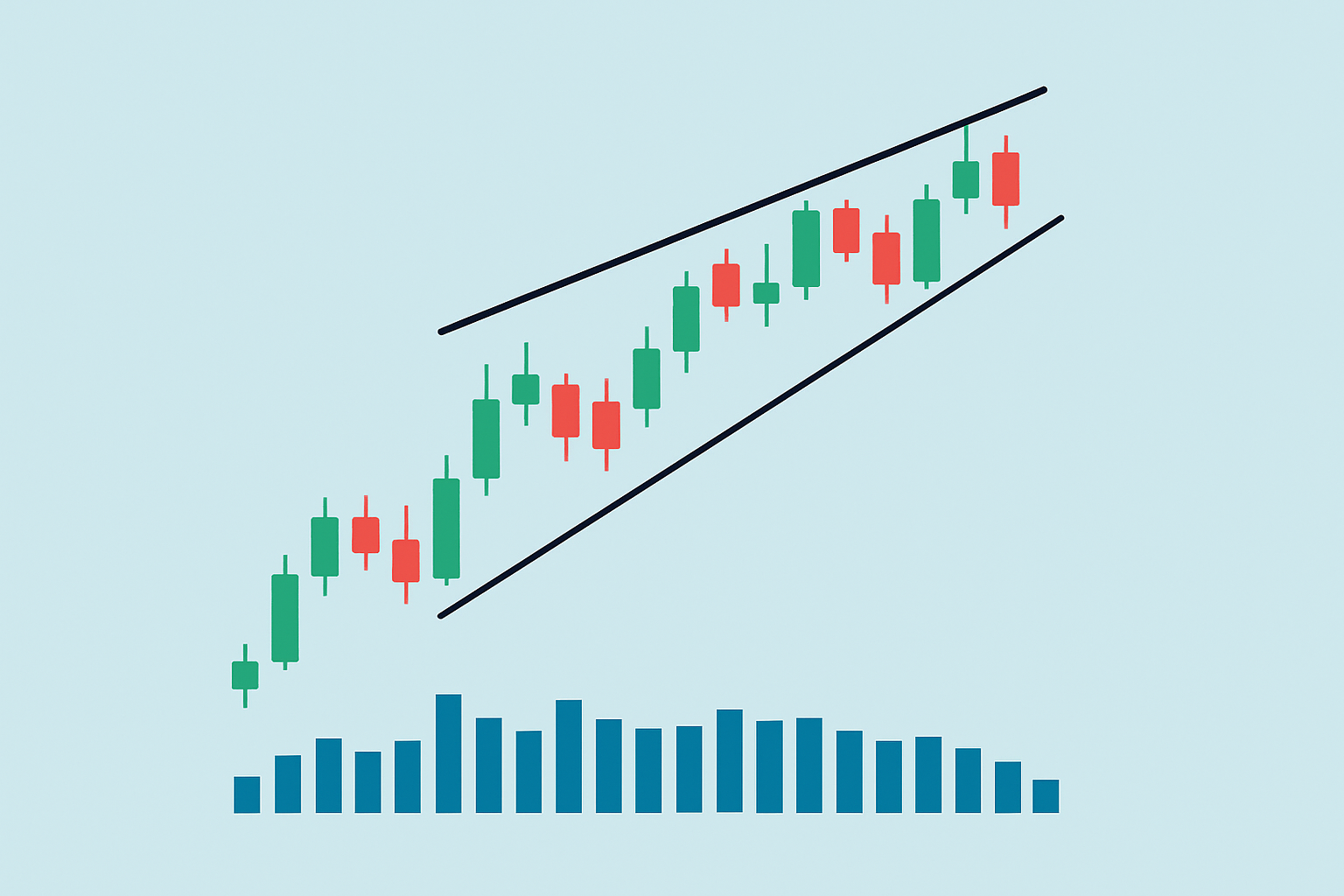

Nailing an ascending wedge takes a bit of patience and a keen eye for those trendlines that tighten up as price action squeezes in over multiple timeframes. It’s worth keeping a close watch on how the price behaves near the wedge’s tip, and pairing that with volume clues to really get a solid read on the pattern.

