Most Important Candle Patterns Every Trader Should Know

Unlock the power of candle patterns to decode market psychology and improve your trading precision....

Technical analysis reveals that certain candlestick patterns can be telling when spotting market reversals. Take the gravestone doji for instance—it often signals a potential turn especially during uptrends. Oddly enough, many traders tend to overlook it or confuse it with other doji varieties which means they miss valuable clues.

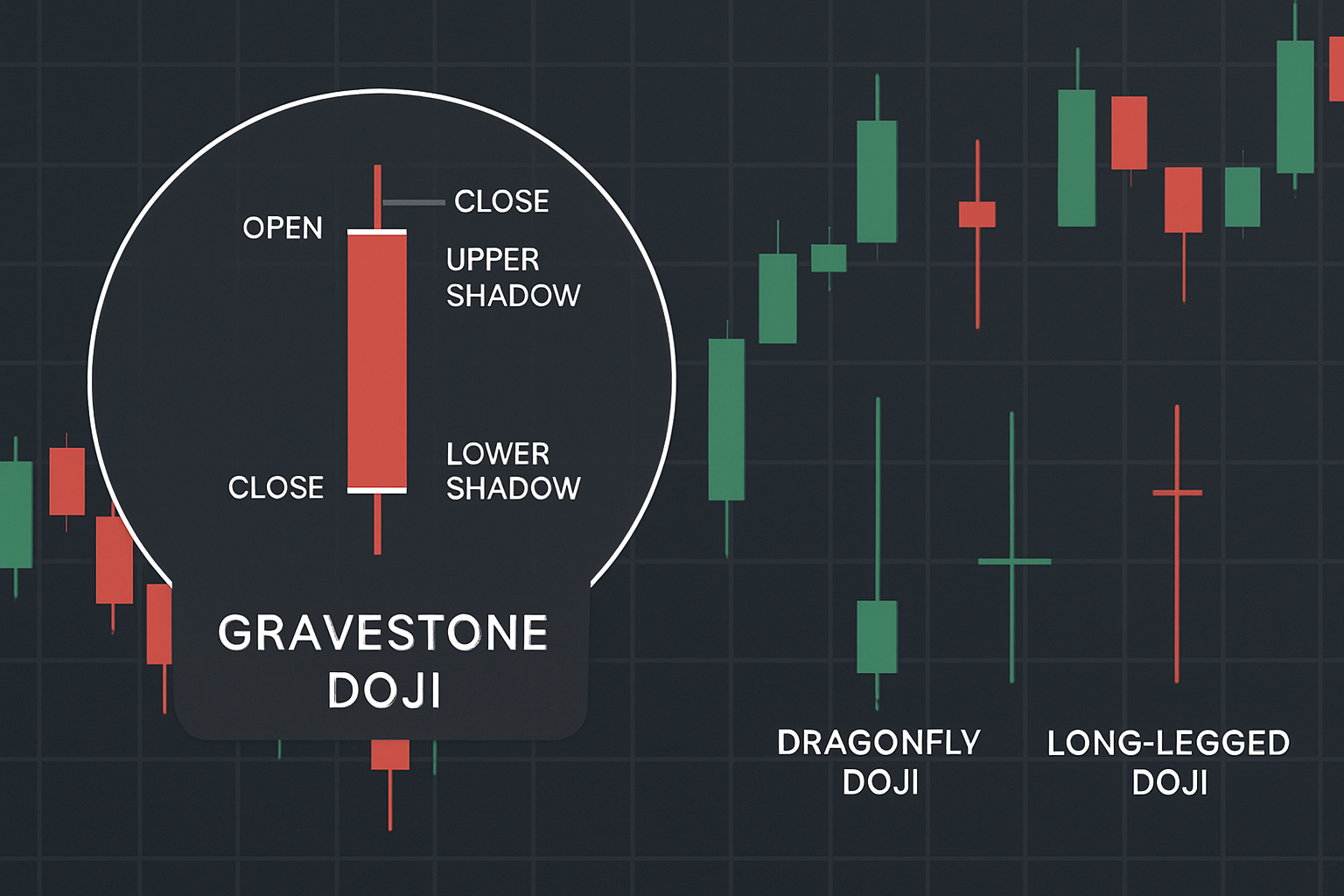

A gravestone doji candle is a truly distinctive candlestick pattern where the opening and closing prices are almost neck and neck, sitting right at the low end of the candle. It’s marked by a long upper shadow and barely any lower shadow to speak of.

