Posts

169 pages

The Meaning Of Whipsaw In Trading Terms Explained

Discover what whipsaw means in trading, why it occurs, and how to recognize and manage sharp price reversals to protect your trades.

Understanding QE Definition and Its Role in Economic Policy

Quantitative easing (QE) is a powerful but often misunderstood economic policy. This article demystifies QE’s definition, explains how it works, and explores its crucial role in managing modern economies.

How to Spot Momentum Shifts Using Relative Vigor Index

Spotting momentum shifts early with the Relative Vigor Index empowers traders to time entries and exits more effectively, boosting profitability and confidence in their trading strategies.

Understanding Bid Price and Ask Price

Master the fundamentals of bid price and ask price in forex trading. This guide breaks down complex market pricing into simple terms, helping you make better trading decisions.

How The Engulfing Candle Pattern Signals Reversals

Discover how the engulfing candle pattern acts as a powerful reversal signal in technical analysis. This guide breaks down its identification, psychology, and practical trading uses.

How Leaps Options Trading Differs from Regular Options Trading

LEAPS options provide a longer-term, less stressful way to trade options compared to regular short-term contracts. Learn the basics, key differences, and beginner strategies here.

How to Spot a Triple Top Pattern in Your Charts

Discover how to spot the triple top pattern on your trading charts with our detailed, beginner-friendly guide, helping you anticipate trend reversals and improve your trading strategy.

Trading the Three Black Crows Pattern

Discover how the Three Black Crows candlestick pattern signals potential market reversals. This easy-to-understand guide covers its appearance, psychology, and trading tactics.

Why Order Block Patterns Matter in Technical Analysis

Discover how order block patterns reveal institutional footprints and enhance your trading edge by identifying pivotal price zones before big market moves.

Key Differences between Options vs Futures Trading

Options and futures represent key derivatives in markets. Understand their differences in obligations, risk, strategies, and costs to choose the right trading approach.

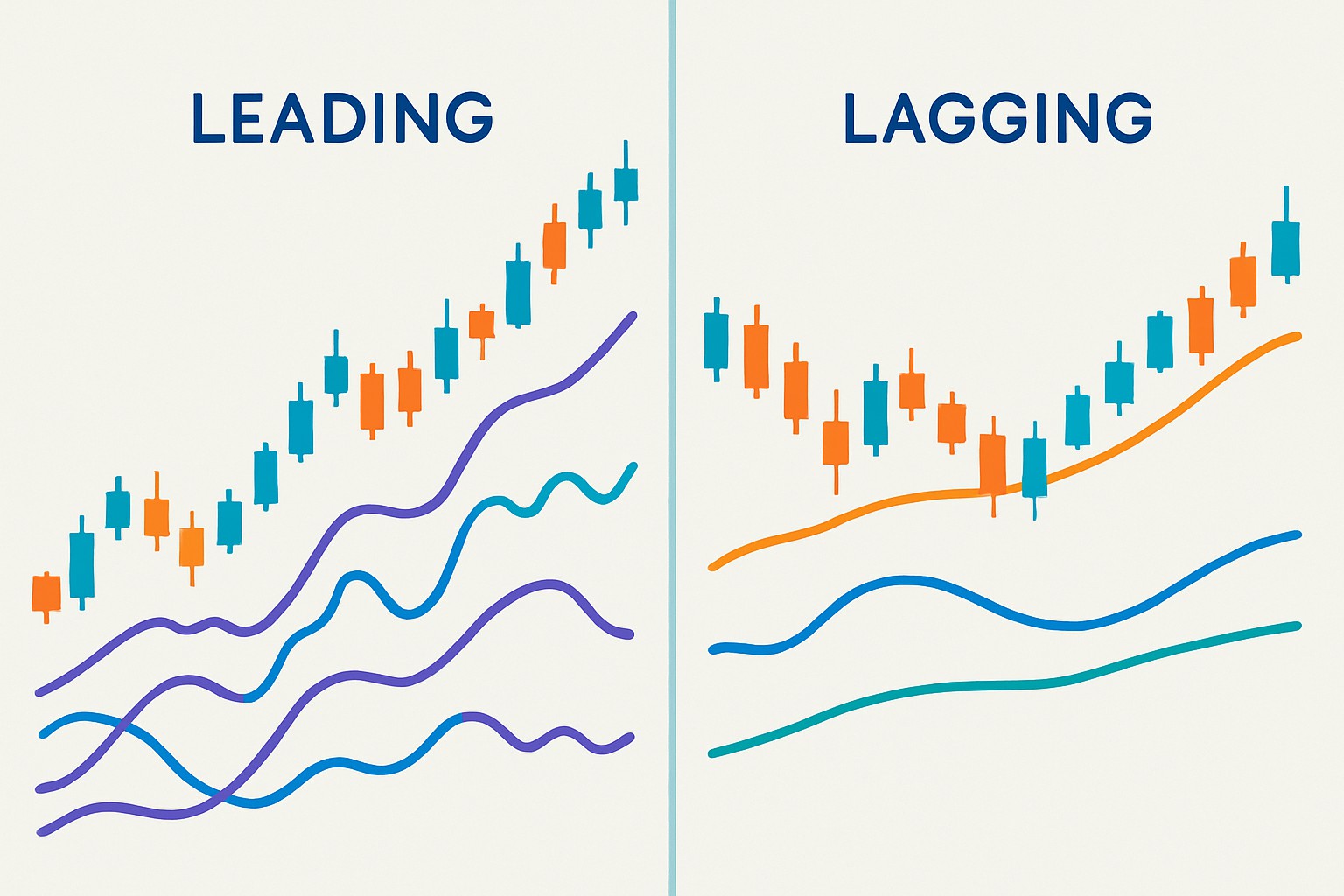

When to Use Leading vs Lagging Indicators for Signals

Master the art of timing your trades with a comprehensive guide on leading vs lagging indicators. Learn their strengths, weaknesses, and how to apply them for smarter market decisions.

Five Recommended Trading Books You’ll Actually Use

Cut through trading noise with five recommended trading books packed with actionable insights you can apply immediately to improve your strategies and mindset.