How money in el salvador works with bitcoin adoption?

El Salvador blends traditional dollars with Bitcoin in a pioneering monetary system, reshaping how m...

In the fast-moving world of forex trading, knowing when to jump in can be as important as knowing what to trade. The term "Asian Hours" pops up often in these conversations, but what exactly is the asian hours meaning? This article breaks down the concept of Asian Hours and explores why it matters and which markets come into play. It also explains how this slice of the day influences trading strategies.

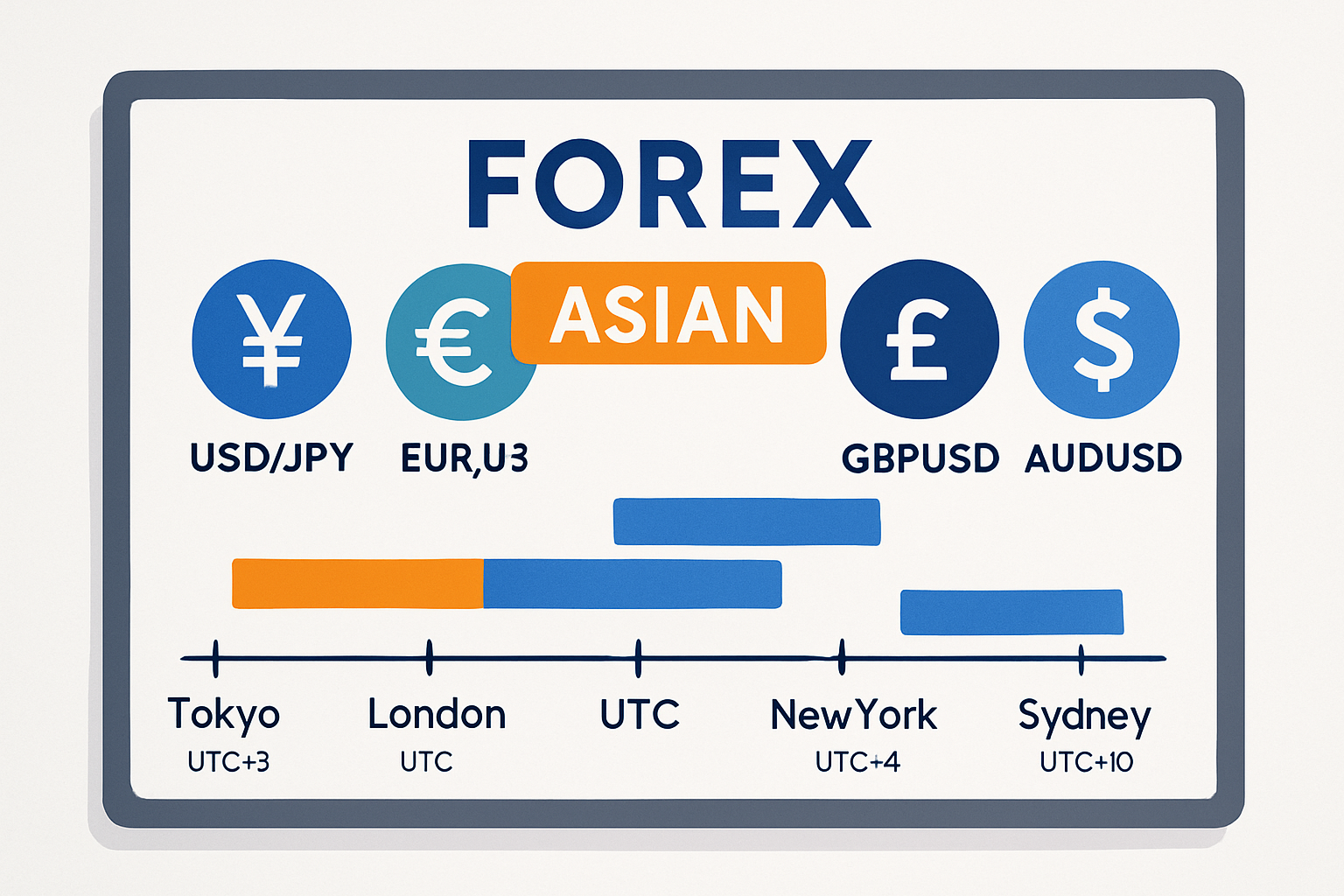

Asian Hours refer to the time when the main Asian financial markets swing into action. This window usually runs from about 12:00 AM to 9:00 AM GMT and features key markets like Tokyo, Sydney, Hong Kong and Singapore.

