The Jordanian Dinar's Role in the Middle East

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...

The London session in forex is one of the busiest and most influential trading periods in the global market. This article explains what the London session entails, breaks down its trading hours and explores why it holds a pivotal role.

The London session kicks off when the London forex market officially opens its doors and plays a important role in the never-sleeping world of forex trading. It often overlaps with other big players like Tokyo and New York but really stands out thanks to its hefty trading volume and deep liquidity. This session tends to buzz with activity since London is a heavyweight financial hub where European banks and institutions roll up their sleeves and get down to business. It often sets the tone for many currency pairs.

The London session kicks off bright and early at 8:00 AM and wraps up by 4:00 PM, local London time that’s GMT or BST depending on the time of year.

| Session | Standard Time (GMT) | Daylight Saving Time (BST) | Typical Local Hours GMT | Notes |

|---|---|---|---|---|

| London Session | 08:00 - 16:00 | 07:00 - 15:00 | 08:00 - 16:00 | Local time in London (GMT/BST) - where the heart of trading often beats strongest |

| New York | 13:00 - 22:00 | 12:00 - 21:00 | 13:00 - 22:00 | Overlaps with London session, giving traders a nice overlap window to catch important moves |

| Tokyo | 00:00 - 09:00 | 00:00 - 09:00 | 00:00 - 09:00 | Covers the bustling Asian trading hours, starting the global market day with energy |

Note: When Daylight Saving Time (BST) kicks in, London’s schedule jumps an hour earlier as the clocks cheerfully spring forward.

The London session is often hailed as the busiest and most liquid stretch in Forex trading and usually sets the tone for the day ahead. Its importance stems from the number of players in the market, hefty transaction volumes and vital overlaps with other sessions that keep things buzzing.

During the London session, currency pairs involving European currencies or the US dollar tend to experience a noticeable bump in volatility and liquidity. This makes sense since much of the market’s activity comes from European financial institutions and traders who are alert and ready during these hours. Pairs such as EUR/USD, GBP/USD and USD/CHF often show livelier price swings and more opportunities to jump in as traders react to the latest economic reports and policy announcements.