Keep an eye out for two or three notable swing lows that you can connect to form an upward support trendline. It’s like finding the sturdy anchors in a sea of price movements.

Similarly, link two or three swing highs with an upward resistance trendline to create an invisible ceiling that price action respects.

Make sure these lines converge to shape a narrowing wedge. This usually means the price range is squeezing tighter and getting ready for something to give.

Notice how traded volume tends to dip as the wedge forms. It’s almost like momentum is catching its breath before the next move.

Peek at this pattern across different timeframes like daily and weekly charts since it helps confirm whether the pattern’s playing by the rules or just putting on a show.

Multi-timeframe chart illustrating an ascending wedge pattern with trendlines and declining volume

Steer clear of these issues by pairing your wedge analysis with a handful of indicators and confirmations from higher timeframes. Combining volume trends with RSI or MACD divergences tends to give your signals a bit more punch and reliability.

Hold off until you see a clear breakdown where the price decisively closes below the wedge’s support trendline. This helps you avoid those tricky false breakouts that can catch you off guard.

Place a stop-loss just above the most recent resistance line of the wedge. It’s a simple step but can really protect you when things don’t go as planned.

Manage your risk by sizing your position based on how much you’re comfortable losing. Never risk everything on a single trade, no matter how tempting it seems.

Set profit targets by measuring the wedge’s height at its widest point and projecting that downward, or aim for solid previous support levels. Think of this as setting a realistic goal.

Watch the trade closely for any sudden changes in momentum. Be ready to adjust your plan or cut your losses if you notice signs of a reversal because staying flexible can be your best asset in trading.

When false breakouts pop up, it’s usually a smart move to hold off and wait for volume confirmation or other momentum clues before adding more to your position. Trailing stops come in handy here—they can protect your profits if the price suddenly takes a nosedive after the initial slip.

Use technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to spot those subtle signs of weakening momentum tucked inside the wedge. Volume analysis tools come in handy too, helping to confirm a drop in participation something wedges are notorious for showing.

Take one example from the tech sector: a daily chart of a major stock revealed an ascending wedge quietly shaping up over three weeks. Alongside it, volume was nosediving sharply and the RSI was throwing a bearish divergence flag—both subtle hints that trouble might be brewing. The pattern wrapped up in a steep breakdown, sending the stock tumbling a painful 15% over the following two weeks. Then there’s a case from the forex world, involving a wedge spotted on a 4-hour EUR/USD chart. Catching it early saved traders from some nasty losses, and they cleverly rode the wave by shorting right after the breakdowns were confirmed. TrendSpider’s pattern recognition tools gave them a sharper edge for timing those entries.

Tired of missing opportunities and making suboptimal trading decisions? TrendSpider's cutting-edge platform automates complex technical analysis, saving you time and reducing human error.

With multi-timeframe analysis, dynamic alerts, backtesting, and customizable charting, you'll gain a competitive edge in identifying trends and making informed trades across global markets.

As a trader seeking opportunities in the dynamic crypto market, you need a reliable and secure platform to execute your strategies. Coinbase, the leading cryptocurrency exchange, offers a seamless trading experience tailored to your needs, empowering you to navigate the market with confidence.

11 posts written

With over a decade of experience navigating the intricate world of trading, Quentin Merriweather's expertise lies in developing innovative strategies that harness the power of cutting-edge technologies.

Read Articles

Unlock the power of candle patterns to decode market psychology and improve your trading precision....

Unlock the power of the head and shoulders pattern with this complete guide. Learn to spot, trade, a...

Learn how the harami candlestick pattern signals potential market reversals. This guide breaks down...

Discover the bullish harami candlestick pattern—a key technical signal that can hint at trend revers...