Asian Hours offer a trading environment that’s notably calmer, often showing lower volatility compared to the European and US sessions. It’s like the market is taking a deep breath, giving traders some breathing room to work with steadier price ranges and more gradual trends.

| Session | Average Volatility | Average Trading Volume | Key Characteristics |

|---|---|---|---|

| Asian Hours | Low to Moderate | Moderate | Usually sees calmer waters with steady price swings; this session mainly dances around the JPY, AUD, and NZD pairs |

| European Session | High | High | Often brings a burst of action with heightened volatility and plenty of liquidity; overlaps with both the Asian and US sessions, making it quite the busy bee |

| US Session | High | Highest | The big league for volatility and trading volume, often spiked by economic news and the moves of major market players |

Volatility is based on average pip movement; volume reflects liquidity and activity levels during each session.

During Asian Hours certain currency pairs tend to steal the spotlight mainly because they are tied to the region's economies. The Japanese yen, Australian dollar and New Zealand dollar often lead the charge with the most activity.

Chart illustrating Asian Hours within the 24-hour forex market, showing key currency pairs and major financial centers.

Traders often tweak their strategies to match the unique rhythm of Asian Hours, usually focusing on techniques that make the most of lower volatility and range-bound markets. News from Asian economies can sometimes shake things up unexpectedly and demand sharp focus and quick moves during this session.

Focus on range-bound trading strategies since price action tends to stick between tighter support and resistance levels during Asian Hours.

Put extra emphasis on yen and aussie currency pairs which typically offer higher liquidity and more predictable moves during this session.

Keep a sharp eye on key Asia-specific economic releases such as Japanese GDP, Australian employment reports, and Chinese trade data because these often trigger quick price jolts.

Use tighter stop-loss orders because price swings tend to be narrower here which is great for keeping risk low when the market is quieter.

Brace yourself for possible breakout opportunities toward the end of the Asian session as the European markets wake up and stir the pot, often increasing volatility.

Institutional traders and market makers often jump into the fray during Asian Hours, aiming to position themselves ahead of the usually more raucous European and US sessions. Retail traders can actually score some pretty valuable insights by keeping an eye on price patterns and volume shifts while the big players are gearing up for the day's action.

"Asian Hours often feel like that calm before the storm, a sort of peaceful pause before the London and New York sessions kick into high gear. This quieter market pace usually sets the stage nicely for all the volatility and opportunities those busier sessions tend to throw our way."

Asian Hours often get a bad rap and are widely misunderstood. A lot of individuals assume that low activity means the session isn’t worth their time, or that only the Tokyo market really counts during these hours.

Trading during Asian hours can feel like a different beast altogether, but with the right approach, you can definitely make it work in your favor. Here are some down-to-earth tips to help you navigate these markets like a pro, even if the timezone grind has you scratching your head every now and then.

Understanding the asian hours meaning is crucial for traders who want to get their setup right, pick currency pairs thoughtfully and stick to rock-solid risk management practices to truly capitalize on this trading session.

23 posts written

Driven by a passion for uncovering the hidden patterns that underlie market dynamics, Isla Wyndham brings a unique perspective to the realm of trading, blending quantitative analysis with a keen intuition for human behavior.

Read Articles

El Salvador blends traditional dollars with Bitcoin in a pioneering monetary system, reshaping how m...

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

Discover the ins and outs of currency market opening hours, their global structure, and how masterin...

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...