Posts

169 pages

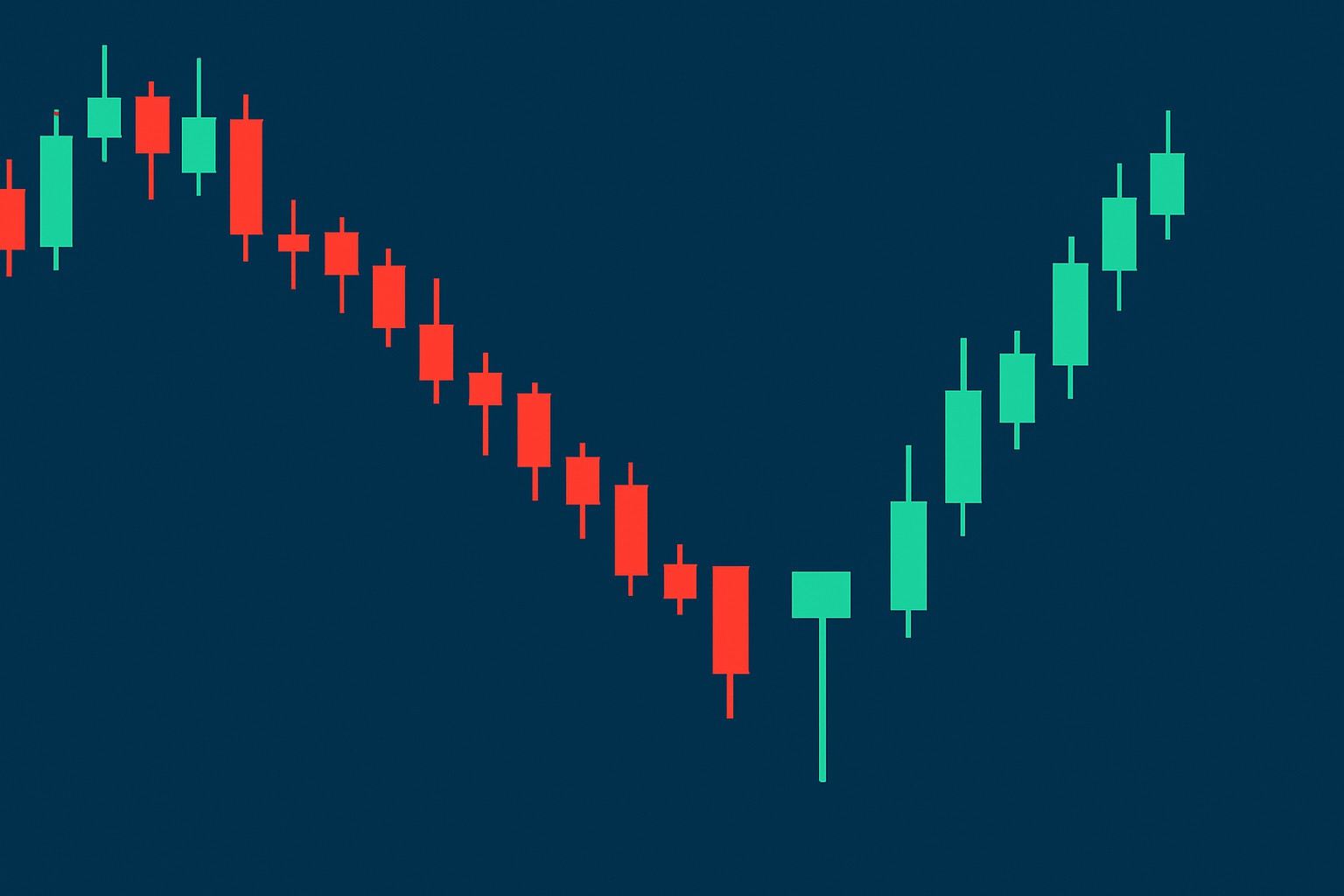

How to Identify the Falling Wedge Pattern in Charts

Master the falling wedge pattern with this comprehensive guide offering clear steps to identify, confirm, and trade this powerful technical analysis formation.

How to Read the Hammer Candlestick Pattern in Forex Trading

Discover how to spot and leverage the hammer candlestick pattern in forex trading. This guide breaks down its identification, interpretation, and integration with other tools for confident trading success.

What Drives the Value of Honduras Country Currency

Discover the main factors that influence the Honduras country currency, the lempira, and understand how economic and political elements shape its value.

What Affects the Saudi Arabian Riyal Currency Movements

Understand what drives the Saudi Arabian Riyal's fluctuations, from oil prices and monetary policy to geopolitical events and market sentiment.