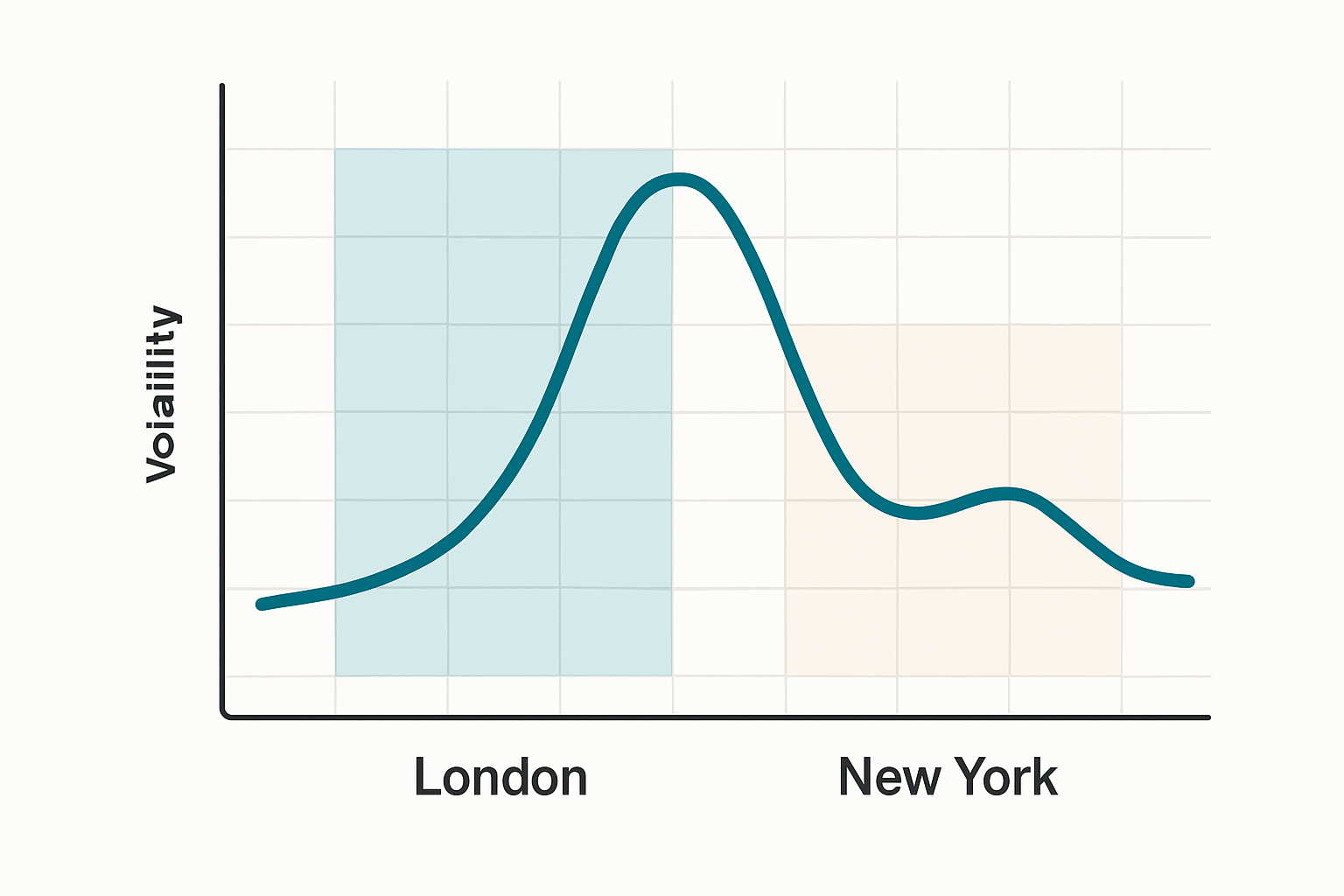

Volatility tends to jump right after the London session kicks off and generally keeps up the pace, especially when it overlaps with the New York session later in the afternoon GMT. This surge in action often serves up some pretty clear trading opportunities, like breakouts and solid trend rides.

Chart illustrating typical volatility spikes during the London forex session compared to other sessions.

Traders lean on a mix of strategies tuned to the London session’s unique vibes to up their odds of making a profit. Breakout strategies usually shine at the session’s kickoff when prices spring into action after a quiet overnight lull. Many traders keep a keen eye on volatility spikes from key economic news in London and Europe because those moments can shake things up. Trend followers ride the wave of longer steady price moves while scalpers aim to snatch small gains from early session jitters.

Zero in on breakout strategies during that key first hour. This is when sharp moves often show up right after the market opens.

Keep a close watch on pesky volatility spikes by tracking scheduled London economic news because an economic calendar is your trusty sidekick here.

Once things mellow out, latch onto established trends and try to ride the momentum wave during the hours when London and New York sessions overlap. Those hours can really make or break it.

Early on, dabble with scalping techniques to squeeze the most out of small frequent price moves, especially in pairs with heavy volume. Think of it as grabbing little wins that steadily add up.

New traders often find their footing by focusing on risk management during the London session, mainly because it tends to be more lively and volatile. It is usually a smart move to avoid the temptation of overtrading and to keep a close watch on the times when the London and New York sessions overlap those moments can really crank up the market action. Having an economic calendar at your fingertips to brace for news events and their ripple effects can be a real lifesaver.

Traders juggling multiple time zones often have to tweak their schedules to catch the London session when it’s firing on all cylinders. Handy tools like online forex session clocks or time zone converters make keeping tabs on London session times in your local area a breeze. Keep a keen eye on daylight saving shifts—they tend to sneak up on you when you least expect it.

There are a few myths that float around about the London session forex time. Some people believe it runs 24 hours a day but it actually sticks to set trading hours. There’s the idea that trading during London hours is a sure way to make profits but it overlooks risks every trader must face. Another common misunderstanding is that only European currency pairs matter during this session. In reality, USD pairs and global factors also play a role.

23 posts written

Driven by a passion for uncovering the hidden patterns that underlie market dynamics, Isla Wyndham brings a unique perspective to the realm of trading, blending quantitative analysis with a keen intuition for human behavior.

Read Articles

Discover how the Jordanian dinar anchors Jordan’s economy and regional trade. This article breaks do...

New to forex trading? This beginner-friendly guide simplifies the essentials, helps build your confi...

El Salvador blends traditional dollars with Bitcoin in a pioneering monetary system, reshaping how m...

Discover the definitive guide to foreign exchange trading hours. Learn how global market sessions in...