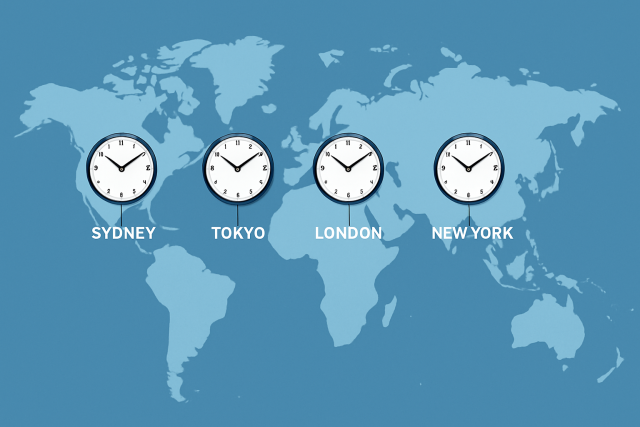

What is Foreign Exchange Trading Hours?

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

This article breaks down Forex lot sizes and why they are important for keeping your risk in check—especially if you are starting out on your trading journey.

Forex trading, understanding what is a lot size basically tells you how much currency you’re buying or selling—kind of like the portion size of your trade.

A lot in Forex is basically the standard unit that tells you just how much currency you’re trading. Instead of juggling individual currency units, Forex bundles them into lots to size up trades neatly. This method keeps things consistent and a whole lot easier to wrap your head around.

Lot size is what sets the stage for just how much currency you’re buying or selling with each trade, and it directly shapes your trading volume.

Your lot size sets the trade size and plays a huge role in determining the value of one pip— that tiny price change in Forex that can make all the difference. The bigger the lot, the more each pip is worth so your gains or losses can really add up with every move.

| Lot Size | Units of Currency | Pip Value (EUR/USD) | Monetary Impact Per Pip |

|---|---|---|---|

| Standard Lot | 100,000 | $10 | High, packing a punch with serious profit or loss potential |

| Mini Lot | 10,000 | $1 | Moderate, striking a nice balance for those who like to keep things in check |

| Micro Lot | 1,000 | $0.10 | Low, perfect for beginners dipping their toes in the waters |

| Nano Lot | 100 | $0.01 | Very low, which means you’re barely flirting with risk here |

Leverage and margin are key concepts tied to lot size. Leverage lets you control larger positions than the cash you have on hand. This can boost your potential profits but also increases the risks, making it a double-edged sword.

Picking the right lot size is vital for safeguarding your trading capital. It’s the difference between taking a big hit and staying afloat during volatile times. Plus, it helps you avoid nasty margin calls and sets the groundwork for consistent profits over time.

"Getting a handle on lot sizes early in your trading journey really helps you manage risk with a bit more confidence, while slowly building your skills step by step — turning that nagging uncertainty into real opportunities to hit your stride."

Calculating lot size boils down to a straightforward formula that factors in your account balance and the amount of risk you are comfortable taking per trade. It also considers the stop loss distance in pips and the pip value. Sticking to this method helps you avoid risking more than you bargained for and keeps your trading disciplined.

Get a clear picture of how much cash you’ve actually got sitting in your trading account, then pick a risk percentage per trade that doesn’t make you sweat—usually somewhere around 1 or 2 percent does the trick.

Take your account balance and multiply it by that trusty risk percentage to find out the exact dollar amount you’re okay with potentially losing.

Figure out how many pips you will set for your stop loss—a neat little safety net that keeps any nasty surprises from wrecking your day.

Do the math to find the right lot size by combining the pip value for your chosen currency pair with that stop loss, so everything fits snugly within your risk comfort zone.

A lot of new traders tend to jump in with lots that are too big and often miss how leverage really works or fail to match their lot size to their account balance properly.

Start small with manageable lot sizes to dodge the usual pitfalls. Take your time learning how to adjust your risk thoughtfully—it's better to be methodical than to dive headfirst into big trades and get burned.

A beginner Forex trader thoughtfully calculating lot size while reviewing charts on a laptop.

Learning to handle lot sizes definitely takes time and practice, especially when understanding what is a lot in trading. It's normal to feel overwhelmed at the start but breaking it down step by step can help you build strong habits. Steady learning paired with handy tools like demo trading platforms or calculators can take much of the guesswork and stress out of managing your risk.

17 posts written

Driven by her passion for empowering individual traders, Annika Eriksson is a renowned educator, offering practical strategies and actionable insights for successful trading.

Read Articles

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...

Understand the key drivers behind Myanmar currency fluctuations in forex trading, from domestic refo...

Discover the ins and outs of currency market opening hours, their global structure, and how masterin...

El Salvador blends traditional dollars with Bitcoin in a pioneering monetary system, reshaping how m...