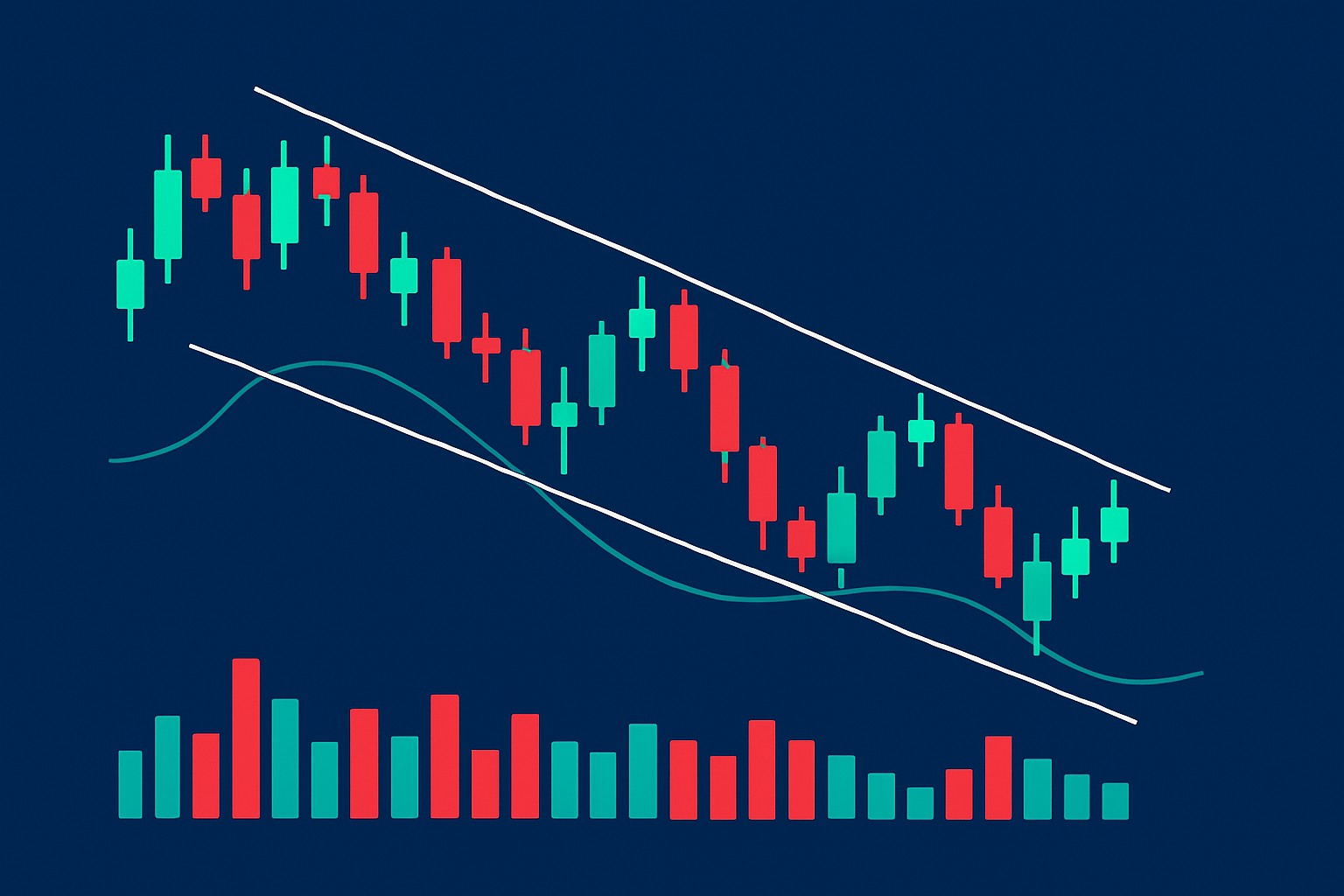

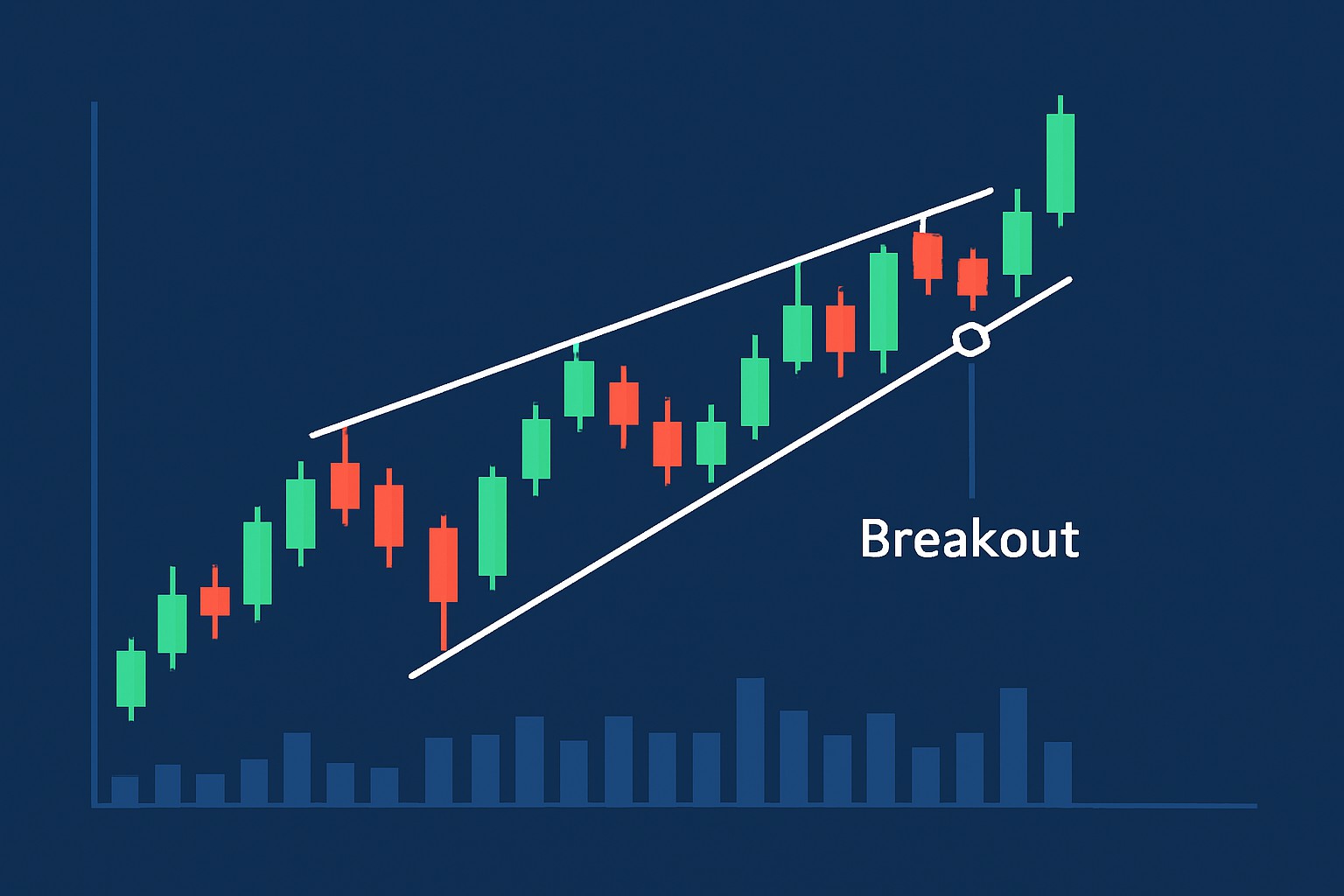

How to Spot a Rising Wedge Pattern in Trading Charts

Master the skill of spotting rising wedge patterns, a key technical analysis tool that helps traders predict bearish reversals and optimize their market strategies.

What the Bearish Harami Pattern Means for Your Trades

Discover how the bearish harami candlestick pattern can signal market reversals and help you make smarter trading choices. Learn to spot, confirm, and apply this pattern effectively.

What's the Meaning of Hawkish Statements?

Hawkish statements signal central banks' concerns about inflation and interest rate hikes. Learn what hawkish means and how such signals affect markets and investment decisions.

What Drives Myanmar Currency Fluctuations in Forex Trading

Understand the key drivers behind Myanmar currency fluctuations in forex trading, from domestic reforms to global market forces, and learn how traders can adapt.

How money in el salvador works with bitcoin adoption?

El Salvador blends traditional dollars with Bitcoin in a pioneering monetary system, reshaping how money moves within the country and beyond.

How to interpret Swiss central bank announcements for trading?

Discover how to interpret Swiss central bank announcements effectively to anticipate market moves and make informed trading choices with ease.

What's the definition of protectionism in trade

Discover what protectionism means in global trade, why countries use it, and its effects on economies. This article breaks down complex trade policies into simple concepts.

Best Cryptocurrency Options Trading Platforms

Unlock the potential of cryptocurrency options trading with our authoritative guide reviewing leading platforms, essential strategies, and key features for success.