When a gravestone doji pops up, buyers initially push the price higher while trying to call the shots.

Gravestone doji candles can be quite handy since they often hint at a possible bearish reversal especially after a good run-up in prices. They reveal a tug of war between buyers and sellers because buyers manage to push prices up but eventually cannot hold the reins. This shift usually signals that bullish momentum is running out of steam and gives traders a nudge to brace for a potential pullback or correction.

A gravestone doji candle often quietly whispers that buyer enthusiasm is starting to wane. It’s a subtle yet unmistakable hint that sellers are slowly but surely creeping back into the driver's seat.

To reliably spot a gravestone doji it’s all about tuning into that distinctive candle shape and the market vibes happening around it. Be patient before calling it—take a good, close look at details like shadow lengths and where prices are hanging out.

Annotated chart showing a classic gravestone doji candle with labels for the open, close, long upper shadow, minimal lower shadow, alongside other doji types for comparison.

Traders often get tripped up by gravestone doji candles, confusing them with other doji types or missing key details about the context they are appearing in. Skipping over factors like trading volume or the prior trend usually leads to misreading the signals and some less-than-stellar trading decisions.

Using gravestone doji candles in your trading can really boost your decision-making because they often signal potential reversals nearby. Traders who find consistent success usually do not rely on them alone. Instead, they pair these candles with volume confirmation, support and resistance levels and well-placed stop-loss orders to manage risk effectively.

It is your hint at a potential reversal brewing.

This extra nudge can really boost your confidence in making the call.

It’s a handy way to time your entry and nail down price targets more precisely.

To keep your risk in check, especially if the reversal decides to play hard to get.

Because honestly, the signal’s a bit less reliable in those conditions.

| Doji Type | Shape Features | Typical Market Implications | Common Scenarios |

|---|---|---|---|

| Gravestone Doji | Opens and closes right around the low, sporting a long upper shadow but completely missing a lower shadow | Usually flashes a bearish reversal sign after an uptrend rides its wave | Shows up when sellers decide it’s their turn to call the shots after prices have climbed |

| Dragonfly Doji | Opens and closes near the high, featuring a long lower shadow with no upper shadow in sight | Often hints at a bullish reversal following a downtrend slump | Happens when buyers suddenly muster the strength to push prices back up after a fall |

| Long-Legged Doji | Boasts long upper and lower shadows, with open and close almost hugging the middle | Captures a market caught in a tug-of-war, signaling indecision that might lead to a trend change or continuation | Pops up during periods of wild swings and plenty of uncertainty |

| Standard Doji | Has a tiny body paired with short or sometimes no shadows at all | Reflects a standstill moment where buyers and sellers are evenly matched | Commonly appears across various market settings, especially when trading feels flat and quiet |

Doji candles hint at indecision but the gravestone doji really stands out because it screams a clear drop in bullish momentum after buyers just cannot keep prices afloat. Unlike your run-of-the-mill dojis, it appears near the session's low and flaunts a prominent upper shadow that gives a much more convincing bearish signal—especially if you’ve just seen a rally.

Gravestone doji candles can definitely lend a hand but they’re no silver bullet for making trading decisions. These patterns can send mixed signals in markets that are thinly traded or noisy. Smart traders don’t rely on gravestone dojis alone. They back them up with a broader look at trends, volume analysis and other technical indicators.

Tired of missing opportunities and making suboptimal trading decisions? TrendSpider's cutting-edge platform automates complex technical analysis, saving you time and reducing human error.

With multi-timeframe analysis, dynamic alerts, backtesting, and customizable charting, you'll gain a competitive edge in identifying trends and making informed trades across global markets.

As a trader seeking opportunities in the dynamic crypto market, you need a reliable and secure platform to execute your strategies. Coinbase, the leading cryptocurrency exchange, offers a seamless trading experience tailored to your needs, empowering you to navigate the market with confidence.

23 posts written

Driven by a passion for uncovering the hidden patterns that underlie market dynamics, Isla Wyndham brings a unique perspective to the realm of trading, blending quantitative analysis with a keen intuition for human behavior.

Read Articles

Unlock the power of candle patterns to decode market psychology and improve your trading precision....

Unlock the power of the bear flag pattern with our practical, step-by-step guide. Understand market...

Learn how the harami candlestick pattern signals potential market reversals. This guide breaks down...

Discover the bullish harami candlestick pattern—a key technical signal that can hint at trend revers...